Oklo’s Isotope Business: Atomic Alchemy

Submitted by Tight Spreads

Oklo is one of the most impressive nuclear companies in the public equities market. They uniquely and strategically intersect arguably the most important themes today: energy dominance, critical material supply chains, and national defense.

The market is not pricing in the potential value of the Y-Combinator backed company: Atomic Alchemy acquisition. And those who attempted to value the business have likely found it difficult with the little information given from management. But the most important takeaways are:

-

Oklo’s management said on a recent earnings call they will be receiving isotope revenues from this segment in the first half of 2026.

-

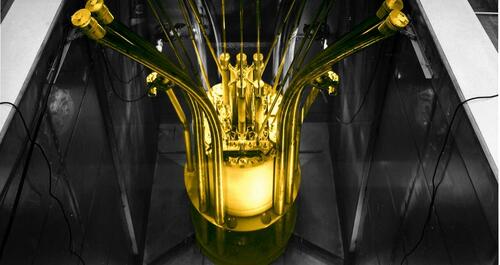

Atomic Alchemy’s Versatile Isotope Production Reactors (VIPR) can simultaneously extract isotopes from waste and create 40+ variations of new types via direct irradiation.

-

Co-locating Atomic Alchemy’s VIPR with Aurora Powerhouses are projected to lower their levelized cost of energy by 30-40%.

-

VIPR technology converts silicon into Phosphorus-31 with atomic-level consistency for cooler-running chips – which could lead to an interesting partnership/contract for Oklo, Intel, and Nvidia as hinted by management.

Oklo has vertically structured its business into the following segments:

-

Power and heat generation

-

Nuclear waste to fuel recycling and fuel fabrication

-

Advanced fuel services

-

Radioisotopes business via Atomic Alchemy

Last February, Oklo acquired Atomic Alchemy for ~$28.4million, primarily funded via stock and represented less than 1% of dilution to Oklo shareholders. As mentioned in my Isotopes 101 article, Atomic Alchemy’s key technology is the Versatile Isotope Production Reactors (VIPR). The VIPR simultaneously extracts high-value radioisotopes from waste streams (ranging from SMRs to traditional nuclear power plants) and by directly irradiating targets in the VIPR to create over 40 types of radioisotopes on demand.

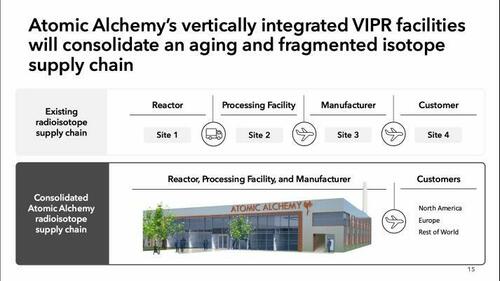

Oklo sees this as a significant high-margin opportunity and it stands up its nuclear generation business, and is moving expeditiously with the DOE to launch their first radioisotope facility. Recently on January 7, 2026, Oklo and the DOE signed what is known as a “Other Transaction Agreement” which established a framework for execution and risk reduction to design, construct, and operate the first radioisotope pilot plant under the DOE Reactor Pilot Program. Atomic Alchemy is using the radioisotope pilot plant to lay the groundwork for future commercial plants that make medical and research radioisotopes in the United States. Today, many are produced overseas or in aging facilities creating a structural supply shrinkage in an increasing demand environment.

This OTA is significant as it is a faster, well-structured pathway to scaling their isotope business compared to their prior planned Meitner-1 commercial radioisotope production facility at Idaho National Laboratory (INL).

