Orsted Shares Crash To Record Lows After Trump Halts Rhode Island Offshore Wind Project

Shares of Danish wind giant Orsted A/S crashed as much as 19% – to record lows – after the Trump administration ordered construction halted on the 80%-completed Revolution Wind offshore project off Rhode Island last Friday, citing unresolved national security concerns under federal review. The struggling wind company still plans to move forward with a $9.4 billion share sale to strengthen its capital structure.

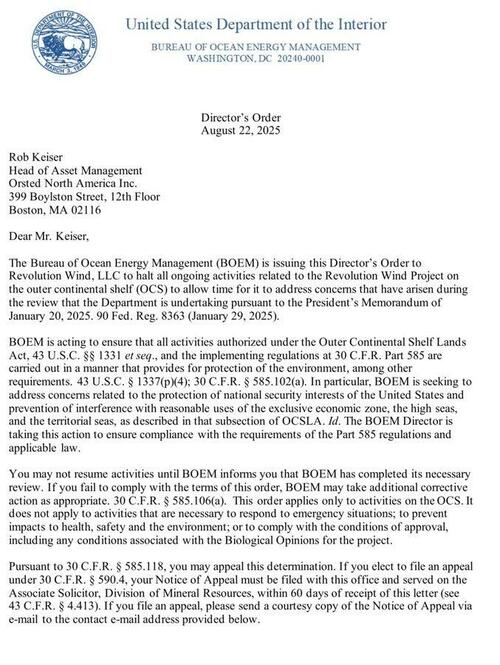

The Interior Department’s Bureau of Ocean Energy Management (BOEM) issued a directive on Friday ordering Orsted to halt all offshore construction activities on the Revolution Wind project. The order stems from a Presidential Memorandum issued on Jan. 20, which triggered a broad review of renewable projects on the Outer Continental Shelf.

Two items the BOEM wants to address:

- Environmental protections

-

National security concerns (e.g., interference with U.S. defense/naval activity in the exclusive economic zone, high seas, territorial seas).

“In particular, BOEM is seeking to address concerns related to the protection of national security interests of the United States and prevention of interference with reasonable uses of the exclusive economic zone, the high seas, and the territorial seas, as described in that subsection of OCSLA. Id,” stated BOEM’s letter addressed to Rob Keiser, head of Orsted North America.

The $5 billion wind project, already 80% complete with 45 of 65 turbines installed, was approved under the Biden-Harris regime in 2023, during the time the Democratic Party looted the nation under the guise of a ‘climate crisis’ to funnel hundreds of billions of dollars into green companies and NGOs. This, in effect, helped spark generational-high inflation, crippling working-poor and middle-class households. Several of these projects have already collapsed, and we anticipate more Solyndra-style busts ahead as the green bubble continues to implode.

Orsted told Bloomberg that it’s exploring regulatory channels and possible legal action to resolve the matter: “Orsted is evaluating all options to resolve the matter expeditiously. This includes engagement with relevant permitting agencies for any necessary clarification or resolution as well as through potential legal proceedings.”

Bloomberg reports Ortsed is still moving ahead with a $9.4 billion share sale and appointed a syndicate of BNP Paribas, Danske Bank, and J.P. Morgan as joint global coordinators, alongside Morgan Stanley. BofA Securities Europe SA and Goldman Sachs will serve as joint bookrunners.

Here are more details about the planned share sale that will help stabilize the balance sheet of the struggling wind company:

-

Orsted is pushing ahead with a planned 60 billion DKK ($9.4B) rights issue, the largest European energy-sector share sale in over a decade.

-

The Danish government has pledged to buy about half the shares.

-

Orsted’s credit rating has already been slashed to the lowest investment grade.

-

Orsted has already canceled two U.S. projects, booked heavy writedowns, and changed out its top executives.

This month, Orsted shares in Denmark have been in turmoil:

-

Wind Giant Orsted Suffers Worst Week On Record As Green Energy Demise Accelerates

-

Orsted Shares Crash Below IPO Price On “Unexpected” Rights Issue

However, good news for the industry last week on new IRS guidance:

- Vestas Wind Shares Surge On Revised Tax Credit Guidance, Wall Street Analysts Breathe Sigh Of Relief

Related:

Orsted crashed as much as 19% in Copenhagen, falling to record lows below its IPO price.

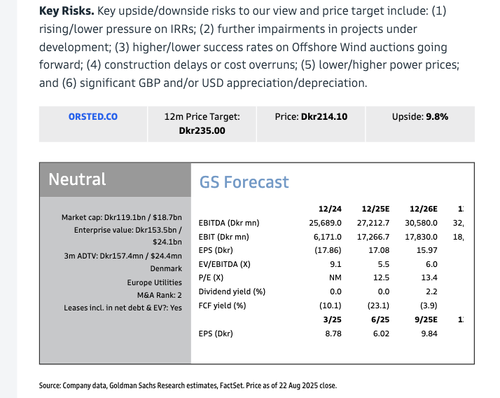

Commentary from a team of Goldman analysts led by Alberto Gandolfi provides clients with the economics of Orsted walking away from Revolution and another offshore wind project, Sunrise:

What are the economics of walking away from both projects? To run this math, we look at three building blocks: (1) walking away from Revolution and Sunrise would save Orsted DKK 45 bn in residual capex, (2) the company would lose around DKK 3 bn EBITDA for a period of c.25 years, and (3) Orsted may face cancellation fees: based on Ocean Wind 1 (DKK 10 bn, based on 2023 accounts), cancellation fees on these two projects could be DKK 10-15 bn.

Can Orsted downsize or delay the rights issue? Based on the math just presented, we estimate that walking away from both US projects would require a smaller rights issue: we estimate DKK 30 bn, half of what was recently announced. To reach our conclusion, we assume that Orsted would have to comply with its target FFO/Net debt “above 30%”. We also estimate that this move – i.e., walking away from projects, paying penalties and downsizing the equity issuance – would be EPS accretive (double digit) in 2025-27, EPS neutral in 2028, but it would then start to be increasingly EPS dilutive as of 2029-30; this scenario wouldn’t meaningfully change our current valuation for the stock. We also note that Orsted would still have to carry out the targeted DKK 35 bn disposals by the end of 2026, to avoid any B/S pressure.

Gandolfi is “Neutral” wated on Orsted with a 12-month price target of DKK 235.

. . .

Tyler Durden

Mon, 08/25/2025 – 07:20ZeroHedge NewsRead More

R1

R1

T1

T1