UMich Consumer Expectations Hit A Record (48 Year) Low

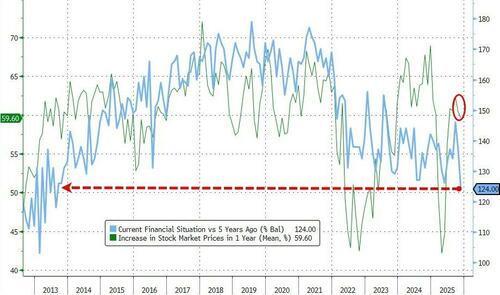

The weakness from the preliminary UMich data for November has been confirmed with the final sentiment print confirmed the so-called ‘K-shaped’ economy as sentiment slumps with stocks near record highs.

However, the small silver lining with today’s UMich data was an improvement intra-month from 50.3 to 51.0 for the headline (but still at its lowest since June 2022).

After the federal shutdown ended, UMich Director Joanne Hsu notes that sentiment lifted slightly from its mid-month reading.

However, consumers remain frustrated about the persistence of high prices and weakening incomes.

Under the hood, Expectations picked up modestly from 50.3 to 51.0, just off record lows, while Consumer Expectations plunged to 51.1 – the lowest in the survey’s history going back to 1977…

Source: Bloomberg

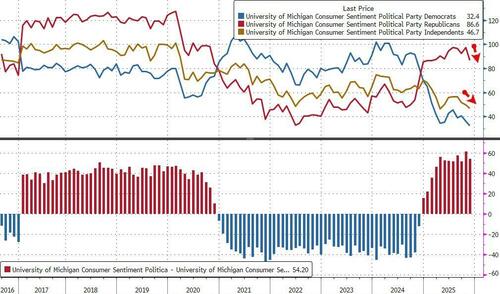

Who the hell are they surveying?

Interestingly, while Democrat’s confidence remains vastly worse than the rest of the political cohorts, November saw Republicans and Independents lose some faith too…

Source: Bloomberg

On the bright side, inflation expectations tumbled. After four months of sharp increases to start 2025, long-run expectations fell for three consecutive months through July, followed by three more months of small increases. Long-run expectations softened considerably this month. The November reading is well below peaks in monthly readings from June 2022 and April 2025, but still above 2024 readings.

Source: Bloomberg

Expectations exhibit substantial uncertainty, particularly in light of ongoing developments with economic policy and concerns that impacts on inflation are still to come.

Democrats continue to lead the fear of inflation (though dropped to January lows this month)…

However, this month, current personal finances and buying conditions for durables both plunged more than 10%…

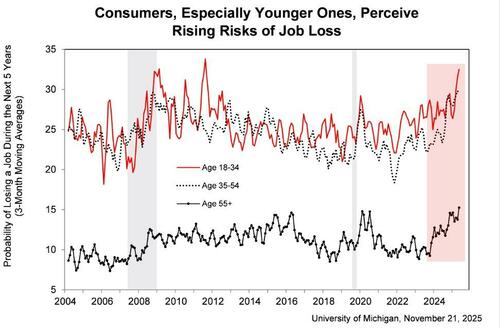

and young and old alike are worried about their jobs…

By the end of the month, sentiment for consumers with the largest stock holdings lost the gains seen at the preliminary reading.

This group’s sentiment dropped about 2 index points from October, likely a consequence of the stock market declines seen over the past two weeks.

Tyler Durden

Fri, 11/21/2025 – 10:15ZeroHedge NewsRead More

R1

R1

T1

T1