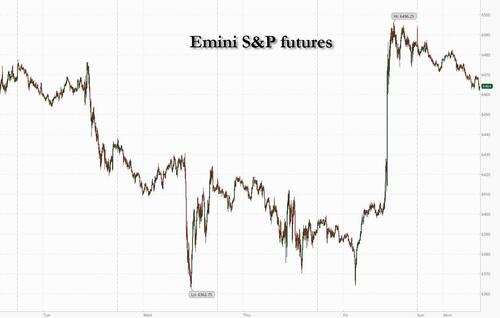

Futures Drop As Powell Dovish Pivot Euphoria Fades

Markets are mixed this morning, with US stock futures ticking lower as euphoria over the prospect of a Fed rate cut fizzling out after Friday’s rally. Attention turns to one of the biggest market tests ahead of the central bank’s September policy meeting: Wednesday’s Nvidia earnings. As of 8:15am, S&P futures are down 0.3% after the best day since May and the index finishing the week 2pts below its all time high. Media are pointing to a lack of Fed consensus to cut based on comments from Goolsbee / Musalem. Pre-market Mag7 names are all lower with Defensives outperforming Cyclicals, reversing some of the gains from Friday. Intel shares rose in premarket trading after the US agreed to take a 10% stake in the chip maker. The yield curve is bear steepening and the USD is strengthening. Commodities are rallying led by Energy. The keys this week are NVDA earnings but also a number of macro data releases that can clarify the US econ growth situation, e.g., Durable / Cap Goods, Consumer Confidence, regional Fed activity indicators, jobless data, PCE, and Personal Income / Spending.Looking at today’s calendar, we get new home sales and Dallas Fed manufacturing index. Fed Voter Williams and non-voter Logan are also scheduled to speak.

In premarket trading, Mag 7 stocks are all lower (Nvidia -0.1%, Alphabet -0.1%, Microsoft -0.2%, Apple -0.4%, Meta -0.4%, Tesla -0.5%, Amazon -0.6%).

- Furniture stocks are reacting after President Trump announced a “major Tariff Investigation on Furniture coming into the United States.” Arhaus (ARHS) -3%, Ethan Allen (ETD) +3%, RH (RH) -7%, Wayfair (W) -6%

- American Eagle Outfitters (AEO) falls 3% after BofA Global Research cut the recommendation on the apparel retailer to underperform amid tariff pressures on profitability.

- Axogen (AXGN) drops 14% after the FDA extended its review its Biologics License Application for Avance Nerve Graft by three months, pushing the decision date to Dec. 5.

- Dyne Therapeutics (DYN) rises 6% after Raymond James raised the recommendation to strong buy from outperform, citing optimism about an investigational therapy for Duchenne muscular dystrophy, a rare muscle disease.

- Intel (INTC) shares rose in premarket trading after the US agreed to take a 10% stake in the chip maker.

- Keurig Dr Pepper Inc. (KDP) is down 4% after after the announcement of a deal to buy JDE Peet’s NV for $18.4 billion in an overhaul that will see it split the coffee business from other beverage operations only a few years after a deal that combined them.

- PDD Holdings Inc. (PDD) surges 6% after company behind the popular Temu platform reported net income and adjusted earnings per American depositary receipts that beat the average analyst estimates.

- Verint Systems Inc (VRNT) jumps 12% after Bloomberg reported that buyout firm Thoma Bravo is nearing a deal to acquire the call center software maker.

Overnight, developments were limited with London out for their Summer Bank Holiday. Over the weekend, Fed voter Musalem told Reuters that more data is needed to decide whether a September rate cut is warranted. In China, Shanghai eased home-buying rules to enable eligible residents, including those from outside Shanghai, to now buy an unlimited number of homes in the outer suburbs.

Sentiment had been weak heading into Friday, with the S&P 500 falling for five straight sessions, its longest losing streak since January, as Wall Street pared bets that the Fed was about to reduce borrowing costs. Powell’s comments halted those concerns, sending the equity benchmark soaring more than 1.5% to notch a third straight weekly advance, with last month’s record high in sight. A plunge in short-end Treasury rates sent the US yield curve to its steepest since 2021 on Friday.

“The limited move in long-dated yields has led to a steepening in the curve, perhaps for fear that the Fed is prioritizing the jobs market, while letting inflation run hot above the 2% target,” said Matthew Ryan, head of market strategy at Ebury Partners Ltd. “Rising fears surrounding Federal Reserve independence, and President Trump’s influence on monetary policy, are not exactly helping matters.

Traders now see an 84% chance of a Fed rate cut next month after Powell signaled that the central bank may ease before inflation fully returns to target amid a softening hiring environment. That optimism faces key tests this week, including Nvidia Corp.’s results on Wednesday and the Fed’s preferred price gauge on Friday. Traders are hoping Nvidia results can soothe fears about AI spending and effectively confirm that the stock market’s latest rally isn’t just a technology bubble. Nvidia’s size — it has the biggest weighting in the S&P 500 at almost 8% — and its position at the center of AI development have made it a bellwether of the broader market. The tech giant’s chips are everywhere, with 40% of its revenue coming from tech giants including Meta Platforms Inc., Microsoft Corp., Alphabet Inc. and Amazon.com Inc.

