Asset Purchases Begin: Fed To Buy $8.2BN In Bills Friday; Full Monthly Schedule Released

It’s only appropriate that one day after Powell unveiled QE, pardon NOT QE, pardon Reserve Management Purchases (as we said he would), that the New York Fed would do what it did for years for the entire duration of QE 1, QE 2, QE 3 and so forth, and publish the POMO, pardon NOT POMO schedule of daily asset purchases. But since it’s Bills and not long-duration bonds, it’s not QE… or something.

As shown in the schedule below and as was first announced yesterday, the Fed plans to buy $40 billion of T-bills, spanning two sectors, over the period beginning Dec. 12 and ending Jan. 14 for “reserve management purchases.” This includes $8.2 billion on Friday (full schedule here).

The central bank also plans to buy another $14.4 billion of T-bills as part of its plan to reinvest all principal payments from its agency securities.

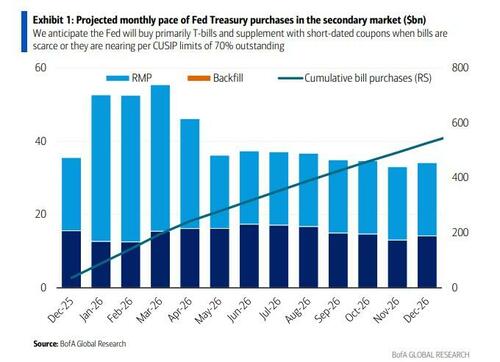

Earlier in the day, Barclays published a note estimating that the Fed could wind up buying close to $525 billion of T-bills in 2026 from a previous forecast of $345 billion, with net issuance to private investors estimated at just $220 billion from $400 billion previously.

Separately, JPMorgan and TD Securities also now see the central bank absorbing a bigger amount of debt. Bank of America anticipates the Fed may have to keep an increased pace of purchases for longer to add enough reserves and stabilize money market rates.

Echoing verbatim what we said one month ago, Wall Street strategists said the measures will help alleviate pressures that have been building up for months while the Fed was shrinking its holdings. They expect the purchases will act as a tailwind for swap spreads and SOFR-fed funds basis trades. And, judging by the market which will close at an all time high on Thursday, stocks and precious metals (the crypto algos may need a reboot to figure out what is going on).

A closer look at what Bank of America’s Mark Cabana had to say:

- There is risk of maintaining higher pace of purchases for longer as RMPs will only add back $80 billion of cash above natural liability growth by mid-April while BofA expects the Fed will need to add back $150 billion to achieve ideal outcome (as a reminder, Cabana initially predicted $45BN in monthly Bill purchases).

- Fed will shift to UST coupons out to three years if they perceive bill investors are “being adversely affected” to limit their displacement. It will be very difficult for the pro-Fed commentariat to pretend this is NOT QE (again).

- Balance sheet actions reinforce core spread views: long January and 1y1y SOFR-fed funds, long 2-year asset swap spreads

On Wednesday, trading in short-term rate futures jumped and two-year swap spreads widened to their highest levels since April, a sign of less stress in the short-term market.

Tyler Durden

Thu, 12/11/2025 – 16:02ZeroHedge NewsRead More

R1

R1

T1

T1