Two Investing Titans Issue The Same Warning

Authored by Peter Reagan,

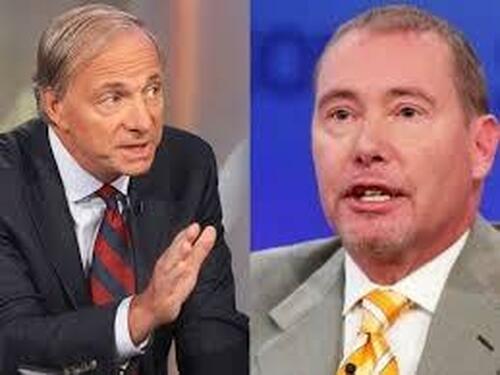

When Ray Dalio and Jeff Gundlach – two legendary investors with wildly different worldviews – start warning about the same thing, it’s worth paying attention. Both say today’s economy is distorted, and warn that “illusory wealth” may vanish when reality hits…

A question for you: In what world would billionaire investing legends Ray Dalio and Jeffrey Gundlach come to the same conclusion about the economy?

Answer: This one.

Now, if you’re not familiar with either of these financial giants, a little background may be useful.

Ray Dalio is the billionaire founder of Bridgewater Associates, the world’s most successful hedge fund.

Jeffrey Gundlach has been trading government debt so successfully for so long he’s called the “Bond King.”

Which means that these two men amassed their fortunes with wildly different philosophies and methods about how to do it.

And that makes it especially surprising that they’ve come to the same conclusions.

Two very different billionaires, one warning

First, there are two principles that they’re both talking about now that have a massive impact once you understand them.

Principle #1 is price signals can lie.

To put it simply, the information that you can normally glean from the prices and valuations may be distorted in the economy (and almost certainly are right now), and you need to know that and understand it.

Principle #2 is unrealized profits are NOT the same as real wealth.

In other words, just because the value goes up on paper doesn’t mean that you can actually get that amount when you convert to actual money.

Now, I need to be clear here: I’m going to be talking about these men and these principles to help you to understand the current investing environment. I am not giving investment advice, and you should do your own due diligence before making any investment decision to ensure that you are making the right decisions for you and your desired goals and outcomes.

Dalio: “Net worth isn’t wealth”

In a recent post over at Linkedin, Dalio gave his views on the current situation.

He said, essentially, that wealth, in terms of net worth, in our world today is measured by numbers on a screen. Those aren’t fixed numbers. Wealth is measured by asset prices, but prices go up and down. When debt is used to buy assets, Dalio says, you can get unreasonable prices.

This a huge problem because debt has to be paid back.

And to pay debt, you have to convert an asset into actual cash.

But selling an asset pushes prices down. It’s supply and demand. The more of something in the market, the less demand for each unit of that thing, and, thus, the price goes down.

Except that the borrowed funds have to be paid back with the proceeds from the sale, which is typically at a lower price. And that means that debt-fueled buyers end up with much lower profits than they expected (maybe even losing money).

Dalio says this price drop that’s necessary to pay off debt is often what causes economic crashes.

All that to say, the prices that we’re seeing in many areas are artificially propped up by debt – not by cash. That’s why those prices don’t have much of a relationship with the purchasing power the price represents.

Dalio wants to remind us:

A price isn’t a profit (not until you sell).

But, because there’s a limited amount of cash underlying the entire economy, the more people to convert assets to cash, the more prices drop. When people see prices drop, they rush to sell – putting more downward pressure on prices.

Gundlach has similar concerns…

Gundlach: “No argument against the fact that we’re in a mania”

Gundlach, for his part, isn’t using the term “bubble,” but he is talking about mania, which is a well documented quirk of human nature.

Specifically, he said that there is “no argument against the fact that we’re in a mania.”

What does he mean, exactly?

Gundlach is pointing out the same craziness that we’re seeing in the economy that Dalio talked about, just pointing it out in different ways.

A mania, as defined by Merriam-Webster, is an “excessive or unreasonable enthusiasm,” and that’s exactly what we’re seeing with prices of financial assets compared to what those assets are really worth.

People are speculating and making buying decisions based on their hope that a higher than normal market valuation will continue to increase. So, one speculator buys at an elevated price, then another even more enthusiastic speculator buys at that even higher price with the expectation that the price will go even higher. (It’s called the “greater fool” trade.)

What we’re seeing is something that we’ve seen before:

-

Asset prices disconnect from reality

-

Stories about assets become more important than facts about them

-

People make decisions based on the story instead of logic

And that always causes problems.

Always.

Because economies, like any other naturally occurring system, eventually correct themselves.

At this point, you may be asking…

Where do Dalio and Gundlach agree?

Besides agreeing that prices are all out of whack and can’t be trusted to reflect actual value, they both agree on a defense.

They agree that physical gold ownership is important.

It’s important to understand why they both say that, though.

Gold’s price is tied to its inherent worth based both on its real-world scarcity and its usefulness in the real world. It’s more than a number on a screen. Precious metals prices stay relatively consistent in terms of purchasing power over long time horizons.

So, while currencies like the dollar will continue to devalue, while irrational exuberance eventually turns into depression and cynicism, and while debt repayment pushes asset prices down, precious metals will retain their real-world purchasing power. Regardless of what else is going on in the world.

Precious metals are a hedge against inflation and against irrationally inflated prices. Their store of value role has lasted over 5,000 years of human history.

And when other asset prices plunge, precious metals tend to shine brightest.

Tyler Durden

Mon, 11/24/2025 – 08:05ZeroHedge NewsRead More

R1

R1

T1

T1