Harley-Davidson Shares Plunge As Bike Demand Stalls

Harley-Davidson shares plunged in premarket trading after the company reported an unexpected decline in motorcycle shipments and a far deeper-than-expected sales miss in the fourth quarter. The results suggest the company is still battling soft demand, with the brand having peaked with boomers and struggling to connect with younger riders.

Global fourth-quarter bike deliveries fell 4% to 13,515 bikes versus expectations of 16,408, while revenue came in at $496 million compared with about $749 million expected (per Bloomberg Consensus estimates). The adjusted loss of $2.44 for the period was more than twice the expected amount.

In premarket trading, Harley shares plunged nearly 12%, the sharpest decline since the 16% drop on April 25, 2024. The stock is trading near Covid-era lows and not far above its 2009 trough.

CEO Arturo Pires de Lima, who took over in October, is focused on reducing excess inventory and repairing dealer relationships amid elevated interest rates that have strained consumers.

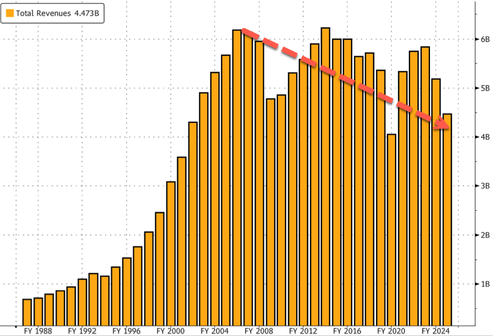

Looking at Harley’s annual revenue, there’s a clear surge in the post-Dot Com period that builds into the 2008 peak. That upswing coincided with the boomer retirement wave, as the oldest boomers became eligible for early Social Security retirement benefits in 2008.

At that time, boomers were the economy’s largest spending cohort, so it stands to reason that some of them, now retired, were buying all sorts of items that reminded them of their younger days: bikes, Packards, second and third homes and whatever else.

But note that, since 2008, annual revenue, instead of trending up and to the right, has been trending down, as the brand never solidly connected with millennials or younger generations as it did with boomers.

Harley tried electric bikes, which failed miserably. It’s in a reset period.

Tyler Durden

Tue, 02/10/2026 – 08:50ZeroHedge NewsRead More

R1

R1

T1

T1