Brace For Massive, “1 Million Plus” Negative Jobs Revision Tomorrow As Birth-Death Model Is Finally Fixed

For the past 5 years we have often hammered the table on the biggest, most glaring fudge factor in the monthly jobs report, namely the

“birth-death adjustment” – which became a statistical fiasco in the aftermath of the covid PPP-loan scam as thousands of fake “new companies” were created to take advantage of the government’s free money handout generosity – and which has since corrupted the underlying statistics in the jobs report beyond recognition again…

Almost half of all “job gains” in the past year are from an excel spreadsheet which assumes 1.84 million new jobs were created from new business creation (i.e. Birth/Death adjustment)https://t.co/C8xQNvZKYF pic.twitter.com/SyJBtBkQBd

— zerohedge (@zerohedge) May 5, 2023

… and again…

Lowering inflation also likely to require softer labor markets.

Translation: stop it with the ridiculous seasonal birth-death adjustments.

— zerohedge (@zerohedge) August 25, 2023

… and again…

holy shit: birth/death model added 412K excel spreadsheet “jobs”, the second highest on record.

US economy sliding into recession and BLS assuming the 2nd fastest pace of new business creation in history! pic.twitter.com/KbTgO0qnqJ

— zerohedge (@zerohedge) November 3, 2023

… and again…

Half of all job growth in the past year is from Birth/Death adjustments pic.twitter.com/UahfONUYZw

— zerohedge (@zerohedge) July 5, 2024

… and again…

57% of all YTD jobs are statistical fakes, thanks only to the Birth/Death adjustment pic.twitter.com/utYosI0k7S

— zerohedge (@zerohedge) August 2, 2024

… and again…

After the upcoming fix to the laughable “Birth/Death model”, we’ll learn that the actual number of jobs is about 10 million lower

— zerohedge (@zerohedge) August 13, 2025

… and so on.

We even correctly predicted – one day ahead of time – that massive, 818,000 negative jobs revision August 21, 2024 which served as the basis for the Fed’s jumbo rate cut and start of the easing cycle despite sticky 3% inflation…

Why 1 million jobs will be quietly removed from the payrolls? Because as noted below, 57% of all YTD jobs are statistical fakes from Birth/Death adjustment which assume the same new business vibrancy as just after covid (which was mostly to facilitate PPP fraud) https://t.co/YHvKRyYFds

— zerohedge (@zerohedge) August 20, 2024

… which prompted both the former BLS commissioner…

The big, downward preliminary revisions to non-farm employment (-818,000) announced this morning by BLS probably stem from overestimating the number of firms in the economy. Slowing as well as recovering economies often post challenges for BLS’s “birth/death” model, which BLS…

— William Beach (@BeachWW453) August 21, 2024

… and Fed Chair Powell himself, to admit that the the monthly jobs report has been perverted beyond recognition because of the BLS calculates the birth/death adjustment.

The big, downward preliminary revisions to non-farm employment (-818,000) announced this morning by BLS probably stem from overestimating the number of firms in the economy. Slowing as well as recovering economies often post challenges for BLS’s “birth/death” model, which BLS…

— William Beach (@BeachWW453) August 21, 2024

For those confused why the Birth-Death adjustment, once a solid statistical adjustment, became the laughing stock of the jobs report, we gave the answer in Sept 2024, when we said that “fraudulent small business creation over the past 4 years (to illegally benefit from PPP loans) is why the US labor market is such a mess (near record downward job revisions) with the Birth/Death indicator the most inaccurate it has ever been.“

The good news is that after years of complaints, the BLS has finally decided to fix the underlying problem… but there will be lots of collateral damage.

Tomorrow, the BLS will release the delayed January jobs report (it was supposed to come last Friday but we had a one-day government shutdown so clearly overpaid government workers couldn’t possibly figure out how to make it work). And while the report itself will be disappointing (consensus expected another mediocre print of 65K, our full preview will come out shortly), this month’s report will be accompanied by the annual benchmark revision to the establishment survey and – much more importantly – a methodological update to the birth-death model.

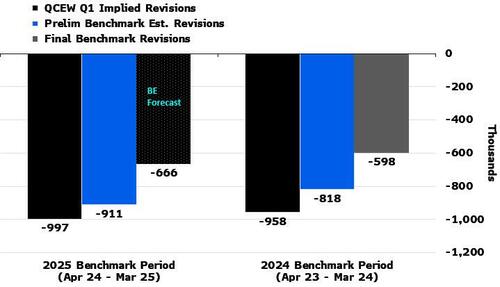

Now, as a reminder, the BLS’s preliminary estimate of the benchmark payrolls revision indicated that cumulative payroll growth between April 2024 and March 2025 would be revised 911k lower, though as in previously occasions, the final downward revision will likely be smaller, and the result will be that tomorrow we will learn that in the period April 2024 – March 2025 the US actually created 750-900k fewer jobs.

