Buffett Buys $1.6BN In New UnitedHealth Stake, Sells More Apple, Liquidates T-Mobile

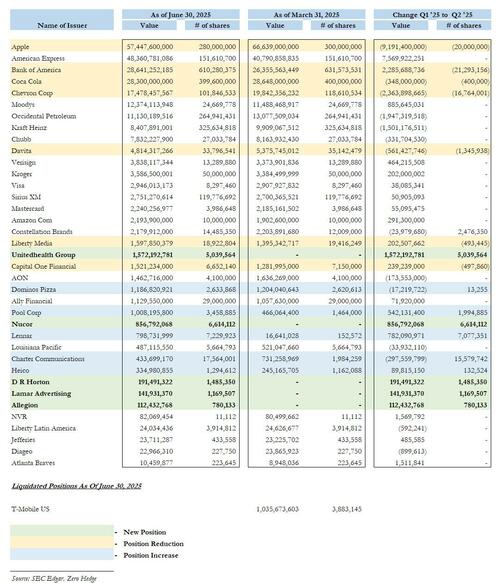

Following mounting speculation in recent months that Warren Buffett was quietly buying a stake in distressed health insurer UnitedHealth, earlier today his Berkshire Hathaway published its latest 13F filing, confirming that it had done just that during the second quarter after the stock cratered in late April amid regulatory concerns. The Omaha, Nebraska-based conglomerate acquired just over 5 million shares in UnitedHealth, a stake which was worth $1.6 billion as of June 30 making it Berkshire’s 19th largest holding. At the same time, Berkshire also liquidated its entire $1 billion stake in T-Mobile during the period.

The investment in the health insurer follows multiple crises for UnitedHealth, including the shocking assassination of UnitedHealthcare CEO Brian Thompson in Manhattan in an execution-style murder by rabid leftist Luigi Mangione.

UnitedHealth has also faced unexpected increases in medical costs. In April, it reported earnings below Wall Street estimates for the first time in more than a decade, and slashed guidance, sending the stock price plummeting. It has since replaced its CEO and announced plans to replace its chief financial officer.

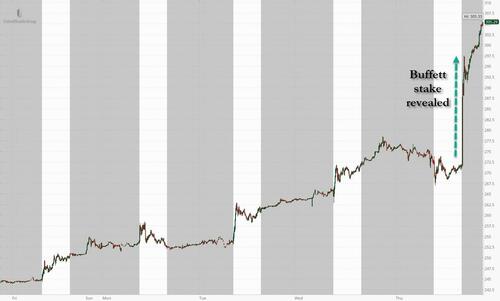

The disclosure of Buffett’s UNH stake sent the insurer’s shares up more than 10% in after hours trading.

There were several other notable changes in Berkshire’s portfolio, which amounted to $258 billion as of June 30.

After a three quarter pause, Buffett resumed selling his Apple stake, offloading another 20 million shares during the period, after slashing his holding of the iPhone maker by more than half last year. Yet even at 280 million shares, Berkshire’s Apple stake remains its largest equity stake by market value, despite it falling by about $9.2 billion in the three months ended June 30.

Berkshire also continued trimming holdings in Bank of America, selling 21 million shares and bringing its stake down to about 8% at the end of June. Buffett started whittling down the bank investment last year, without providing any explanation for the move.

Curiously, Buffett remains in largely degrossing mode, and reduced his holdings in 4 of his top 5 positions (AAPL, BAC, KO and CVX), only keeping his American Express stake unchanged. Other names that saw a reduction were Davita, Liberty Media, Capital One.

Buffett also added to some of his holdings: he modestly boosted his stake in Constellation Brands and Dominos, and more than doubled his position in Pool Corp.

One of Berkshire’s equity bets, a stake in consumer foods giant Kraft Heinz, has been a headache for Buffett’s company. The conglomerate took a $3.8 billion impairment charge on its investment earlier this year, and kept its holding unchanged in the second quarter.

Finally, while liquidating his entire $1 billion stake in TMobile, Buffett also added new positions in Nucor, DR Hodton, Lamar Advertising And Allegion. As Bloomberg notes, Berkshire boosted its investment in US homebuilders in what appears to be a bet on lower rates in the future, building its stake in Lennar and buying 1.5 million shares of D.R. Horton. The company also bought more shares of steel manufacturer Nucor Corp. Those changes were omitted in a previous filing as the company requested confidentiality.

The full breakdown is below.

Source: 13F

Tyler Durden

Thu, 08/14/2025 – 21:20ZeroHedge News

R1

R1

T1

T1