US Manfacturing Survey Signals “Wile E Coyote” Scenario

With ‘hard’ data showing resilience into year-end, ‘soft’ survey data has cratered (not helped by the government shutdown)…

Source: Bloomberg

…and this morning brings more weakness as S&P Global’s US Manufacturing PMI (final print for December) dipped to 51.8 – its lowest since July (the only contractionary – sub-50- month of 2025)…

Source: Bloomberg

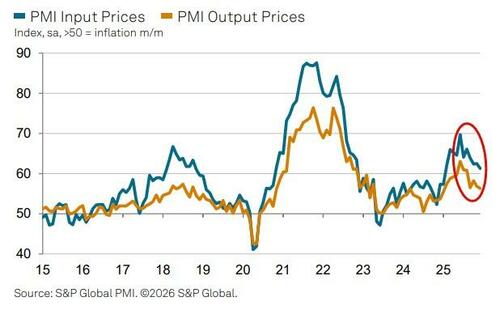

The latest survey showed a weaker gain in production, amid a renewed contraction in new order books – the first in exactly a year. International sales continued to fall, in part linked to tariffs, which also continued to push up operating expenses at an elevated pace. That said, although remaining historically elevated, both input and output prices rose at their slowest rates for 11 months.

“Although manufacturers continued to ramp up production in December, suggesting the goods producing sector will have contributed to further robust economic growth in the fourth quarter, prospects for the start of 2026 are looking less rosy,” according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

“Something of a Wiley E Coyote scenario has developed, whereby – just like the cartoon character continues to run despite chasing the roadrunner off a cliff– factories are continuing to produce goods despite suffering a drop in orders.“

The gap between growth of production and the drop in orders is in fact the widest seen since the height of the global financial crisis back in 2008-9:

“Unless demand improves, current factory production levels are clearly unsustainable.”

Payroll numbers will also be adversely impacted if production capacity has to be scaled back.

“A key factor causing concern over sales is the extent to which producers are having to pass higher costs on to customers in the form of raised prices, with higher costs continuing to be overwhelmingly blamed on tariffs,” says Williamson.

There is some good news:

“Some encouragement comes from input cost inflation moderating in December to the lowest recorded since last January.

But…

However, while this cost trend suggests the tariff impact on inflation peaked back in the summer, costs are still rising month-on-month at an elevated rate to suggest that US firms continue to face higher cost growth than competitors in most other major economies.”

So, choose your own adventure: Hard or Soft data?

Tyler Durden

Fri, 01/02/2026 – 09:54ZeroHedge NewsRead More

R1

R1

T1

T1