And when thinking about timelines, it’s important to note that this superior pathway to commercializing their isotopes business was only recently announced. Richard Craig Bealmear, Oklo’s Chief Financial Officer, made the following statement about ten months earlier on Oklo’s March 2025 earnings call when the isotope business was still pursuing production at INL:

“Radioisotopes are among the most valuable materials on earth. Take Actinium-225 for example, which sells for $400 per nanogram or an astonishing $400 billion per gram. With our recent acquisition of Atomic Alchemy, we are positioning Oklo to capitalize on this high margin market. Our radioisotope demonstration project is already underway and we could begin generating revenue as early as the first quarter of 2026, unlocking significant near-term value for our business… [while] this acquisition is not expected to have material near-term operating cost increases for Oklo”

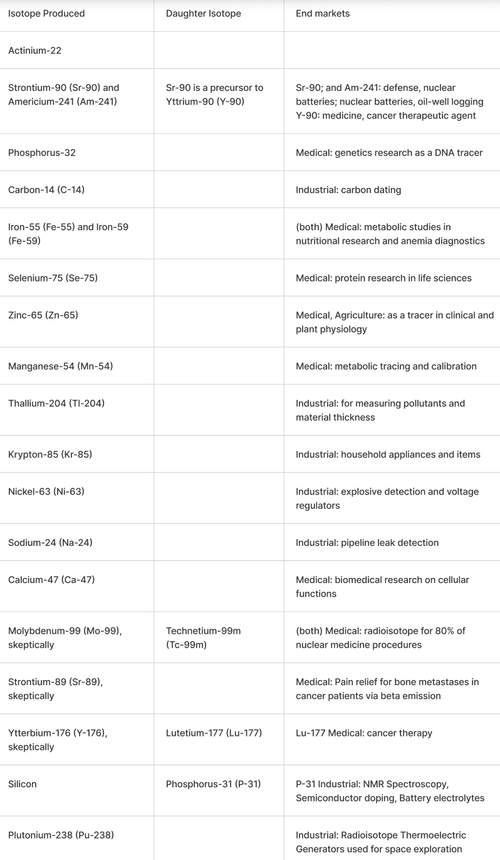

Isotopes that are currently disclosed, including special isotopes not found in nature and exclusive to VIPR technology, and rumored are included at the end of the article.

Unpacking Oklo’s vertically integrated business model

In a co-located facility, the Aurora Powerhouse and VIPR function as a single, integrated ecosystem where the flow of nuclear material is never a “choice” between power or isotopes, but rather a sequential process that maximizes every atom. The “closed-loop” system is anchored by Oklo’s Advanced Fuel Center in Tennessee, which employs electrorefining-based pyroprocessing—a high-temperature electrochemical technique uniquely capable of recycling spent fuel into fresh high-assay low-enriched uranium (HALEU) metallic fuel for reuse in Aurora units. VIPR complements this by acting as an on-site “value-added” processor: as spent fuel exits the Aurora core, it undergoes initial extraction in co-located “hot cells” to harvest high-value isotopes like Strontium-90 and Americium-241, removing fission products that act as impurities without diminishing the fuel’s remaining energy potential. The purified remnants are then shipped to Tennessee for full re-fabrication, closing the loop and achieving up to 95% fuel reuse while minimizing waste.

Oklo could also co-locaate their VIPR technologies with the Tennessee fuel recycling and fabrication site as they scale to concentrate the logistics of mass producing and shipping isotope products. But if Oklo chose to co-locate generation and isotopes, that would likely be for a significant contract. The strategy of co-locating Oklo’s Aurora Powerhouse with the VIPR creates a highly efficient industrial hub by functioning as a “shared oven” for energy and advanced materials. By simultaneously extracting high-value co-products from spent fuel and irradiating specialized feedstock, Oklo aims to maximize neutron utility and transform the traditional nuclear cost structure. As highlighted in company updates from August 2025, this vertically integrated approach leverages the Atomic Alchemy segment to create a multi-stream revenue model. By offsetting power generation costs with high-margin isotope production, Oklo is positioning its Aurora-VIPR ecosystem to significantly lower the levelized cost of energy, with analyst projections suggesting a potential 30-40% reduction in long-term operational costs compared to non-integrated advanced reactor designs.