Powell, in what was likely his final Jackson Hole speech at the helm of the Fed, detailed the cloudy signals coming from the economy. While the effect of tariffs on prices is now visible, there are still questions about whether that will reignite inflation in a more persistent way, he said. He called the labor market’s current status — with both falling demand for, and declining supply of workers — “curious.”

“It’s clear that Fed is prioritizing the job weakness concern over inflation and that’s their stance now,” said Jin Yuejue, Hong Kong-based multi-asset solutions investment specialist at JPMorgan Asset Management. Still, the signal from the speech is “quite clear” that the Fed is ready to pivot, she said.

“The path ahead is not so straightforward,” said Daniel Murray, chief executive officer of EFG Asset Management. “‘While easier monetary policy is usually welcomed by markets, the context also matters and there remains significant uncertainty regarding the macro and corporate environments.”

The Stoxx Europe 600 index dropped about 0.2% after closing just short of an all-time high Friday. Liquidity was lower than usual, with UK markets closed for a holiday. Danish renewable-energy company Orsted A/S plunged after President Donald Trump’s administration halted construction on an almost-finished offshore wind farm. JDE Peet’s soared on the Keurig Dr Pepper takeover offer. Here are the biggest movers Monday:

- Orsted shares fall as much as 19% to a record low, after the Trump administration halted work on the Danish firm’s offshore wind farm. European wind energy peers also decline

- Thule falls as much as 6.4%, the most since May, after SEB cut its recommendation for the Swedish outdoor equipment maker to sell from hold with a Street-low price target of SEK225. The analyst cited swiftly rising costs and a lack of volume growth

- Valneva shares plunge 26%, the most since June 2022, after the French vaccine maker’s shot for a mosquito-borne disease was suspended in the US on an investigation into its adverse effects among older patients

- SBB drops as much as 7.7%, most since July, after Pareto Securities reiterates its sell rating and street-low price target of SEK2.8, saying core challenges remain for the Swedish landlord even as the country’s property market stabilizes and interest rates decline

Earlier in the session, Asian stocks rose, boosted by Chinese chip stocks and continued optimism that the Federal Reserve will lower interest rates next month. The MSCI Asia Pacific Index rose as much as 1.1%, with TSMC, Alibaba and Tencent providing the biggest boosts to the benchmark. Most major equity indexes were in the green, with Taiwan, South Korea and Hong Kong leading the gains in the region. China’s stock rally extended, partly as investor sentiment on the outlook for the nation’s chip sector strengthened. The STAR 50 Index rallied 3.2% in China, extending last week’s 13% surge, while the onshore benchmark CSI 300 Index gained 2.1% to the highest since July 2022. Positive news such as DeepSeek’s new model update, customized to work with next-generation Chinese-made AI chips, has helped propel the rally.

“Asian equities across the board will certainly be boosted if expectations of a cut rise further as the September FOMC approaches,” said Gerald Gan, deputy chief investment officer at Reed Capital.

A gauge of the dollar was steady after posting its third straight weekly loss. The 10-year Treasury yield rose two basis points and bonds in Europe fell, with yields on German bunds climbing five basis points. The TSY yield curve continues to steepen, extending the trend from Friday, when UST advance following Fed Chair Powell’s Jackson Hole speech was the biggest since the Aug. 1 rally sparked by weak employment data.

In commodities, WTI crude futures are rose 0.6% to $64.04, while gold dips to $3,366.

The US economic data calendar includes July Chicago Fed national activity index (8:30 a.m.), July new home sales (10 a.m.) and August Dallas Fed manufacturing activity (10:30 a.m.); Fed speaker slate also includes Dallas Fed President Logan (3:15 p.m.) and New York Fed President Williams at 7:15 p.m.

Market Snapshot

- S&P 500 mini -0.3%

- Nasdaq 100 mini -0.3%

- Russell 2000 mini little changed

- Stoxx Europe 600 -0.3%

- DAX -0.4%

- CAC 40 -0.6%

- 10-year Treasury yield little changed at 4.26%

- VIX +0.9 points at 15.11

- Bloomberg Dollar Index little changed at 1202.63

- euro -0.1% at $1.1701

- WTI crude +0.4% at $63.92/barrel

Top Overnight News

- Despite Powell’s speech, clear divisions remain among Fed officials. The St. Louis Fed’s Alberto Musalem said he’ll need more data, Reuters reported, while Chicago’s Austan Goolsbee pointed out he’s still more concerned about the inflation side of their mandate than employment. BBG

- Investors are piling back into NY office buildings, lending billions of dollars to property developers in a sign big money managers see return to office wave as a much needed salve to the mkt. FT

- Thousands of homes in northern California and central Oregon were under evacuation orders on Sunday from wildfires. AP

- Pentagon plans a military deployment in Chicago as President Trump eyes a crackdown: WaPo

