Ford Takes Record $19.5 Billion Charge As EV Bet Implodes, Pivots To Grid Batteries

Shares of Ford in New York have yet to hit a new high since the debut of the all-electric F-150 Lightning in April 2022. What was pitched as a flagship EV push has since devolved into an epic miscalculation, with the automaker now preparing to take $19.5 billion in charges, mostly in the fourth quarter, as it unwinds and overhauls its electric vehicle strategy.

Ford is overhauling its entire electrification roadmap. The reset includes the cancellation of three future EV programs, the termination of the current F-150 Lightning, and a shift toward new offerings across multiple powertrains, including a future extended-range hybrid vehicle variant of the F-Series.

The pivot also entails a complete restructuring of battery operations, highlighted by the breakup of its partnership with South Korean battery maker SK On. The next chapter of Ford’s strategy is a pivot toward grid-scale energy storage systems.

We’ve explained to readers that lithium prices are on the rise as EV battery makers pivot to energy storage systems:

Last year, Ford lost a staggering $5.1 billion in its EV division and expects this year to be even worse. The pivot puts the struggling automaker’s EV division on track for profitability by the end of the decade.

Here are the key highlights of the pivot:

-

Offers broad choice with gas, hybrids, and EVs: Ford will offer a range of hybrids to complement efficient gas engines. The Universal EV Platform will underpin multiple models. By 2030, about 50% of Ford’s global volume will be hybrids, extended-range EVs, and electric vehicles, versus 17% today.

-

Fills U.S. plants with affordable new models: New Built Ford Tough pickups will be assembled at BlueOval City in Tennessee, and a new gas and hybrid van will be produced at the Ohio Assembly Plant. Ford plans to hire thousands of new employees in the U.S. in the next few years.

-

Launches battery energy storage business: Ford will leverage wholly owned plants in Kentucky and Michigan and leading LFP technology to provide solutions for energy infrastructure and growing data center demand. Ford plans to begin shipping BESS systems in 2027 with 20 GWh of annual capacity.

-

Improves profitability: Actions are expected to drive accretive returns and accelerate margin improvements across Ford Model e, Ford Pro, and Ford Blue. Ford Model e is now expected to reach profitability by 2029, with improvements beginning in 2026.

-

Rationalizes U.S. EV-related assets and product roadmap: Ford expects to record about $19.5 billion in special items, with the majority in the fourth quarter. The company expects about $5.5 billion in cash effects, with most paid in 2026 and the remainder in 2027.

-

Raises guidance: The company raised 2025 adjusted EBIT guidance to about $7 billion, citing continued underlying business strength and cost improvements. It reaffirmed adjusted free cash flow guidance, trending toward the high end of the $2 billion to $3 billion range.

Goldman analysts led by Mark Delaney offered clients their first take on the restructuring of Ford’s EV unit:

We believe the realignment and restructuring actions will help improve the P&L as Ford reduces Model e losses and increases production of more profitable Blue and Pro vehicles. Over the longer term, we expect a key debate will center on how these actions impact Ford’s ability to reach Model e profitability, particularly as it increasingly competes with Chinese OEMs outside of China. We think successful execution on the UEV platform and EREV technology, as well as software and digital services, will be key factors. On the ESS business, industry participants have historically seen varied margins, and we believe costs and the company’s ability to deliver a full solution will be important determinants of long-term profitability.

On capital allocation:

We do not expect these charges to affect Ford’s dividend. Recall that Ford’s dividend target is based on 40% to 50% of adjusted free cash flow, and we believe these charges will be excluded from the adjusted FCF calculation. In addition, the company has a strong cash position on the balance sheet, in our view.

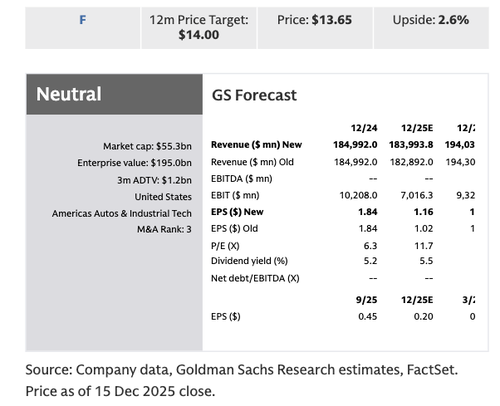

Goldman maintained a Neutral rating on the stock, raised EPS estimates to $1.16, $1.65, and $1.80 for 2025, 2026, and 2027, respectively, and lifted its 12-month price target to $14 from $13, based on an unchanged 8x multiple on normalized EPS.

Ford shares have yet to recover since the F-150 EV debuted in April 2022.

In November, we reported that Ford mulled scrapping the EV truck:

The F-150 EV is shaping up to be America’s first major EV casualty. Henry Ford would likely be turning over in his grave after such a massive miscalculation in chasing the “green” narrative. The question now is whether the board will hold management accountable for drinking the green Kool-Aid.

Tyler Durden

Tue, 12/16/2025 – 06:59ZeroHedge NewsRead More

R1

R1

T1

T1