BlackRock Credit Fund Hit With 19% Markdown As Loans Go Bad

BlackRock TCP Capital Corp., a publicly traded private-credit fund structured as a business development company, filed an 8-K with the SEC late Friday afternoon, disclosing a 19% markdown in net asset value as troubled loans weighed on performance. The move marks one of the first major private credit signal woes of the new year.

The credit fund told investors in the 8-K filing that NAV fell from $8.71 as of Sept. 30 to $7.05 to $7.09, or about a 19% markdown.

“This decline is primarily driven by issuer-specific developments during the quarter,” the fund said.

For a simpler translation: borrower-level stress intensified, loans deteriorated, and expected recovery values collapsed.

According to Bloomberg, the credit fund “has struggled in part because of its exposure to e-commerce aggregators — companies that buy and manage Amazon.com Inc. sellers — as well as troubled home improvement company Renovo Home Partners, which has filed for bankruptcy with plans to liquidate.”

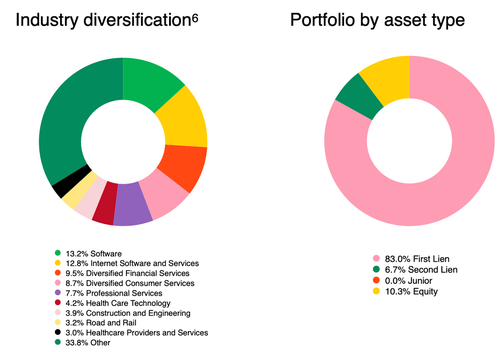

A TCPC fact sheet published Sept. 30 shows the fund holds 83% first-lien exposure across software, internet software and services, financial services, and other professional services.

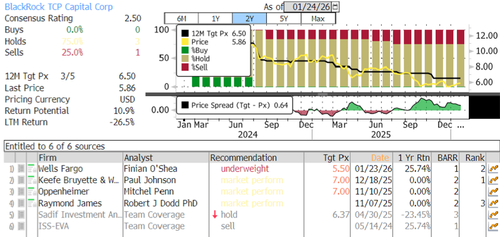

Analyst coverage of TCPC is overwhelmingly negative.

There are zero “buy” recommendations among analysts tracked by Bloomberg, with three “hold” ratings and one “sell.” The average 12-month price target stands at $6.50.

Shares of TCPC dropped 8.2% in after-hours trading on Friday following the filing.

Over a longer timeframe, the stock has slid back to COVID-era lows and remains locked in a multi-year bear market.

We’ve been closely tracking private credit markets, observing bumps along the way, to determine whether the cycle is beginning to show early signs of systemic risk or simply reflecting a normal credit downturn. While credit conditions have remained benign for an extended period, several emerging warning signs have begun to surface, which we have highlighted:

-

“There’s No Emergency Here”: Blue Owl CEO Says As Private Credit Provider Abandons Merger Plan

-

We’re “At The Beginning Of The Credit Destruction Cycle”; Ed Dowd Warns

As a reminder, last fall, JPMorgan’s Jamie Dimon warned, “When you see one cockroach, there are probably more.”

However, not everyone sees a crisis coming, despite the surge in supply.

We recently quoted Jeff Eason, Head of IG Credit at Citadel Securities, who says the market is in the early stages of a robust Capital Markets cycle, driven by Credit Expansion, fueling two themes:

-

M&A activity and broad corporate re-leveraging and

-

Growth in AI CapEx with debt usage becoming necessary/attractive to fund the mega cycle.

Jeffrey Gundlach has recently called out private lenders for making “garbage loans” and warned the next financial crisis will be in private credit.

Moody’s Analytics chief economist Mark Zandi told CNBC that private credit is “lightly regulated, less transparent, opaque, and it’s growing really fast, which doesn’t necessarily mean there’s a problem in the financial system, but it is a necessary condition for one.”

The rumblings in private credit raise deeper questions about the soundness of the broader financial system and whether the Trump economy, with incoming tailwinds from data-center, power grid buildouts, and re-manufacturing trends, can withstand potential stress in credit markets.

Tyler Durden

Mon, 01/26/2026 – 10:25ZeroHedge NewsRead More

R1

R1

T1

T1