But wait, there’s more: the BLS will also update the net birth-death forecasts in the post-benchmark period (April 2025-December 2025) to incorporate information from the QCEW and the monthly payrolls survey, where a downward revision also appears likely and will likely subtract another 500-700k jobs, which never existed in the first place.

In total we expect that as much as 1 million jobs will be revised from the December 2025 nonfarm payrolls. Poof. Because, as we said in November 2023, these “jobs” were only 1s and 0s in some BLS excel spreadsheet.

The changes will also significantly shift the contour of hiring momentum. According to BBG Economics:

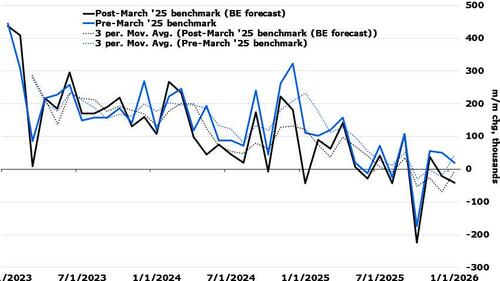

- The revised seasonally adjusted series will likely show the labor market fell below stall speed in summer 2024, when three-month moving-average job growth was at 55k – well below the 180k pace many analysts estimated was needed to keep unemployment steady.

- Net hiring resumed cooling after President Donald Trump’s announcement of “Liberation Day” tariffs in early April, a period when the Fed held rates steady.

- Post-revisions and after accounting for seasonal adjustments, payroll growth was negative in at least five months of 2025.

- Outside of the one-off payroll drop from government employees’ deferred resignations in October, the worst monthly contraction was in August.

Some more striking consequences of the renormalization of the jobs report:

- On a nonseasonally adjusted basis, Bloomberg’s chief economist Anna Wong expects to see a decline of 3.025 million jobs – and seasonal patterns also point to a decrease of that size. However, the seasonal-adjustment factor is particularly uncertain, as the BLS will re-estimate it to account for benchmark revisions and for updates to its birth-death model. That uncertainty could move the payrolls estimate by 40k in either direction.

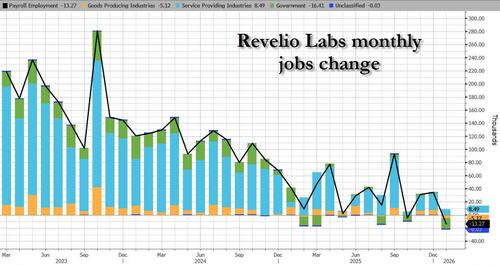

- Alternative indicators have pointed to further deterioration in payrolls: as we noted last week, Revelio Labs – which had become the go to alternative while the govt data was suspended during the shutdown – reported that in January payrolls plunged by 13,270, driven by goods producing jobs which dropped by 5.1K but mostly a plunge in govt jobs, which declined by 16.4K.

- Due to disruptions from the government shutdown, the BLS has delayed the introduction of its annual population-control adjustment – typically released with the January employment report – until the February report a month from now. BLS said it will revise January’s household survey to incorporate the population controls after the release. So expect even more negative adjustments next month!

- When the population-control adjustment is eventually released, Wong expects it will reduce the population level by at least 700k – based on the 2025 vintage of US Census estimates. It will also result in 2026 population growth being less than half of the 1.9% indicated in 2025.

- The BLS will re-benchmark the March 2025 employment level to Quarterly Census of Employment and Wages (QCEW) data, which should lead to a downward revision of 666k. It will apply updated birth-death forecasts and re-estimated seasonal factors for April-December 2025, likely producing an additional downward revision of 270k.

January’s jobs print, and large downward benchmark revisions expected to past payrolls, will make the labor market appear rather dire. And while that may be an exaggeration – the labor market bottomed in mid-2025 and has been improving very gradually since then, with real-time indicators suggesting true net birth and death of firms is finally improving – any recovery will remain fragile and will require further Fed support.

Massive negative revisions aside, what is most important is that starting with this month’s report, the birth-death model will incorporate current sample information each month, something we have been demanding since 2021. The good news is that this methodological change will almost certainly reduce the magnitude of annual revisions; the bad news is that it will contribute to far greater month-to-month volatility in payrolls readings, which means overall market volatility as well as the job report will be an multiple-sigma outlier relative to expectations.

Taking a step back, the variety of adjustments in tomorrow’s jobs report, will show that the labor market started cooling sharply in mid-2024, and dipped again in mid-2025. These changes may make January payrolls appear very weak, with many expecting the BLS to show zero job growth.

And, like in August 2024 when a massive negative revision to the jobs report forced the Fed to cut aggressively by 50bps two months before the presidential election, that rather dire labor market picture will pressure the Fed to lower interest rates. The January CPI, due two days later on Friday the 13, will also be more subdued than the consensus expects, opening the door for a cut sooner rather than later.

In all, we expect the Fed to cut rates by 100 basis points this year.

Tyler Durden

Tue, 02/10/2026 – 20:30ZeroHedge NewsRead More

R1

R1

T1

T1