Intensifying Shortage: This Is What A Run On The London Silver Market Looks Like

Authored by David Jensen via Substack,

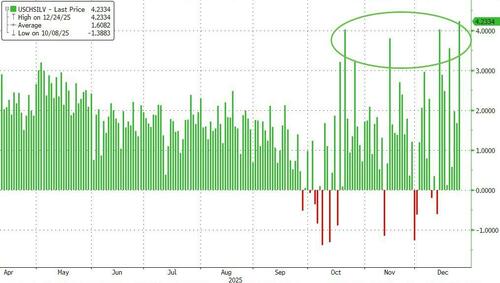

Dutch trading specialist Karel Mercx posted the following commentary where the opposite (multiply by -1) of the silver swap rate minus US interest rates can be used as a proxy for the implied silver lease rate to determine physical shortage in the London silver market.:

“The 1-year silver swap minus the US interest rate is now –7.18%.

That distortion explains why the silver rally is not over.

Only at the red line do supply and demand normalize.”

A further six days ago Mercx posted the following commentary:

“ The 1-year silver swap minus the US interest rate is now almost –7%! That distortion is the key reason the silver rally is not over.

That spread should be positive, since silver needed in one year comes with storage, insurance, and financing costs.

Extra explanation.

The silver swap rate is a crucial part of the global precious-metals trade. It exists because major players such as banks, producers, industrial users, and investors constantly exchange silver for dollars without physically moving metal from vault to vault. This mechanism keeps the London physical market tightly connected to the New York financial market.

But that system is now under strain. Physical silver today is almost 7% more expensive than silver for delivery one year from now. Swaps were designed to avoid shipping metal around the world, yet today silver is being moved because buyers are demanding delivery.

Holding physical silver isn’t easy or cheap.

A $1 million position weighs several hundred kilograms, spread across dozens of heavy bars that require vault space, insurance, and security…

…That question is now being priced in. As long as the 1-year silver swap minus US rates remains below the red line, silver’s upside pressure continues. No one knows where supply and demand will reconnect. … ”

I’ve added a trend arrow to the chart that Mercx posted:

Figure 1 – One Year Silver Swaps Minus One Year One Year US Interest Rates at Dec 23, 2025; source: Karel Mercx x.com

Note that the distance from the red line normalization is increasing as the London silver shortage intensifies. The London silver market is devolving, not stabilizing.

[ZH: the spread between SHFE and COMEX silver futures is extreme to say the least – incentivizing the flow from London to Shanghai]…

This is what a run on the London ‘physical’ silver market looks like where holders of unallocated promissory notes for silver ownership and delivery, at the margins, start to demand physical metal delivery.

The enormous leverage of London paper (vapor) claims vs physical silver available for delivery gives the potential for a very quick unwind of London.

Tyler Durden

Thu, 12/25/2025 – 10:30ZeroHedge NewsRead More

R1

R1

T1

T1