Battle For Rare Earths And Recognition: Germany’s Wadephul Arrives In China As A Supplicant

Submitted by Thomas Kolbe

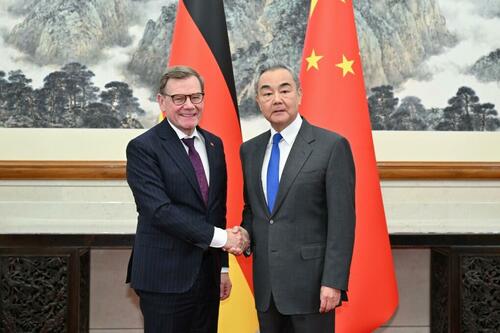

After German Foreign Minister Johann Wadephul was forced to cancel his October trip to China due to a lack of scheduled meetings, he has now finally met with Foreign Minister Wang Yi and Commerce Minister Wang Wentao. At the center of the talks was one issue with immense strategic weight for Germany and Europe: the future handling of critical raw materials—above all rare earths.

The relationship between Germany and the EU on the one hand and China’s political leadership on the other is clearly creaking. The growing trade tensions between both sides have become impossible to ignore.

In October, rising diplomatic friction culminated in China’s export halt on rare earth elements.

Rare earths, put simply, are a foundational pillar of modern industrial production and high-end technology. Without them, production stalls—and China’s sudden export freeze sent shockwaves through the executive floors of German industry, especially the automakers, prompting warnings of immediate production shutdowns.

Raw Materials and China’s Leverage in Ukraine

Pressure was therefore immense ahead of Wadephul’s visit. His originally planned trip had been scrapped after Beijing denied him meetings with the key ministers he needed—his counterpart Wang Yi and Commerce Minister Wang Wentao. It was a humiliation that exposed the real power imbalance between Berlin and Beijing.

Wadephul also witnessed firsthand that Beijing is deadly serious about using its geopolitical levers—partly as a way to counter U.S. tariffs and rising trade pressure.

Europe is trapped: on the one hand, it suffers from China’s dumping exports that hollow out European industry. On the other hand, it relies heavily on Chinese rare earths, 90% of which are refined and exported under Chinese licensing authority.

Second Attempt

Thus, on December 8 and 9, the German delegation attempted a second round of engagement with Beijing. Central to the agenda: access to rare earths, chips, raw materials—and China’s stance on Russia’s war in Ukraine. Wadephul described the exchanges as “open and intensive,” with progress on economic issues and some signs of de-escalation in the raw materials dispute. He insisted it had been wise to pause, regroup, and attempt talks once more—talks that should also help pave the way for the German Chancellor’s upcoming visit.

Berlin wants to stay engaged, possibly even through a broader European mission, in order to shore up supply security for its industrial base.

But a genuine thaw between Berlin, Brussels, and Beijing remains nowhere in sight. Wadephul’s vague assessment that Beijing, like Germany, was interested in “serious and concrete” dialogue remains noncommittal.

For now, Wadephul leaves with Beijing’s signal that export licenses for rare earths may be issued more readily. But he emphasized that much work remains before supply can be considered truly secure.

China and the U.S. Play Their Cards

Germany imports around two-thirds of its rare earths from China. For key magnet metals—like neodymium, praseodymium, and samarium—the dependence is nearly total. The EU’s strategy to reduce this dependency remains limited to recycling and attempts at building partnerships in South America—none of which have delivered meaningful results.

China’s licensing strategy mirrors Washington’s latest move in the chip war. The U.S. this week unveiled a model under which Nvidia’s H200 chips may be exported to China—provided Beijing pays a 25% levy.

Both superpowers are ruthlessly leveraging their strategic advantages to reorder global trade and secure long-term dominance.

Brussels, meanwhile, must bend, concede, and build new trade alliances. The EU’s failure—after years of talks—to finalize the Mercosur agreement shows Brussels’ inability to compromise, tripping over its own feet even in an area of existential importance.

Europe Caught Between Weakness and Geopolitical Pressure

Brussels and Berlin would have been wise to realign strategically with Washington, drop their resentment toward President Trump, accept U.S. frameworks, and leverage America’s geopolitical umbrella for their own advantage. Europe’s resource and energy dependency is fast becoming its Achilles heel in this global contest for power, markets, and influence.

This makes Wadephul’s largely fruitless visit all the more troubling—German industry is desperate for clarity on rare earth supply security.

It may also have been tactically unwise for Wadephul to press Beijing to use its influence on Moscow and bring Russia back to the negotiating table over Ukraine. Beijing surely noticed that it has been European governments, not China, who have opposed any negotiation track with maximalist rigidity.

In contrast to most assessments of this unimpressive trip, Reuters reported that China may offer priority access to rare earths for European manufacturers as part of a supply-chain stabilization effort. Diversion tactic—or a genuine first step toward rapprochement? The coming weeks will tell.

* * *

About the author: Thomas Kolbe, a German graduate economist, has worked for over 25 years as a journalist and media producer for clients from various industries and business associations. As a publicist, he focuses on economic processes and observes geopolitical events from the perspective of the capital markets. His publications follow a philosophy that focuses on the individual and their right to self-determination.

Tyler Durden

Fri, 12/12/2025 – 03:30ZeroHedge NewsRead More

R1

R1

T1

T1