Yields Hit Session Highs After Poor, Tailing 2Y Auction Sees Lowest Foreign Demand Since 2023

It’s the last treasury auction week of the year, and due to upcoming holidays, we are running on an accelerated scheduled which means the 2Y auction which usually takes placed on Tuesday, is Monday’s business instead. It was a subpar auction with modest demand; overall grade – not great, not terrible.

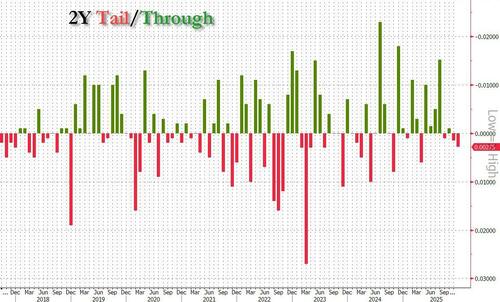

The auction of $69BN in 2Y paper stopped at a high yield of 3.499%, up 1bp from last month’s 3.489%, and tailed the When Issued by 0.3bps, the biggest tail for the short-end since April’s 0.6bps tail. It followed a series of what had been mostly stopping through auctions throughout 2025.

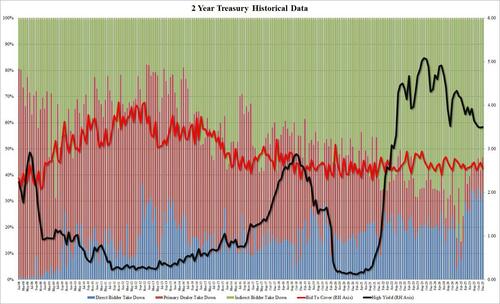

The bid to cover was 2.543, down from 2.684 in November and the lowest since September; it was also below the 6-auction average of 2.623.

The internals were also mediocre at best, with Indirects awarded just 53.21, down from 58.07 and the lowest since March 2023. And with Directs taking down 34.05%, higher than November’s 30.74% and above the recent average of 31.69%, Dealers were left holding 12.74% of the sale, the most since June.

Overall, this was a soft, subpar auction, with weak demand metrics, confirmed by the jump in 10y yields to session highs after the break.

Tyler Durden

Mon, 12/22/2025 – 13:32ZeroHedge NewsRead More

R1

R1

T1

T1