China Tells Banks To Limit Exposure To US Treasuries, But To Some This Is “Hardly An Issue At All”

Treasury yields hit session highs shortly after midnight ET, when Bloomberg reported that Chinese regulators had advised financial institutions to rein in their holdings of US Treasuries, citing concerns over concentration risks and market volatility.

Citing anonymous “people familiar with the matter” Bloonberg added that officials urged banks to limit purchases of US government bonds and instructed those with high exposure to pare down their positions. The directive doesn’t apply to China’s state holdings of US Treasuries.

Communicated verbally to some of the nation’s biggest banks in recent weeks, the guidance reflects growing wariness among officials that large holdings of US government debt may expose banks to sharp swing . The worries echo those made by governments and fund managers elsewhere amid a brewing debate over the safe haven status of US debt and the appeal of the dollar.

The move, which otherwise would have been seen as a clear escalation in the US-China trade war, was framed around “diversifying market risk” rather than anything to do with geopolitical maneuvering or a fundamental loss of confidence in US creditworthiness, the sources said, adding that officials didn’t given any specific target on size or timing. While significant tensions remain between Beijing and Washington, relations have steadied in the wake of a trade truce last year.

Treasuries slipped on the news, with yields edging higher across maturities in Asian afternoon trading. The dollar weakened slightly against major peers.

According to data from the State Administration of Foreign Exchange, Chinese banks held about $298 billion worth of dollar-denominated bonds as of September, It’s unclear how much of those were Treasuries.

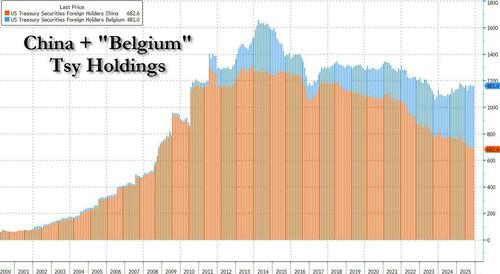

Largely dismissing the report, Westpac’s Martin Whetton said that China’s holdings of US Treasuries peaked in 2017, and what’s left is small relative to the size of the overall market.Now at $682 billion, China’s holdings represent “hardly an issue at all,” says Martin Whetton, head of financial markets strategy.

“If you include Belgium and Luxembourg, which can be proxies for some of their holdings, you’d barely make it over $750 billion”, which actually is completely incorrect since Belgium alone holds $481 billion in TSYs, as shown below.

A lot of US debt will be held by China’s official institutions and is likely short-dated for liquidity reasons, Whetton said. “So what is left for the banks is small, and China doesn’t exactly set the Treasury market on fire at the monthly auctions”

Donald Trump, who held a phone call with Xi Jinping last week, plans to meet the Chinese leader at a presidential summit in Beijing as soon as April. The regulatory guidance to Chinese banks on Treasuries came before last week’s call, the people said.

China’s warning comes as global investors question Washington’s fiscal discipline. Concerns have mounted regarding Trump’s commitment to a strong dollar and the continued independence of the Federal Reserve. Last month, Deutsche Bank’s FX analyst George Saravelos warned that money managers in Europe could choose to trim their holdings in response to Trump’s threats on tariffs and the proposed acquisition of Greenland, a call which sparked an international scandal with Deutsche Bank washing its hands off his comments.

Still, Scott Bessent said last week that “despite the popular narrative,” the Treasuries market last year delivered its best performance since 2020 and saw record foreign demand at auctions.

For context, foreign holdings of US Treasuries rose to a record $9.4 trillion in November, more than $500 billion higher than a year earlier, according to the latest official data.

Tyler Durden

Mon, 02/09/2026 – 10:55ZeroHedge NewsRead More

R1

R1

T1

T1