Oracle Claims Michigan Data-Center ‘On Schedule’ Despite Blue Owl’s Absence

Update (0900ET): Oracle has issued a statement claiming the deal on the Michigan data center remains on schedule (though not with Blue Owl):

“Our development partner, Related Digital, selected the best equity partner from a competitive group of options, which in this instance was not Blue Owl . . . Final negotiations for their equity deal are moving forward on schedule and according to plan.”

Related Digital said:

“This is an exceptional project that drew significant interest from equity partners. We evaluated all of our options and selected our equity partner of choice for their unparalleled expertise in the space.”

Related Digital declined to name the equity partner for the project. A person close to the company said it was in the “final stages of diligence” with the investor.

ORCL shares rebounded very modestly on the news…

* * *

The broad equity futures markets, most notably Nasdaq, is falling the pre-market after The FT reports that Oracle’s largest data centre partner Blue Owl Capital will not back a $10bn deal for its next facility, as the software group faces increased concerns about its rising debt and artificial intelligence spending.

The private credit provider had reportedly been in discussions with lenders and Oracle about investing in the planned 1 gigawatt data centre being built to serve OpenAI in Saline Township, Michigan. But the agreement will not go forward after negotiations stalled, according to three people familiar with the matter.

Blue Owl has been the primary backer for Oracle’s largest data centre projects in the US, investing its own money and raising billions more in debt to build the facilities, which Blue Owl typically owns and leases to Oracle.

The FT adds that people close to the Michigan deal said lenders pushed for stricter leasing and debt terms amid shifting market sentiment around enormous AI spending including Oracle’s own commitments and rising debt levels.

As a result, the deal was less attractive financially for Blue Owl than its earlier projects, according to some of the people.

One quick question… what happened in the last 7 days that changed their mind?

*BLUE OWL’S PACKER: DATA CENTERS ARE ‘REALLY ATTRACTIVE SPACE’ https://t.co/BRL0HMAu71

— zerohedge (@zerohedge) December 10, 2025

This sparked an immediate drop in ORCL shares..

…which knocked into the tech sector more broadly…

This could potentially be very bad news for both the data-center ecosystem within AI and ORCL itself, since, as we have detailed numerous times previously, if private credit is saying ‘no mas’, then no way the AI cycle will be completed…

Who could have seen this coming?

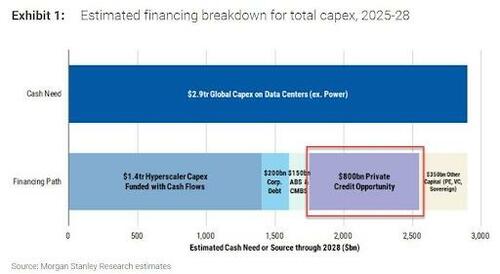

This, plus the fact that the AI cycle will need $1.5 trillion in private credit funding, is why the US will have to throw private credit in the bailout bucket too.

Yes, a lot of things will need a bailout to win the AI wars. That’s why the $ is reserve for now. https://t.co/ozlvzvD98K

— zerohedge (@zerohedge) November 18, 2025

As far back as June 2024, we have warned that the debt backing of this massive capital expenditure has been an event horizon that seemed inevitable. We appear to be crossing it now…as Blue Owl has largely pioneered this type of arrangement with large tech companies that want to offset the upfront costs of enormous data center construction projects… and is now, apparently, becoming much more discerning.

Tyler Durden

Wed, 12/17/2025 – 09:00ZeroHedge NewsRead More

R1

R1

T1

T1