Walmart Lifts Outlook, But Profit Miss Drags Shares Lower

Ahead of the Jackson Hole central bank summit in Wyoming, beginning later today through Saturday, investors are parsing Walmart’s earnings.

The world’s largest retailer delivered stronger-than-expected revenue last quarter and raised its full-year outlook. This is a reassuring sign that consumers remain resilient despite inflation, tariffs, and elevated interest rates. However, the real focus is not the improved outlook, but the profit miss relative to expectations.

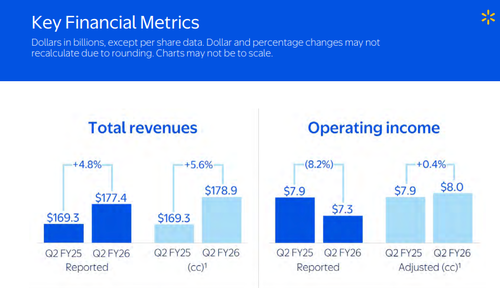

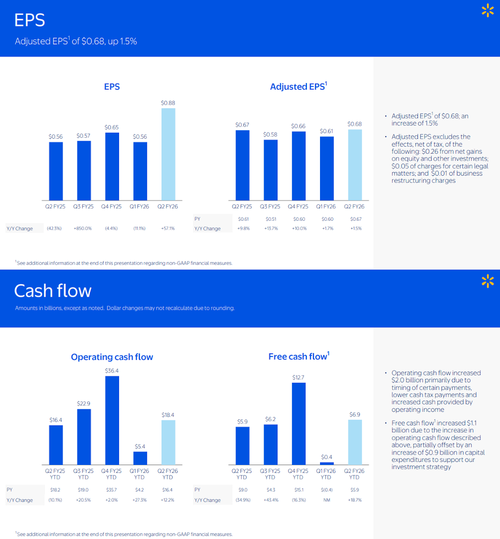

For the quarter ending July 31, Walmart posted a profit of $7.02 billion, or about 88 cents a share, versus $4.5 billion, or 56 cents a share, for the same quarter one year ago. Total revenue for the quarter rose 4.8% to $177.4 billion, topping the FactSet estimate of $175.9 billion.

Excluding legal and restructuring costs, adjusted earnings came in at 68 cents a share. Analysts polled by FactSet expected adjusted earnings of 73 cents.

The world’s largest retailer cited a rise in insurance claims, legal charges, and restructuring costs as major factors that pressured profits.

Here’s an earnings snapshot for the second quarter (FactSet)

-

Net income: $7.02B (88c/shr) vs. $4.5B (56c/shr) a year ago.

-

Adjusted EPS: 68c, below the 73c expected.

-

Revenue: $177.4B, up 4.8% and above $175.9B consensus.

-

U.S. sales: $120.9B, up 4.8%; comparable sales +4.3% (ex-fuel +4.8%).

-

International sales: $31.2B, +5.5%.

-

Sam’s Club sales: $23.6B, +3.4%.

Charts: EPS & Cash Flow

Charts: Operating Income & Operating expenses as a percentage of net sales

CFO John David Rainey told Bloomberg, “The consumer is resilient,” adding that the retailer continues to win market share across all income levels, especially the upper middle class.

The takeaway from the second quarter is that Walmart is gaining market share and boosting sales, especially in e-commerce and international markets. However, profitability remains pressured, with adjusted earnings lagging expectations even as top-line strength supports upgraded full-year guidance.

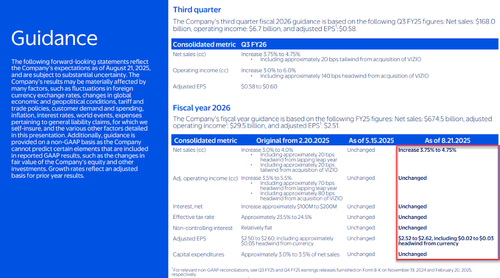

Here’s guidance for the current quarter

- Adjusted EPS 58–60c; sales growth 3.75%–4.75% (vs. analysts’ 57c, $176B).

Full year guidance:

-

Sales growth outlook raised to 3.75%–4.75% (prior 3%–4%).

-

Adjusted EPS: $2.52–$2.62, slightly above prior $2.50–$2.60, though shy of Street’s $2.62.

Earnings Deck

Commenting on the earnings report is UBS analyst Nana Antiedu, who notes that even though the retailer is gaining more market share, profitability is under pressure:

Walmart raised its net sales, now 3.75%-4.75% from 3-4%, and EPS outlook, now $2.52 -$2.62, for FY26 in its latest earnings report. The retailer said each business segment experienced growth, with eCommerce growing 25% with digital mix up across all segments. Revenue was reported at $177.4 bn, up 4.8% and beating Reuters expectations of 176.16 bn. However, adjusted EPS came in at $0.68, below Reuters expectations of $0.74. Walmart stocks are indicating 2.65% lower in the pre-market due to the EPS miss.

The stock is lower 2.5% in premarket trading as investors focus on the EPS miss that overshadows the positive outlook hike…

Shares are still near record highs…

. . .

Tyler Durden

Thu, 08/21/2025 – 07:55ZeroHedge News

R1

R1

T1

T1