Goldman Says Off-Price Retailers “Structurally Well-Positioned” To Benefit As Trade-Down Behavior Persists

Building on Goldman analyst Scott Feiler’s note last week that consumer trends remain resilient despite ongoing K-shaped concerns, Brooke Roach, a Managing Director in Equity Research at Goldman covering the U.S. retail sector, published a consumer note on Tuesday analyzing recent store-traffic trends across income and ethnicity cohorts.

“We remain constructive on the off-price sector, and believe the industry is structurally well-positioned to benefit from trade down activity, a healthier middle-income consumer, and modest AUR growth as a result of tariff-related pricing increases at full-price retail,” Roach told clients.

She said, “Our checks indicate trends remain solid across the group, though we do note relatively more muted momentum at BURL.” She added, “We see the strongest momentum for ROST and TJX into F4Q results.”

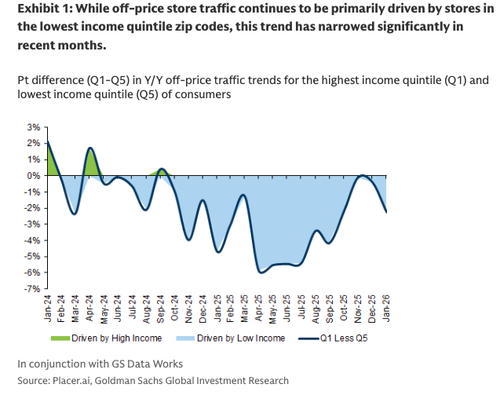

A key chart Roach highlighted showed that off-price store traffic was primarily driven by low-income consumers, but that shifted sharply as trade-down activity accelerated among higher-income shoppers through late 2025.

Feiler recently noted, “It seems like consumer trends are still solid. It’s not a clean sweep, but we’re seeing January growth as strong, or stronger than December for most companies we have heard from.”

On Friday, the latest data from the Federal Reserve showed 2025 closed with a surprising surge in consumer credit. However, retail sales data for December, released on Tuesday, disappointed, as fears about a fragile consumer economy returned.

Roach’s key takeaway: off-price retailers should remain solidly performing this year as consumer trade-down behavior persists and K-shaped fears mount.

Read more about Feiler’s consumer spending trends (here). And of course, Professional subscribers can learn more about the consumer trends on our new Marketdesk.ai portal.

Tyler Durden

Tue, 02/10/2026 – 14:25ZeroHedge NewsRead More

R1

R1

T1

T1