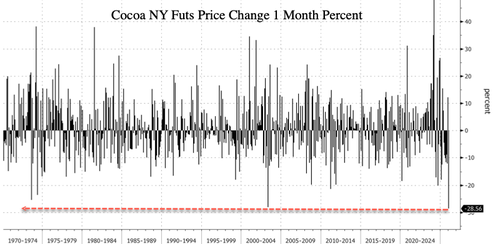

Cocoa Prices Set For Worst Monthly Drop On Record As Demand Craters

Cocoa futures in New York tumbled to two-year lows as fresh grinding data confirmed that consumers are balking at high chocolate prices.

Contracts are now down more than 28.5% on the month, and if the decline holds through the end of next week, January would register the largest monthly percentage drop on record, with Bloomberg data going back to 1970.

The great cocoa panic of 2023-24, which sent prices from $2,190 a ton to as high as $13,000 a ton by December 2024, has now retraced nearly the entire bull move to the 76.4% Fibonacci level. This latest downward pressure comes as new grinding data in Europe, cited by Bloomberg, shows clear demand deterioration:

-

Demand is deteriorating: European cocoa grindings fell to the lowest quarterly level since 2013, Asia also declined, while North America was roughly flat.

-

Reduced grindings have hit processors hard: Barry Callebaut AG reported a 22% drop in cocoa division volumes and nearly 10% lower overall sales volumes.

Goldman analyst Natasha de la Grense provided clients with more color on Barry Callebaut’s earnings, which showed negative market demand for chocolate:

Barry Callebaut – Q1 volumes in line (-9.9%) with a better outcome in Gourmet (-3.6% vs -5.5%) and Food Manufacturers (-7.4% vs -8.0%) offset by worse volumes in Cocoa Products (-22% vs -16.5%). The miss at the latter was impacted by negative market demand notably in AMEA and the prioritisation of volume towards higher return segments. Pricing was +19% YoY (vs +40% last quarter) so sequentially improving and now passed its peak. They say that global chocolate volumes were -6.8%. No change to FY26 outlook but they note lower bean prices are encouraging for chocolate market stabilisation. With this release, a new CEO has been announced which is a bit of a surprise (and Mr Feld is leaving almost immediately). However, the newly appointed Mr Schumacher is former CEO of Unilever and well-liked by investors. On the call, the Chairman suggested there will be no major change in strategy or need for reinvestment under new management. Note that BC also said it is committed to its integrated business model which should pour cold water on speculation around a split.

Barry Callebaut CFO Peter Vanneste told investors on an earnings call, “We believe consumers will adapt and adjust to these new price levels and ultimately continue to buy chocolate given the high engagement of the category.”

We told readers in December that sliding cocoa prices would produce “Tailwinds” for the badly beaten-down Hershey stock …

Read the note here.

Tyler Durden

Thu, 01/22/2026 – 05:45ZeroHedge NewsRead More

R1

R1

T1

T1