The Problem With GDP

Authored by Alasdair Macleod via VonGreyerz.gold,

With signs of economic stagnation hard to ignore, politicians, economists, and even central bankers talk about the necessity for economic growth. Not only are they displaying economic ignorance, but by chasing something that is not a measure of production, they are bound to fail in their objectives.

The consequences for us all end in a crisis of reality. The errors of economic and monetary management by modern governments result in a credit crisis, which ultimately destroys their currencies. The signs that such a crisis is descending upon us are growing.

This article focuses on the delusions and destruction by macroeconomics: its principle objective is demonstrated to be an egregious error: to achieve economic growth. Being the sum of all recorded qualifying transactions over a period usually of a year, the measure of GDP is not of output, but of credit deployed in the economy. The error is to assume that all credit is deployed productively.

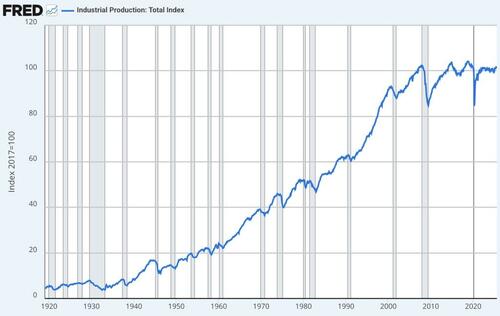

Credit recorded in GDP finances consumption, production (including investment), and government spending. Only credit for production and investment in it leads to price stability. But US industrial production is lower than in 2008, when on the Federal Reserve Bank of St Louis’s total index, it was 102.38 compared with 101.27 last:

Separately, FRED shows that industrial investment increased by a paltry $100 billion since 2008.

Credit expansion to finance production, particularly of goods, is non-inflationary because it is employed to make goods better, cheaper and more relevant to evolving consumer desires. And if credit funding goods production and investment have gone nowhere in the last seventeen years, then the increase in GDP is misleading.

Since 2008, GDP has more than doubled to about $30,000 billion. With the exception of service industries, many of which add little value, the expansion of credit funds, excess consumption and government spending. Credit expansion to finance the credit bubble is excluded from GDP, which is a separate issue.

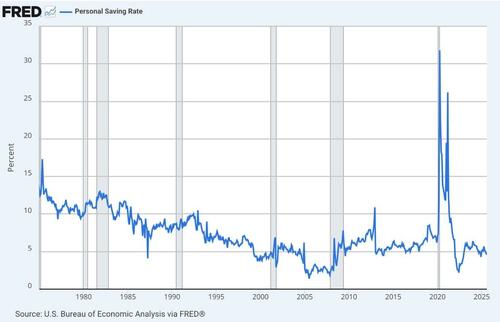

It should now be clear that economists and politicians trumpeting growth are being misled or misleading themselves into promoting inflationary policies. The only offset is savings. If consumers save instead of spending, then consumer prices will not be driven up so much by excess credit. But here the US’s record over time is dismal:

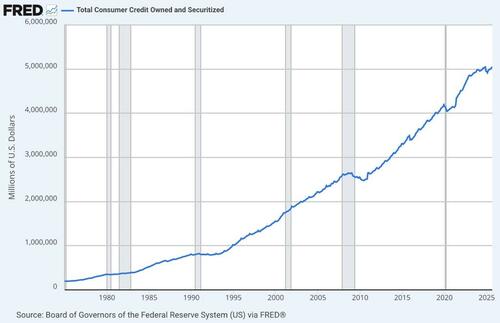

Other than the spikes during the COVID lockdowns, when no one could spend, the long-term savings trend is down. Not only are savings down, but consumer debt is up:

Using 2008 as our base, consumer debt has doubled, while production of goods has stagnated. So not only has the personal savings rate generally declined, but the expansion of consumer debt has been a driving factor behind growth in GDP.

That leaves government spending. Governments are notoriously bad distributors of economic resources, and nowhere is this more so than reflected in GDP. Total US Government spending is about 40% of GDP, with the federal government portion being 23%. At least state and local governments’ spending is more relevant to their communities, but federal government spending is not, and that is where trouble is mounting from wasteful spending, all of which is included in GDP.

The easiest way to grow GDP is for the federal government to increase its useless and economically destructive spending, which undoubtedly encourages the political class to do so.

The deflator myth

Starting with nominal GDP, econometricians point out that it should be deflated for inflation. If nominal GDP is shown to grow by 5%, than an inflation rate of 2% reduces that to real growth of 3%. The deflator usually used is the consumer price index.

The temptation to bolster real GDP growth by tinkering with the CPI is irresistible. Various methods are used to achieve this outcome. The result is that the current US inflation rate is calculated by the Bureau of Labour Statistics to be 3%, while John Williams of Shadowstats, who uses the original 1980 basis of calculation, computes it as 12%. Taking nominal GDP growth currently estimated by the Congressional Budget Office of 4.5%, this changes “real” GDP growth from 1.5% to minus 7.5%.

Imagine the furore if that was admitted! But we can’t even believe this more realistic presentation of the contraction of the value of total credit deployed in the economy (for that is what it is), because in theory there is a general level of prices, but in practice, no such thing exists. Its construction is therefore purely subjective and can say anything a government statistician wants. Hence, the difference between Shadowstats’ 1980 basis and subsequent revisions.

Consequently, the idea that GDP growth, nominal or real, represents the economic progress we all desire gets even further away from the truth. Instead, we can explain how the real economy is being suppressed by statistical misrepresentation, despite GDP headlines.

The debt trap

If there is one thing GDP is genuinely useful for, it gives a nation’s lenders a basis for judging its creditworthiness. Put simply, if national debt is growing faster than its tax base — roughly measured by the growth in GDP — then the economy is in a debt trap. However, if we are realistic about the distortions in the numbers, then many of the G7 nations are already there.

The reason that debt traps are yet to be properly recognised by markets is that they have been captured by governments themselves. The entire macroeconomic myth, coupled with regulatory oversight, have engendered complacency, which eventually will be shattered.

It happened in Britain the last time it had a far-left government. In 1976, sterling began to fall, and the IMF were called in to stabilise government finances. Inflation the previous year had hit 25% and bond yields had soared to over 16%. The problem was that without the IMF forcing the UK government to cut spending and raise taxes to generate a budget surplus, the dynamics of the debt trap would have driven gilt yields higher still.

An understanding that GDP represents credit and not economic progress, and that most of its deployment is inflationary, tells us that the dollar and other major currencies already face debt traps. That is why central bankers in the know are selling currencies and buying gold.

Conclusion

Investors should be aware that the government statistics upon which they rely for guidance are thoroughly misleading. Nowhere is this truer than in GDP, the quicksand upon which macroeconomics is built. Distortion of the facts compounds distortions of the past. This is why the entire basis of economic analysis is misleading and is bound to end up in a general economic and credit crisis when reality returns.

For this reason, individuals should follow the actions of central banks and protect themselves from a looming credit crisis. That can only be done by getting out of credit and into real money without counterparty risk, which is only physical gold.

Tyler Durden

Thu, 12/04/2025 – 17:40ZeroHedge NewsRead More

R1

R1

T1

T1