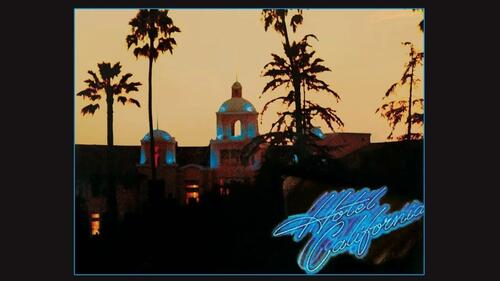

Welcome To Hotel California: Democrats Push Retroactive Billionaire Tax

California was once known as the destination for anyone seeking a fortune, from the Gold Rush to Hollywood. The image of a line of wagon trains heading West has now been replaced by a line of U-Hauls heading anywhere but California. Unable to stem the exodus, California is again toying with retroactive taxes — targeting the wealthy regardless of whether they flee the state.

Welcome to Hotel California, “you can check out any time you like, but you can never leave.”

California democrats have long faced the same dilemma of constantly tapping the wealthy to cover their deficit spending: these individuals and their wealth are mobile. They can simply leave and many are doing so. We recently discussed how California is now losing a taxpayer every minute.

Previously, the state moved to tax people who left the state. Now, the state is seeking a billionaire tax and making it retroactive. Thus, even if you were waiting to decide to leave, it is too late. You are being taxed for the prior year.

California Governor Gavin Newsom is pushing the retroactive billionaire tax targeting the roughly 220 billionaires residing in California in 2025. It signals not just desperation in the face of crippling debt and overspending but a recognition that California is chasing its highest earners out of the state.

The “2026 Billionaires Tax Act” would impose a one-time 5% tax on individual wealth exceeding $1 billion. While technically using 2026 wealth figures, it would apply to billionaires who resided in California in 2025.

So you cannot hope to flee… at least with your wealth intact.

It is a penalty for those who stayed too long hoping that rational minds would prevail in California.

The tax is a familiar tactic of many in politics who attack the wealthiest citizens as somehow ripping off the poor.

If states can do this for billionaires, it is likely to do it for those in lower tax brackets as they face the choice between financial discipline and tax increases.

As I discuss in my forthcoming book, Rage and the Republic: The Unfinished Story of the American Revolution, there is a common myth that the top five percent of this country do not “pay their fair share.” However, putting that debate aside, the question is whether it will produce more revenue than it costs the state in the long run. As these politicians campaign on clipping the “fat cats” who are not paying their fair share, many are likely to follow the exodus to lower tax states with greater fiscal discipline.

The constitutionality of a retroactive tax has long been controversial. In Landgraf v. USI Film Products (1994), the Supreme Court declared “the presumption against retroactive legislation is deeply rooted in our jurisprudence… [e]lementary considerations of fairness dictate that individuals should have an opportunity to know what the law is and conform their conduct accordingly; settled expectations should not be lightly disrupted.”

Most Americans are obviously not billionaires, but see the obvious unfairness to such retroactive taxes. People are allowed to make decisions on whether they want to stay in a state and how to invest their money in light of tax and other considerations. These retroactive taxes allow a bait-and-switch for taxpayers as politicians tap wealth from prior years.

However, in United States v. Carlton (1994), the Court addressed a new estate tax deduction for selling stock in employee stock ownership plans that was included in the 1986 tax reform law. In January 1987, the IRS announced that the legislation had a flaw: it did not require a taxpayer to own the stock before dying. New legislation was passed in December 1987 with retroactive effect to the 1986 law.

The Supreme Court refused to strike down the 14 months of retroactive application. Calling the change “modest,” the Court noted that the IRS sent out a quick notice that it would seek a legislative fix, and that the law essentially corrected an unintended error. However, even that left some on the Court uneasy, and justices like Sandra Day O’Connor, Antonin Scalia, and Clarence Thomas warned against “bait-and-switch taxation.” The key was the notice and the fact that it only applied to a single year.

Some retroactive taxes have been struck down. For example, in Blodgett v. Holden, 275 U.S. 142 (1927), a 12-year period of retroactivity was struck down as “so arbitrary and capricious as to amount to confiscation.”

The Court has left the area a mess of countervailing rationales and holdings. However, it has clearly held that retroactive taxes are not per se unconstitutional. In Welch v. Henry, 305 U.S. 134, 147 (1938), the Court upheld a retroactive tax and held that the outcome depends upon whether “retroactive application is so harsh and oppressive as to transgress the constitutional limitation.” It stressed that:

“Provided that the retroactive application of a statute is supported by a legitimate legislative purpose furthered by rational means, judgments about the wisdom of such legislation remain within the exclusive province of the legislative and executive branches . . .’

The rational basis test is difficult for a state to fail. However, California could force the Court to reexamine this area and offer more concrete protections for citizens who are retroactively fleeced by a state.

Until then, welcome to the Hotel California:

Last thing I remember, I was

Running for the door

I had to find the passage back

To the place I was before

“Relax,” said the night man

“We are programmed to receive

You can check out any time you like

But you can never leave”

Tyler Durden

Tue, 12/02/2025 – 10:20ZeroHedge NewsRead More

R1

R1

T1

T1