Stellar 2Y Trasury Auction: Surge In Indirects & Bid-To-Cover; Second Lowest Dealers On Record

The first coupon auction of the week just took place, and it could not have gone any better.

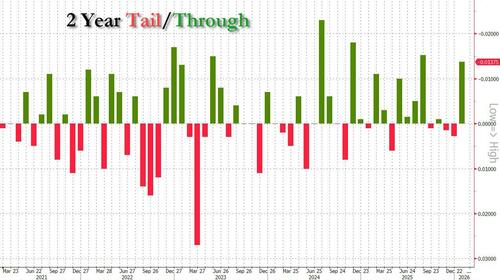

According to the US Treasury, $69BN of 2 Year paper was just sold at a high yield of 3.580%, up from the 3.499% in December, and stopped through the When Issued 3.594% by 1.4bps, the biggest stop through since August.

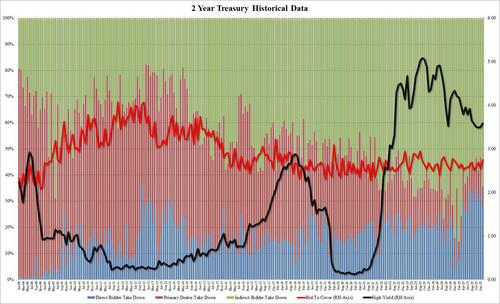

The bid to cover jumped to 2.750, up from 2.543 and the highest since Nov 2024 (the six-auction average was 2.61).

The internals were even stronger: Indirects took down 64.4%, a big jump from 53.2% in December and the highest since March 2025. And with Directs awarded 28.3%, Dealers were left with just 7.3%, the second lowest on record (only Feb 2025 was lower).

Overall, this was a stellar auction and clearly there were no jitters head of Wednesday’s FOMC decision, where prevailing consensus is that the Fed will be more hawkish.

Ahead of the auction, the UBS desk thought 2s looked to be locally cheap on outright terms and that the recent flattening had also introduced some value, albeit marginal, on the curve. The market is rallying on the follow.

Tyler Durden

Mon, 01/26/2026 – 13:35ZeroHedge NewsRead More

R1

R1

T1

T1