Solid 2 Year Treasury Auction Prices At Lowest Yield In Over 3 Years

The first coupon auction of the holiday-shortened week just priced and it was a snoozer, which came in right as expected.

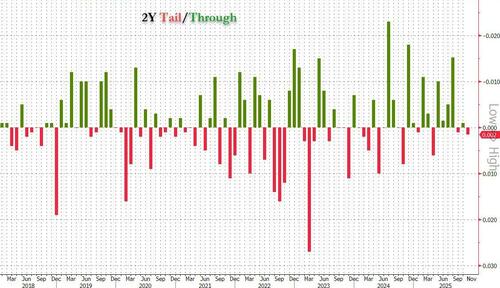

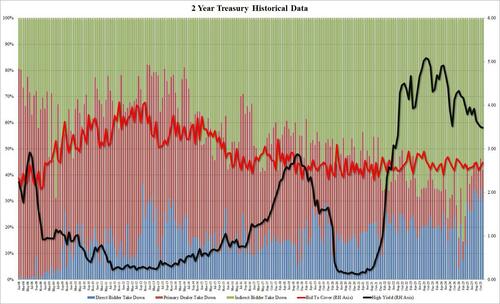

The sale of $69BN in 2 year notes, priced at a high yield of 3.489%, down from 3.504% in October and the lowest since August 2022; it also priced on the screws with the 3.489% when issued.

The bid to cover was 2.684, up from 2.590 and the highest since August.

The internals were also solid, with Indirects awarded 58.1%, the highest since June, and above the six auction average of 57.9%. And with Directs taking 30.7%, in line with the recent average of 30.9%, Dealers were left with 11.2%, also right on top of the recent average of 11.1%.

Overall, this was a solid auction, which came in line with expectations on most metrics, which explains why the market reaction was non-existent with yields trading near session lows after news of the auction priced, and why traders took one look at the results and went on their merry way.

Tyler Durden

Mon, 11/24/2025 – 13:35ZeroHedge NewsRead More

R1

R1

T1

T1