Grid-Scale Battery Boom Sparks Lithium’s Comeback

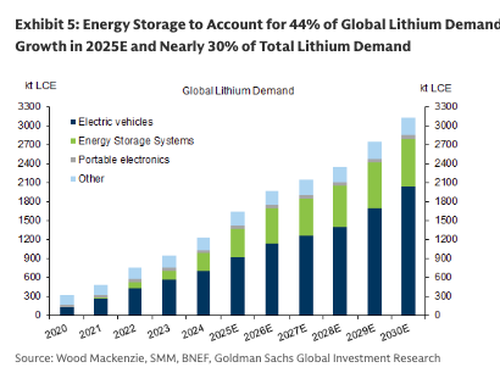

Lithium prices have awakened from a multi-year bust in the second half of this year, with Chinese lithium carbonate prices jumping from $6,000 a ton to $11,000 a ton, driven by what Goldman analysts describe as “temporary Chinese supply cuts” and “strong energy-storage-system (ESS) demand.“

For some context, lithium markets flipped dramatically from the 2020 to 2022 “white-gold supercycle” hype to a two-year bust cycle as supply collided with much softer-than-expected worldwide EV demand growth.

With the EV adoption curve stalled and consumers balked at record-high new-car prices amid high interest rates, lithium prices have been on the rise due to a major surprise: tightening near-term supply and rising ESS demand.

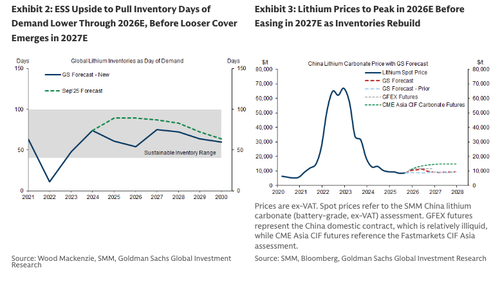

“This leads us to delay the timing of a price correction we still expect to the latter half of 2026. We maintain our view that supply delays will be required by 2027 to rebalance the market,” Goldman analysts led by Lavinia Forcellese wrote in a note.

Forcellese noted that the core driver in higher prices is stronger-than-expected ESS demand, which has significantly reduced available inventory.

2026 Outlook: Tight in H1, Loose in H2

H1 2026: Market remains tight.

ESS demand up 22% YoY, total lithium demand up 24%.

Inventory cover falls to 54 days.

Prices expected to hold around $11,000/t.

H2 2026: Market loosens as supply accelerates.

Supply jumps +27% YoY with CATL’s lepidolite restart and stronger spodumene output.

Prices seen easing to $9,500/t (still above the prior $8,900 forecast but well below GFEX/CME forwards at $11,530–13,613/t).

2027: Surplus Risk Returns

Supply will again outpace demand unless producers curb output.

Without supply cuts, inventories would exceed 100 days (forecast is 75 days with cuts).

Prices expected around $9,250/t, far below CME forwards near $14,950/t.

Earlier this month, Tesla CEO Elon Musk said that the US could effectively double its usable electricity output simply by adding large-scale batteries to the grid.

Elon Musk: Just by adding stationary batteries to the grid, we could double the electricity production in the United States.

“If you look at the total U.S. power generation capability, it’s roughly a terawatt, but the average power usage is less than half a terawatt. That’s… pic.twitter.com/aKyg4kFqFG

— ELON CLIPS (@ElonClipsX) November 11, 2025

The ESS boom has given the lithium market new hope, after it had been stuck in a multi-year bust since EV demand stalled.

ZeroHedge Pro subs can read the full note in the usual place.

Tyler Durden

Tue, 11/25/2025 – 13:10ZeroHedge NewsRead More

R1

R1

T1

T1