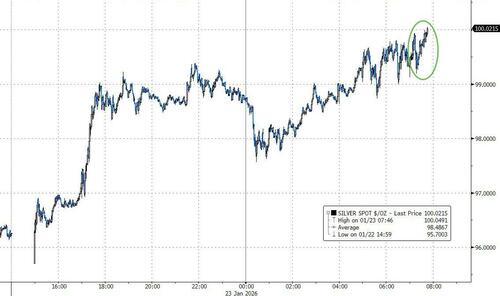

Silver Tops $100 As Chinese Demand Is Literally ‘Off The Charts’

Spot Silver prices just topped $100 for the first time in history…

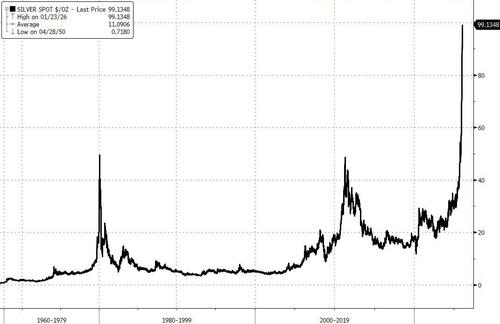

Quite a journey of late…

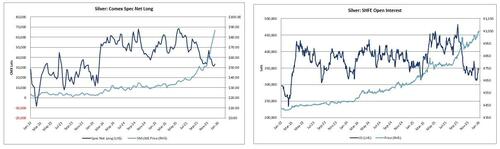

Yet, as we noted earlier in the week, despite record highs prices, Goldman’s commodity trading desk notes that spec positioning in New York and Shanghai remains close to the lows.

Perhaps with the understatement of the week, Goldman’s Delta-One desk-head Rick Privorotsky noted earlier that gold and silver remain in an aggressive uptrend.

The broader signal still looks like reserve diversification rather than pure risk hedging.

There is clearly hot money involved, but first and foremost gold is a central bank trade… a slow erosion of the dollar’s exorbitant privilege rather than a sudden loss of confidence.

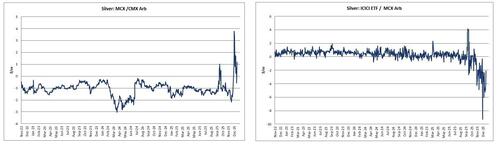

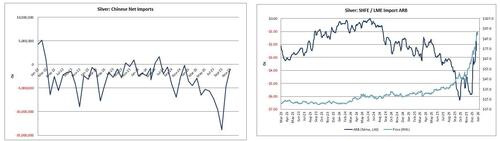

If there was one chart that summed up the craziness in the silver market it is this… the premium being paid for silver in Shanghai over silver in the West…

‘Off the charts’…

Which appears to back Goldman’s Adam Gillard belief that Chinese and Indian physical demand (partly from retail) has been the driver behind the last leg of the rally.

Positioning:

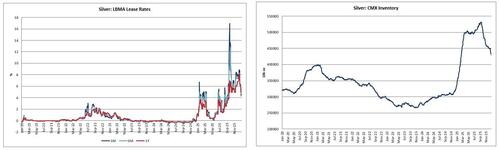

Surprisingly low on both CMX and SHFE, despite record prices and macro focus.

Managed money positioning is at 1y lows in NY, and increasing OI in CMX silver puts is sharply outpacing calls; Friday’s close was the highest OI in silver puts as a % of calls in the last 10 years.

Indian physical:

Appears strong despite price strength, we think due to strong physical demand from Indian retail (typically physical bids drop on rapid (derivative) price rallies).

Chinese physical:

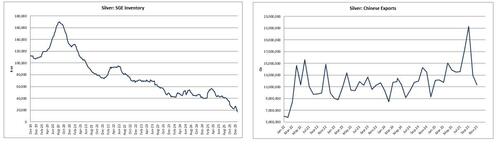

Remains tight because strong exports in October (21mn oz, an ATH high) due to the LBMA lease rate strength tightened the domestic market, sending SGE inventory to record lows.

Chinese import / export arbitrage economics:

Domestic tightness has caused significant SHFE / CMX strength, which resulted in Dec25 net imports of 1mn toz vs Jan25-Nov25 monthly average of 5.8mn toz.

~90% of Chinese silver exports flow to India via Hong Kong, which explains the current HK physical premium.

LBMA physical:

All whilst the LBMA system remains relatively tight due to previous US import strength from tariff concerns (although this flow is starting to reverse now)

So, to sum it all up, Goldman’s commodity desk view is that price has run too far but they’re reluctant to short until we see physical premia ease.

Professional subscribers can read much more from Goldman’s Sales & Trading team here at our new Marketdesk.ai portal

Tyler Durden

Fri, 01/23/2026 – 10:45ZeroHedge NewsRead More

R1

R1

T1

T1