Trump Era Sparks Biggest U.S. Gas Pipeline Boom Since 2008

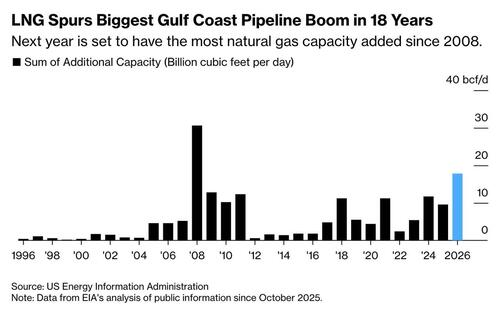

A massive pipeline buildout is sweeping across Texas, Louisiana and Oklahoma, marking the largest expansion of Gulf Coast natural-gas capacity since the 2008 shale boom, according to Bloomberg.

As many as a dozen projects are slated for completion next year, enough to boost the region’s gas-shipping capacity by 13%—roughly the equivalent of Canada’s total consumption, according to US Energy Information Administration data.

“This is the most activity I’ve seen in my 20 years in the industry,” said Jack Weixel of East Daley Analytics.

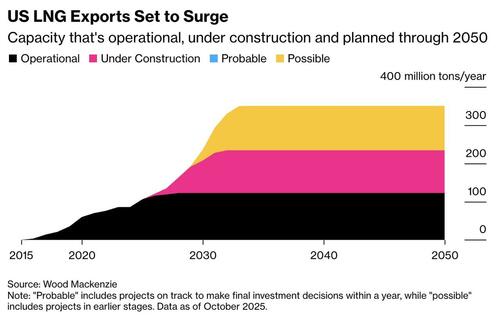

Though most projects long predate Donald Trump’s second term, the timing aligns neatly with his push to expand US LNG exports and strengthen US dominance in global energy markets. New LNG terminals scheduled for service in 2027 and beyond will rely heavily on these pipelines. As one analyst put it, “Pipeline development tends to respond to LNG export capacity — not so much drive it.”

The surge is powered by rising global LNG demand and by the US—the world’s largest exporter—sinking tens of billions into new terminals from Sempra, NextDecade, Venture Global and others. Texas and Louisiana regulators, typically friendlier to fossil-fuel infrastructure, have also sped up approvals.

Bloomberg writes that environmental groups warn the boom locks in decades of gas use, but industry insists LNG helps countries transition away from dirtier fuels.

Among the major lines underway are Enbridge’s 137-mile Rio Bravo line and the 366-mile Blackcomb Pipeline, along with new or expanded systems from Kinder Morgan, Williams and Energy Transfer. The Permian Basin, awash in associated gas, badly needs the relief; prices there routinely fall below zero because pipelines are maxed out. “The general rule of thumb is the Permian needs a mega pipeline every 16 to 18 months,” said Amol Wayangankar of Enkon Energy Advisors.

Energy Transfer says its 442-mile Hugh Brinson Pipeline will be its most profitable asset yet, helped by rising demand from AI-driven data centers. More capacity is also planned for 2027, suggesting the boom is far from over.

As Caitlin Tessin of Enbridge summed it up: “Natural gas is definitely on. The country is thirsty.”

Tyler Durden

Sun, 11/23/2025 – 11:05ZeroHedge NewsRead More

R1

R1

T1

T1