Putting it all together into one Golden Formula,

Bundled services (Aurora nuclear power + fuel services + partnership with RPower for back-up generation + VIPR materials) = (Reliable power delivery that is not at risk to the grid + supplies customers with specialty materials within half-life spans in decay)

Oklo additionally intends to use their Tennessee fuel facilities to recycle spent U.S. nuclear fuel reserves and Atomic Alchemy to produce isotopes from U.S. nuclear waste. The annual cost of managing spent nuclear fuel across the U.S. has risen sharply, reaching nearly $49 billion in 2025 according to congressional testimony. This will only increase as the U.S. expands its nuclear install base. The company views the approximately 94,000 metric tons of used nuclear fuel stored across the U.S. as a significant energy reserve equivalent to 1.3 trillion barrels of oil. The nuclear fuel recycling market has a CAGR range of 6.5-8.5% between 2024-2035. And if spent fuel management wasn’t burdensome enough, the country is also facing a potential liability of up to $39.2 billion due to its failure to fulfill a legal mandate to dispose of uncontrollable nuclear waste. The market opportunity for high-level waste management for isotope recovery is a 7.8% CAGR between 2024-2034.

Applying the power and material stack to other industries

Semiconductors and Quantum Computers

In late 2025, NVIDIA CEO Jensen Huang publicly backed nuclear energy as the essential “round-the-clock” power source for the AI era. It makes sense that NVIDIA, Intel, and Oklo could form a vertically integrated “Quantum and AI Stack” that addresses the critical hurdles of power density and material evolution.

The technical and economic logic for this trifecta is driven by the escalating energy crisis in modern data centers, where individual server racks now demand up to 1 MW of power. To manage these unprecedented loads, Intel requires high-performance power semiconductors, such as MOSFETs and IGBTs, capable of high-frequency electrical switching with minimal thermal loss. While the industry has long used phosphorus as a “dopant” to induce electrical conductivity in silicon, traditional chemical methods are often “blotchy” and uneven, leading to efficiency-draining heat. By leveraging Oklo’s VIPR reactor, Intel can convert its pre-existing silicon sources into Phosphorus-31 atom-by-atom. This achieves an atomic-level consistency that no other commercial method can currently replicate, ensuring chips run significantly cooler and more efficiently bringing down the total cost of ownership in its factories.

It is notable to highlight that Richard Craig Bealmear, Oklo’s Chief Financial Officer, made the following statement on Oklo’s earnings call March 2025:

“We are already exploring joint ventures with customers in radiopharmaceuticals and advanced silicon doping for semiconductor manufacturing positioning Oklo for long-term success in high growth industries”

This collaboration between Intel and NVIDIA, announced in September 2025, elevates both companies from traditional semiconductor manufacturing to a next-generation tier that tightly integrates software and specialized hardware for accelerating AI workloads, requiring next-generation materials. NVIDIA agreed to invest $5 billion in Intel common stock, while the two firms jointly develop custom x86 CPUs designed to connect seamlessly with NVIDIA’s GPUs using NVIDIA’s high-bandwidth NVLink interconnect (a technology that provides significantly faster data transfer and lower latency than standard PCIe connections used in most systems today). This creates a unified “super-system” where Intel’s CPUs and NVIDIA’s GPUs work as one cohesive unit, allowing enterprise customers—such as data centers running massive AI models—to process complex tasks more efficiently without needing to rewrite existing software codebases heavily reliant on NVIDIA’s CUDA platform.

Beyond the atomic-level architecture of the chips themselves, the collaboration between nuclear production and semiconductor fabrication enhances industrial quality control and long-term hardware reliability. Thallium-204 is utilized as a vital tool for high-precision thickness gauging, allowing foundries like Intel to monitor the extreme uniformity required for advanced 300mm wafer fabrication nodes. This ensures that microscopic layers across the wafer meet the rigorous standards necessary for next-generation Extreme Ultraviolet (EUV) lithography. To further safeguard these assets, Krypton-85 is employed for sophisticated leak detection in hermetically sealed electronic components. This is especially critical for high-power AI enterprise hardware, where the failure of sealed cooling systems or protective enclosures could lead to catastrophic thermal failures. Together, these isotopes provide the material precision and operational security required to reduce the total cost of ownership for data centers while enabling the reliable scaling of the world’s most advanced computing technologies.

List of Isotopes associated with Atomic Alchemy:

More in the Tight Spreads substack

Tyler Durden

Tue, 01/20/2026 – 10:40ZeroHedge NewsRead More

R1

R1

T1

T1