Black Friday Turnout Solid: Goldman, UBS Highlight Decent Start To Holiday Spending Season

Heading into Black Friday and Cyber Monday, there were mounting concerns about consumers, especially lower-tier ones – a cohort we’ve repeatedly warned as facing tough times. But early shopping data from this past weekend from Goldman and UBS suggest that, in aggregate, consumers held up better than feared.

Goldman’s top sector specialist, Scott Feiler, penned a note to clients earlier that “U.S. consumer does continue to show up for events, this Black Friday included. After all, Adobe did say Friday and Saturday both came in above their forecasts.”

A long line of cars formed near a freeway exit in Dublin, California on Friday as shoppers flocked to score Black Friday deals at the San Francisco Premium Outlets. pic.twitter.com/1Bqy64MTKT

— CBS News (@CBSNews) November 28, 2025

Feiler cited high-frequency data from Mastercard SpendingPulse, Adobe Analytics, Salesforce, and internal sources, all of which indicated a strong weekend. These are numbers that President Trump’s economic team will likely highlight this week as economic proof that consumers are holding up late in the year.

Here’s a snapshot of those data points:

Mastercard SpendingPulse

Retail sales (ex. auto) increased +4.1% y/y on Black Friday.

Last year, Mastercard said Black Friday sales were +3.4% Y/Y.

The breakdown of this year’s +4.1%v was in-store sales +1.7%, while online sales were +10.4%

It’s 1 day only, but that +4.1% was compares to Mastercard’s holiday prediction of +3.6%. They noted strength in apparel (+5.7%) and jewelry (2.3%).

Adobe Analytics

- Online sales grew +9.1% YoY, slightly below last year’s +10.2%, but both Thanksgiving and Black Friday exceeded initial forecasts.

Salesforce

- Global online spend hit $79B (+6%), with U.S. online at $18B (+3%). Gains were price-driven, with unit volumes down YoY.

Goldman Sachs Store Checks:

The GS Research team published takes this morning from their weekend store visits . They noted overall traffic at “traditional” Black Friday weekend destinations were in line to slightly better than last year. There were certain retailers where traffic was a little stronger than average like TGT, ULTA, ASO and at the mall at BBWI, Garage (GRGD) and Victoria’s Secret (VSCO). They think toys, kids apparel, beauty and footwear were the areas within stores with the most traffic, while home goods traffic was lighter.

Store traffic remains muted vs online.

Sensormatic

- Said physical retailer traffic dropped 2.1% y/y on Black Friday, compares to the 2025 average of -2.2%.

RetailNext

- Said Friday/Saturday traffic was -5.3% Y/Y. Friday was much stronger than Saturday. Would note most regions were consistent, but the negative Saturday data looks wonky, skewed by an outlier read in the Midwest. The total conclusion though is in store traffic remains soft, compares to online.

In a separate note, Goldman analyst Natasha de la Grense said that Black Friday data came in slightly better than expected.

De La Grense noted, “Black Friday, Aspirational Luxury and the return of “boom boom.”

Here are her top observations from the weekend:

-

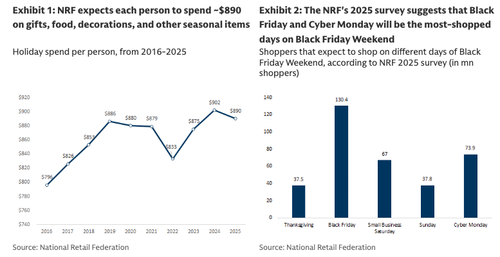

Reassuring start to Holiday trading in the U.S., with Black Friday data coming in slightly better than feared, following last week’s disappointing confidence print. In summary, retail sales growth was in line with NRF’s forecast for the season as a whole, with discount levels that were very similar to last year.

-

Lots of focus recently on the “K-shape” economy, with commentators observing that the top income earners are increasingly holding up discretionary spending in the U.S. While we do think this cohort is outperforming (driven by equity market wealth creation which accrues more to higher-income households), the very top of the income pyramid participates less in discount shopping events. Therefore, Black Friday is a good first check on gifting trends and mass-market spending ahead of holiday. By many accounts, retailers were pleased with their level of business – WWD cites a broad number of players confirming this.

-

By category, it sounds like apparel did well (benefiting from cold weather), while jewellery remains strong and we are continuing to see signs of life in the handbag category. I still think that aspirational spending is recovering in the U.S. – that was a theme emerging from Q3 earnings season and seems to have continued into Q4 based on 1) November guidance raises at Ralph Lauren, Tapestry and The RealReal; 2) qualitative commentary over Black Friday weekend. Note that a number of retailers have called out younger cohorts showing up to spend on Black Friday – consistent with Deloitte’s survey heading into the event.

-

Our preferred sub-sector within Consumer Discretionary right now remains Luxury Goods. While Black Friday isn’t a perfect read for this sector (given the cohort behaviour mentioned above), there’s enough data suggesting that high end spending is improving QTD in the U.S. Outside of the U.S., China luxury is also recovering (off a low base) – the high frequency data here is a bit mixed as handbag imports through October were not as good as Q3 (although with the caveat that the 2-year comp is very tough). However, jewellery/cosmetics sales in China have been strong, Macau GGR just beat expectations meaningfully (+14% YoY this morning and reaching the highest recovery level vs pre-pandemic since reopening) and micro feedback/channel checks are good.

UBS analyst Michael Lasser struck a similar tone to Goldman, pointing to the same data and noting that “spending has been decent, but the shape of the season has yet to be determined.”

Here’s from Lasser:

Overall, the data points to steady demand during the key holiday weekend for retailers. Though, it is still quite early. Plus, we suspect that there will be steep drop off following Cyber Monday as consumers have tended to concentrate their spending around key events. This has been the pattern for some time. Importantly, there’s still a good amount of time remaining. For many retailers, we think December can account for 40% to 45% of the fourth quarter. Thus, we think it’s best to reserve judgement on the overall result of the holiday season for the next few weeks.

However, the analyst said it’s still too early to draw conclusions about the overall shopping season. He noted several important considerations to keep in mind as the Christmas shopping period quickly approaches:

Consumers are likely prioritizing essentials and seeking discounts this year as inflation continues to weigh on budgets. This favors retailers like Walmart and Costco who are perceived to be pricing aggressively.

We believe retailers have been more aggressive with promotions to drive sales. Best Buy and Dick’s Sporting Goods suggested last week that promotions were higher this year than in the past. Yet, we think that many retailers are finding ways to mitigate the impact to their profits. This is from areas like improving shrink, generating growth in retail media, and driving increases in third party marketplaces.

The adoption and influence of Artificial Intelligence is in its early stages, but is having a growing impact. Data from Adobe shows that the use of this technology is up significantly YoY. This follows recent announcements from retailers like Walmart and Target, which are partnering with OpenAI in various ways. We suspect that with each passing day, the effect that this technology is going to have on the retail sector is going to significantly grow. This will favor the larger, well-positioned retailers, in our view.

While the consumer in aggregate is still holding up, the split (read report) between lower-income shoppers and higher-income households has increasingly widened. Trump’s “Operation Affordability” initiative is framed as an effort to reverse the Biden-era inflation that has squeezed the working poor and younger Americans.

Tyler Durden

Mon, 12/01/2025 – 07:45ZeroHedge NewsRead More

R1

R1

T1

T1