US Deficit Explodes In July Despite Jump In Tariff Revenue As Government Spending Soars

We used to dread covering the monthly update of US government income and spending because, without fail, it would show that the USS Titanic was getting that much closer to the inevitable iceberg. A few months ago, there was a glimmer of hope when the US found a new revenue stream in the form of tariffs and excise taxes, which helped boost government revenue notably. Alas, in the grand scheme of things, this bounce in revenue proved to be too little… and some would say too late.

With that in mind, here is a look at the latest Treasury Income Statement published earlier today.

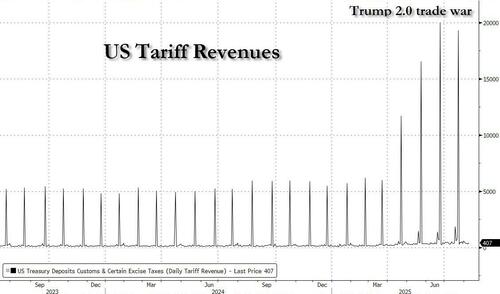

First, the good news: for the fourth month in a row, the US government benefited from outsized tariff revenues, which as shown in the chart below, have peaked at around $20BN per month – or about $240BN annualized – at the current tariff rate.

But while the $20BN tariff revenue in June was sufficient to tip the overall US Treasury budget into a surplus, July proved to be too great an obstacle.

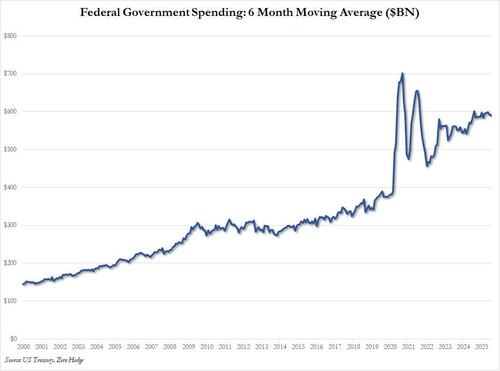

According to the latest Monthly Treasury Statement, in July the US government spent $630 billion, up 9.7% from the $574 billion a year ago, and the second highest monthly spending total since January. So much for the cost-cutting efforts of DOGE.

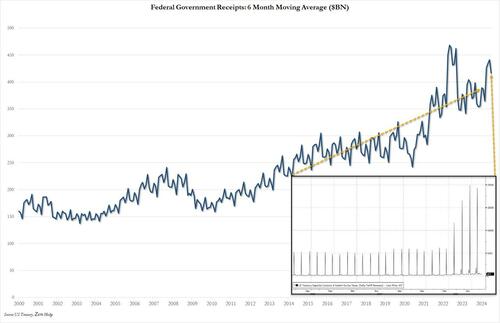

This almost 10% surge in spending was offset by a far more modest, or 2.5% increase in revenues, which increased from $330 billion to $338 billion, and this includes the $19.3 billion in tariff revenues noted above. Take those out and government income would have declined YoY.

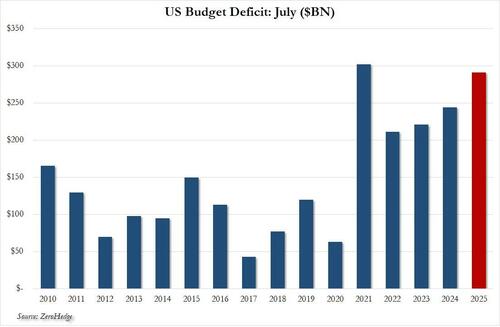

Putting these two together, and we get a July deficit of $291 billion, a dramatic deterioration from the $27 billion surplus in June, a 20% increase from the $243 billion deficit a year ago, and the second highest monthly deficit of calendar 2025. Worse, it was also the second worst July deficit in US history, with just the post-covid surge in spending (barely) overtaking 2025.

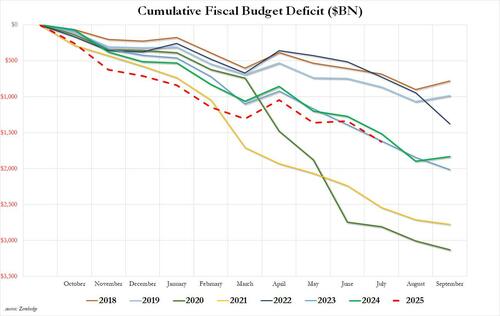

Looking at the deficit on a cumulative basis, we find that after last month’s improvement, the deficit took another lunge, and in July – two months before the fiscal year end – it hit $1.629 trillion, up 7.4% from the $1.517 trillion a year ago. That means that with just two months to go, 2025 is shaping up as the third worst year in US history for the budget deficit, with just the covid years 2020 and 2021, worse.

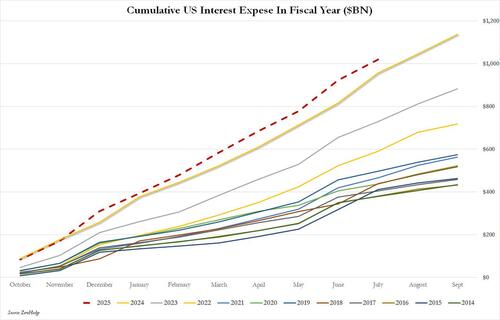

Last but not least, the epic disaster that is US gross interest spending continues to rise, and in July the US spent $91.9 billion on interest, pushing the total for the first ten months of the fiscal year to a record $1,019 trillion, and on pace to surpass $1.2 trillion for the full year.

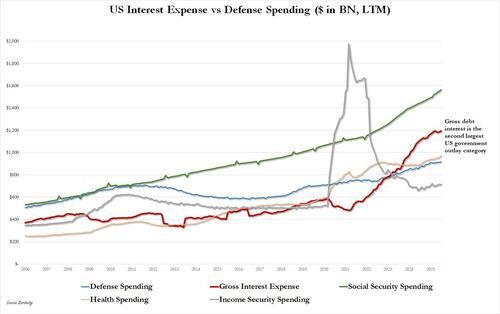

It also means that, as we first showed over a year ago, gross interest remains the second highest spending category for the US, well above defense, income security and health spending, and only Social Security remains a larger outlay category (although it is unclear for how much longer).

Tyler Durden

Tue, 08/12/2025 – 15:46ZeroHedge News

R1

R1

T1

T1