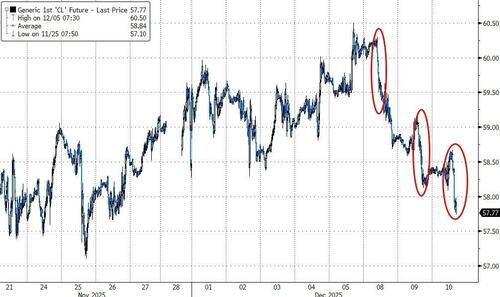

WTI Holds Losses After Big Product Inventory Builds, US Crude Production Nears Record Highs

Oil prices extended their recent decline this morning as concerns about global oversupply continued to weigh on sentiment.

Crude has been trapped in a tight $4-a-barrel range since the start of November, as oversupply concerns vie with geopolitical risks surrounding the flow of sanctioned Russian barrels into nations including India.

“I’m increasingly becoming a bit of a contrarian here, given the limited selling response to all the negative news,” said Ole Hansen, head of commodities strategy at Saxo Bank AS.

“The biggest risk to prices could be to the upside if next year’s oversupply is already priced in,” he added.

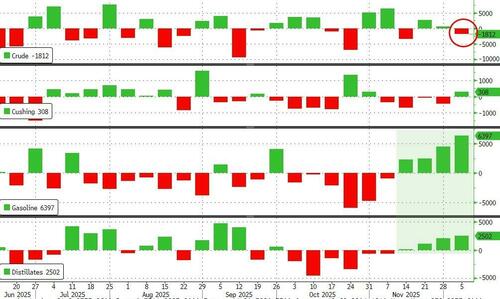

Overnight saw API report a large crude draw but sizable product builds…

API

-

Crude -4.78mm (-1.7mm exp)

-

Cushing

-

Gasoline +3.14mm

-

Distillates +2.88mm

DOE

-

Crude -1.812mm

-

Cushing +308k

-

Gasoline +6.397mm – biggest build since Dec 2024

-

Distillates +2.5mm

US crude stocks fell last week but products saw notable builds (4th straight week) as Cushing inventories hover near ‘tank bottoms’…

Source: Bloomberg

US Crude production picked up again to a new record high as rig counts remain near cycle lows…

Source: Bloomberg

Oil prices have stuck within a tight range in recent weeks as rising geopolitical risks amid Ukrainian attacks on Russian oil infrastructure and shipping counter rising global inventories of the fuel.

In its monthly Short-Term Energy Outlook released Tuesday, the EIA warned rising global production has outpaced demand and it expects inventories to continue rising by two-million barrels per day in 2026, pressuring prices.

Tyler Durden

Wed, 12/10/2025 – 10:49ZeroHedge NewsRead More

R1

R1

T1

T1