Core Producer Price Inflation Slowest In 15 Months, But…

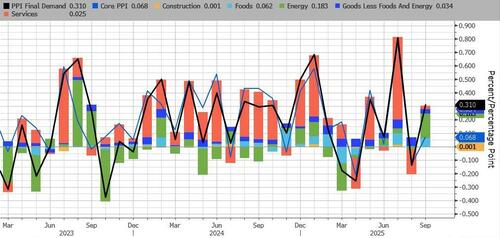

Headline Producer Prices rose 0.3% MoM in September (as expected)

Source: Bloomberg

Under the hood, Energy costs were the biggest driver (see below for why that may not be a problem) and Construction saw the smallest rise in prices…

Source: Bloomberg

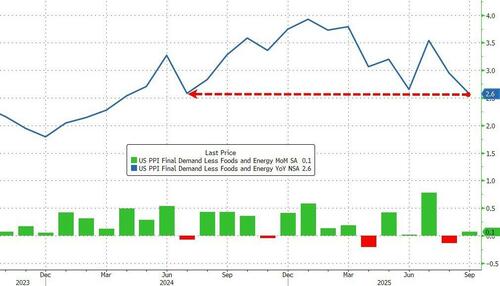

Core PPI (Ex Food & Energy) rose just 0.1% MoM, bringing Core PPI YoY down to +2.6%…

Source: Bloomberg

That is the lowest YoY print for Core PPI since July 2024.

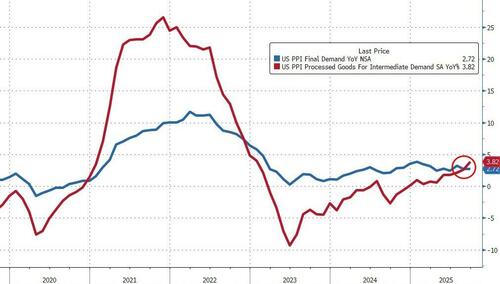

However, there could be trouble ahead as the pipeline for prices (intermediate demand) is starting to accelerate once again…

Source: Bloomberg

But, there is a silver lining as oil prices have plunged since this data suggesting PPI Final Demand Energy will be dramatically deflating in the coming months…

Source: Bloomberg

So that’s 3 of 3 macro data points this morning that ‘support’ doves at The Fed – lower employment, weaker retail sales, and lower inflation – and rate-cut odds are rising.

Tyler Durden

Tue, 11/25/2025 – 08:53ZeroHedge NewsRead More

R1

R1

T1

T1