Instacart Doomed? Goldman Sees Millions Of Prime Members Flocking To Amazon’s Same-Day Grocery

Amazon CEO Andy Jassy took to X this morning to promote new plans to expand the company’s same-day grocery delivery service from 1,000 to over 2,300 cities by year-end. With 129 million Prime members, the expansion could be an instant hit, putting fresh pressure on Instacart, DoorDash, and traditional grocers competing in the last-mile delivery race.

Thousands of fresh groceries are now available for Same-Day Delivery orders in 1,000+ U.S. cities and towns, with plans to expand to 2,300+ by end of 2025. Think customers are going to love being able to add fresh produce, milk, eggs, and more to their everyday Amazon purchases… pic.twitter.com/ZBfA1xLJXW

— Andy Jassy (@ajassy) August 14, 2025

News of Amazon more than doubling its footprint to offer same-day grocery delivery for Prime members – with free delivery on orders over $25 in most cities – was first unveiled on Wednesday (read here). This means customers will soon be able to order a wide range of items, including perishables like produce, dairy, meat, seafood, and baked goods, as well as frozen foods and household basics, all delivered directly to their front door.

Commenting on Wednesday’s news, a team of Goldman analysts led by Eric Sheridan told clients that if Amazon can capture a low single-digit percentage of its 129 million Prime members for weekly grocery orders, it could create a “potential gross revenue opportunity of ~$30–200 billion.”

Here’s from Sheridan and his team:

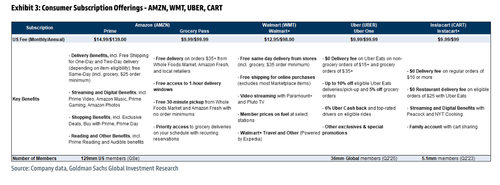

Earlier today, AMZN announced an expansion of their grocery offering. Specifically, customers in more than 1,000 cities and towns now have access to fresh groceries with free Same-Day Delivery on orders over $25 for Prime members, with plans to reach over 2,300 cities and towns by the end of 2025 (and expand to more areas in 2026). We’d note AMZN generated >$100bn in gross sales of groceries and household essentials in 2024, not including sales from Whole Foods Market (AMZN’s Physical Stores segment, which we believe is primarily WFM, did ~$21bn of sales in 2024) and Amazon Fresh. This compares to CART GTV of ~$33bn in 2024 & UBER disclosing that its Grocery & Retail offering was at a $7bn runrate as of Q4’23 (and grew ~40% in Q1’24, implying ~$7.5bn runrate based on our assumptions).

AMZN has been testing new experiences that make it easier for customers to shop expanded selection in one place, including co-locating selection from Whole Foods Market, Amazon.com, and Amazon Fresh in the same fulfillment center enabling customers to shop items from all three brands and have them delivered in a single order. On their Q2 EPS call, Amazon talked about how they started expanding their perishables pilot, where they offer customers perishables at a point of purchase when they’re ordering other items that will be delivered same day from same-day fulfillment nodes. 75% of customers who have used this service this year are first-time shoppers for perishables on Amazon, with 20% of customers who used the service returning multiple times within their first month. While its still too soon to have a read on the scope of adoption, we estimate AMZN has ~129m US Prime Members. For context, if this move shifts $50-150 of weekly grocery activity to their platform by 10-20% of those members, this would result in a potential gross revenue opportunity of ~$30-200bn.

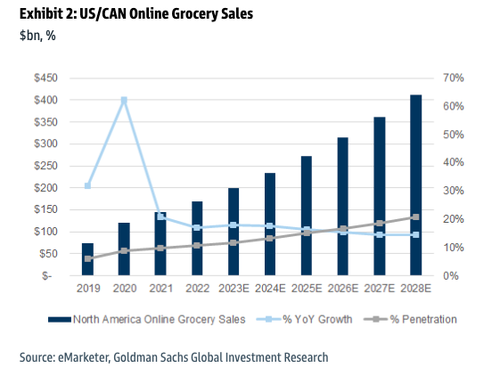

That said, we see this as a large addressable market for multiple players to benefit from the secular shifts from offline to online spend. We have previously sized the TAM for US/CAN Grocery (incl. food & non-food products people regularly buy from a grocery store) at ~$1.8tn in 2024E, of which ~$235m was expected to be online (~13% penetration). We expect that US/CAN online grocery sales will grow at a +15% CAGR between 2024-2028 as consumers increasingly lean on online channels for more meal occasions and as the industry continues to invest against this evolution in consumer preferences. Our forecasts have online grocery penetration reaching 21% in 2028.

We see this announcement as another example of how platforms continue to push deeper into last mile/local delivery across both food and non-food retail, and acknowledge that this creates incremental competition for consumer share of wallet in Grocery. We also see a broader theme of delivery platforms with exposure to the Grocery category increasingly looking to tackle both large & small basket sizes. CART recently lowered basket minimums to $10 for Instacart+ members to get waived delivery fees, which has helped drive accelerating order volume, and continues to drive deeper tech integration across their platform with grocery & retail partners.

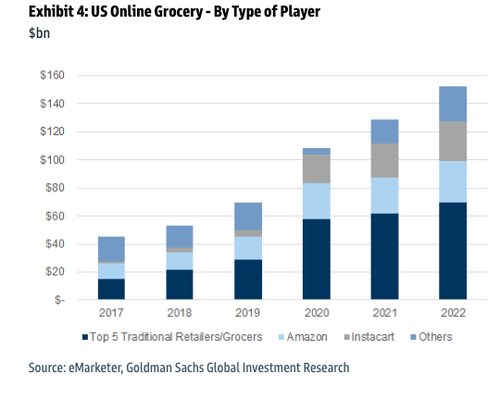

US Online Grocery – By Type of Player

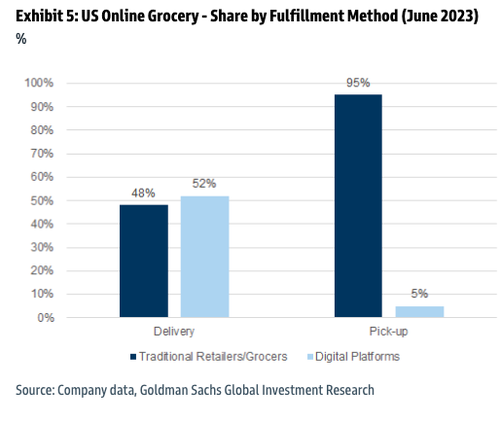

US Online Grocery – Share by Fulfillment Method (June 2023)

Rounding back to what’s happening in markets. News of Amazon expanding its grocery footprint has sent Instacart, DoorDash, and some traditional grocers lower for the second session.

. . .

Tyler Durden

Thu, 08/14/2025 – 11:50ZeroHedge News

R1

R1

T1

T1