Appalachian NatGas Output Faces “Intense Losses” As Arctic Blast Drives Power Grid Risk Higher

The Lower 48 has entered the depths of Northern Hemisphere winter. A series of Arctic cold blasts, combined with fears of a 1996-style blizzard stretching from Texas through the Mid-Atlantic and into the Northeast, has sent U.S. natural gas futures quite literally vertical, marking the largest weekly spike on record (that’s if gains hold through Friday).

But the next focus now turns to Appalachian Basin gas production, which sits at the center of severe winter reliability risk just as demand surges across the eastern half of the country.

January 20-21, 1985 low temperatures across Lower 48.

4.1°F average low temperature on the 21st. That’s it.

We’ll be looking at about 10°F this Sat/Sun. pic.twitter.com/4x5Jer4dX4

— Ryan Maue (@RyanMaue) January 21, 2026

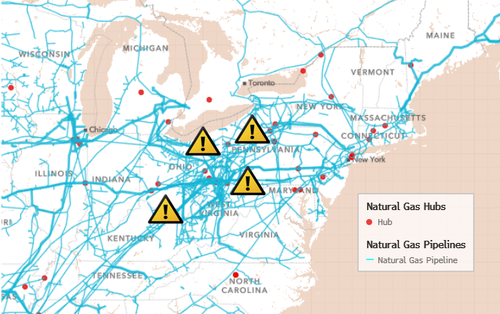

Criterion Research’s James Bevan, vice president of research, has drawn our attention to freeze-off risks across the critical gas production hubs in the Appalachian region. This area is driven by the Marcellus Shale and Utica Shale, which produce roughly one-third of total U.S. NatGas.

Bevan explains:

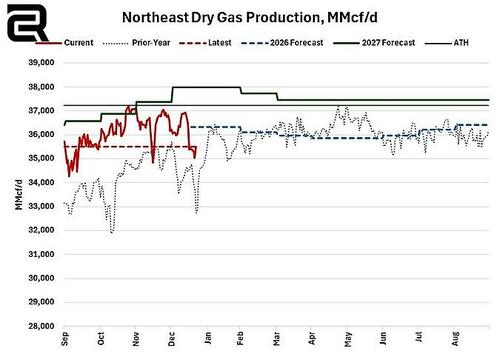

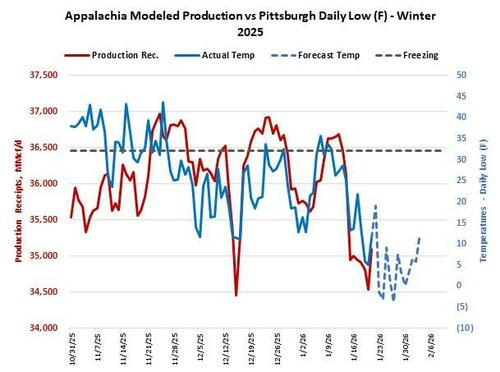

The Appalachian production basin is poised for intense losses with the incoming winter storm. As volumes stand today at 35.5 Bcf/d, they have regained some of the last few days of freeze off losses but they are far shy of recent highs closer to 37 Bcf/d.

We should see some more upwards movement in the next 2–3 days before the next round of cold hammers the region.

Freeze offs are going to happen again by the weekend. It’s just a matter of how much and how long those impact supply.

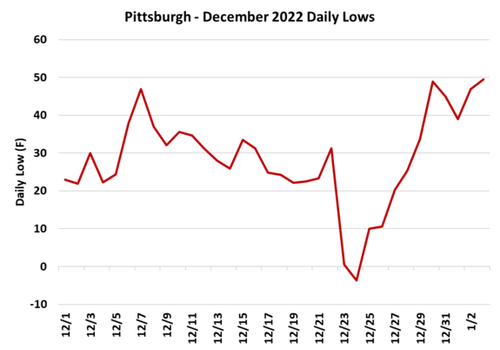

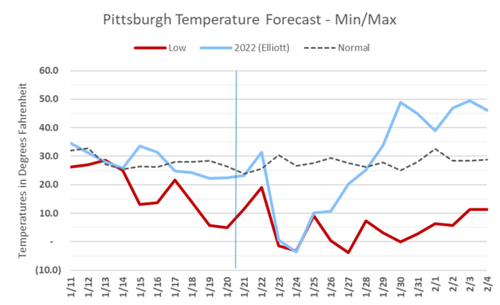

Winter Storm Elliott in December 2022 pushed Pittburgh to overnight lows of -3.7F at the peak cold that weekend, and production was crushed as a result.

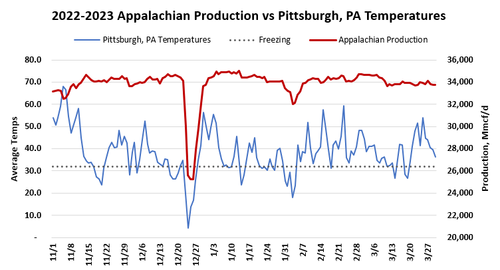

Winter Storm Elliott in December 2022 had a massive impact on regional production. As regional temps fell into the single digits, observed production nominations declined 26% at their lowest to a minimal 25.2 Bcf/d.

We overlaid the Pittsburgh, PA low temperatures during Winter Storm Elliott (2022) with the coming cold shot, and the 1/30 cold event has similar overnight lows on 1/23-1/24. However, the cold lingers long after that versus the rapid warming seen during Elliot that propelled averages back into the 40-50F range within a week.

Appalachian gas production is going to fall substantially over the weekend, and that could push it to 30 Bcf/d or lower depending on what infrastructure is impacted during the event.

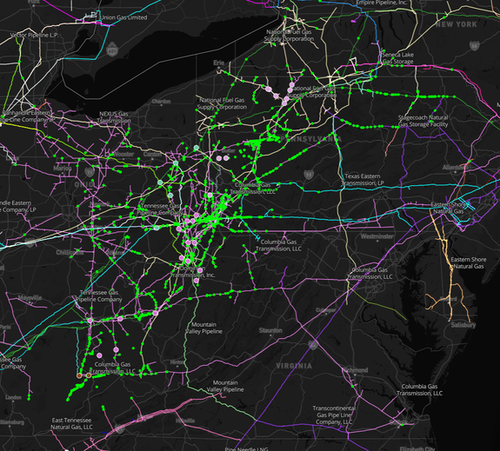

The screenshot from our Mapping Analytics Platform below shows all production meters in the region (green dots) and processing plants (pink dots) — and the key item to watch is where winter precipitation hits and where the power outages hit. Those two factors will drive how bad production losses end up

The MAP Analytics tool also lets you dig into specific states and pipelines, isolate what their production receipts looked like during specific events and times like Winter Storm Elliott or other deep freezes.

Review note from earlier:

Our risk assessment suggests that the combination of dangerously cold air and a major winter storm could cascade into a severe power grid risk. Freeze-offs and power outages across the Appalachian region could materially disrupt NatGas flows to power plants at the exact moment demand is peaking.

Recall Winter Storm Uri in 2021, when extreme cold paralyzed the NatGas supply and collapsed the ERCOT grid in Texas for a week. A scenario like that could be in play in parts of the eastern US, regions where power grids are already tight because of bad ‘green’ energy policies colliding with the era of data centers.

Tyler Durden

Wed, 01/21/2026 – 13:35ZeroHedge NewsRead More

R1

R1

T1

T1