WTI Holds Gains As Cushing ‘Tank Bottoms’ Loom; US Crude Production At Record High

Oil prices are higher this morning after API’s report showed crude inventories fell last week, while negotiations to end Russia’s war on Ukraine failed to reach an agreement.

Prices have stuck in a narrow range in recent weeks as geopolitical concerns have countered rising supply as OPEC+ returned 2.6-million barrels of production cuts to market amid increasing production outside of the cartel.

But a lack of progress in U.S.-led negotiations to reach a peace deal between Ukraine and Russia and the Trump Administration’s military build up off Venezuela continue to command a risk premium for the commodity.

“Traders weighed prospects for an end to the war in Ukraine while watching for Trump’s next moves on Venezuela. Ahead of today’s EIA report, the API said US crude stockpiles rose by 2.5 million barrels last week. Overall, Brent and WTI remain confined to tight ranges as ample global supply continues to offset geopolitical risk,” Saxo Bank noted.

Will the official data confirm API’s

API

-

Crude -2.48mm

-

Cushing -89k

-

Gasoline +3.1mm

-

Distillates +2.88mm

DOE

-

Crude +574k

-

Cushing -457k

-

Gasoline +4.518mm – biggest build since May

-

Distillates +2.059mm

The official report was delayed but once it hit, it showed a small crude build (as opposed to API’s reported draw). Products saw big builds (Gasoline largest weekly add since May) and Cushing stocks fell for the 4th straight week…

Source: Bloomberg

Cushing’s ongoing draws leave stocks near ‘tank bottoms’ once again…

Source: Bloomberg

US Crude production hovers near record highs despite the rapid decline in rig counts…

Source: Bloomberg

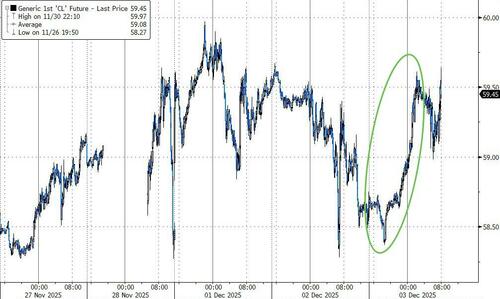

WTI is holding gains after the delayed data…

Source: Bloomberg

Geopolitical tensions are keeping the market jittery and adding a risk premium to prices, partly countering concerns about a surplus. That includes US rhetoric against Venezuela, with President Donald Trump suggesting the Pentagon will soon start targeting drug cartels with strikes on land.

“The Brent crude price remained roughly unchanged in the low $60s over the last week as Russia-Ukraine peace talks continue,” Goldman Sachs Group Inc. analysts including Yulia Grigsby said.

“Oil markets and prediction markets do not appear to price a large probability of a near-term peace agreement and removal of the sanctions on Russia oil.”

Grigsby also noted that overall levels of Russian oil exports have remained robust, even after US penalties on Lukoil and Rosneft, as sales rapidly pivoted to non-sanctioned producers.

On the bright side, the broadly weaker trend on crude oil prices has dragged gas (pump) prices down to their lowest since May 2021…

Source: Bloomberg

While it’s not exactly ‘drill, baby, drill’, it’s certainly what Trump wanted (the question is, will the lower price push shale producers to cut production… and round and round we go).

Tyler Durden

Wed, 12/03/2025 – 11:18ZeroHedge NewsRead More

R1

R1

T1

T1