- California warns that its agricultural industry feeds the US but is now under assault from Trump’s immigration policies, creating the risk of higher prices or food shortages. NYT

- China’s financial hub of Shanghai eased home-buying rules in the latest attempt by authorities to contain the nation’s prolonged property crisis. Eligible residents, including those from outside Shanghai, can now buy an unlimited number of homes in the outer suburbs, according to a statement Monday. BBG

- China is banking on artificial intelligence (AI) to become a new growth engine, and there are projections that it could add several trillion yuan to the economy by 2035 amid a national push for computing power and a unified data market. SCMP

- South Korea’s Lee Jae Myung meets Trump at the White House today. He’ll urge him to revive stalled North Korea talks and follow up on a recently signed trade deal. BBG

- German business confidence unexpectedly improved in August to the highest level since 2022, after the EU struck a trade deal with the US. BBG

- Keurig Dr Pepper will buy JDE Peet’s for $18.4 billion in cash in an effort to revive its struggling coffee business. The combined company will later separate its beverage and coffee operations, essentially reversing the 2018 deal that combined Keurig and Dr Pepper. BBG

Trade/Tariffs

- US food industry groups are pushing for exemptions from US tariffs and arguing that products from fish to cucumbers cannot be affordably grown at home, according to FT.

- European Commission President Von der Leyen defended the EU-US agreement on tariffs which she said was a ‘conscious decision’ that avoided a trade war and called it a “good, if not perfect agreement”, according to euro news.

- South Korea’s President Lee said they will ultimately arrive at a reasonable trade deal with the US and he expects to discuss with US President Trump security and defence costs, as well as tariff negotiations.

- India’s Foreign Minister said trade negotiations are still going on and they have lines to maintain and defend, while he added the lines India cannot cross are the interests of farmers and small producers. Furthermore, he said India buying Russian oil was never brought up before the public announcement of tariffs and issues about buying Russian oil are not being used to target other major users such as China and the EU.

- French President Macron said he had an in-depth discussion on major international crises with South African President Ramaphosa, while they also reviewed economic and trade issues, as well as bilateral cooperation between France and South Africa.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week on the front foot as the region took its opportunity to react to the dovish comments by Fed Chair Powell at Jackson Hole on Friday, in which he signalled the potential for a September rate cut as he noted that the shifting balance of risks may warrant adjusting policy. ASX 200 rallied to a fresh record high at the open but gave back a majority of the early gains as participants also digested a slew of earnings releases. Nikkei 225 advanced at the open but then lost steam and faded most of the early upward momentum to return to beneath the 43,000 level with headwinds from last Friday’s currency strength and with some hawkish-leaning comments from BoJ Governor Ueda at Jackson Hole who expects a tightening job market to push up wages. Hang Seng and Shanghai Comp outperformed with the advances in Hong Kong led by property, mining and tech, while the mainland was also lifted after China’s State Council called for efforts to bolster overall coordination and refine implementation mechanisms of large-scale equipment upgrades and consumer goods trade-in programs to better leverage their role in boosting domestic demand. Furthermore, participants digested several earnings releases and the PBoC announced last Friday to conduct CNY 600bln of 1-year MLF loans for today.

Top Asian News

- BoJ Governor Ueda said at Jackson Hole that barring a major negative demand shock, the labour market is expected to remain tight and put pressure on wages, while he added that competition for workers has increased and more people are switching jobs. Ueda said they will continue to monitor the labour market developments closely and incorporate that into monetary policy. Furthermore, he said wages are now rising and labour shortages have become one of the most pressing economic issues, as well as noted that the demographic shift that began in the 1980s is producing acute labour shortages and persistent upward pressure on wages.

- Japanese PM Ishiba said Japan agreed to strengthen security and economic ties with South Korea, while South Korean President Lee said they agreed on South Korea-Japan relations, which are important in a fast-changing global political landscape.

- Shanghai lifts the home buying limit in the outer suburbs effective August 26th, according to Bloomberg.

- RBNZ opened consultation on New Zealand’s capital settings for deposit takers with the review to consider whether current prudential capital requirements are set at the right level, while the central bank proposed to lower the minimum capital requirement to NZD 5mln.

- Fitch affirms India at BBB-; outlook stable.

European bourses (STOXX 600 -0.2%) have begun the week on the backfoot, as indices pare back some of the Powell-induced strength seen on Friday. European sectors opened mostly in the red, only a few remaining afloat including Banks, Media along with Travel & Leisure. At the bottom of the pile is Utilities due to notable losses in Orsted (-17%) after it received an offshore stop-work order from US BOEM.

Top European News

- BoE Governor Bailey said at Jackson Hole that the UK faces an “acute challenge” over its weak underlying economic growth and reduced labour force participation since the COVID-19 pandemic, while he said the BoE shifted its focus away from long-term trends in unemployment to looking at levels of labour force participation instead, according to Reuters.

- ECB’s Lagarde said at Jackson Hole that the labour market has weathered recent shocks and proved to be surprisingly resilient in the face of an inflation shock and aggressive interest rate hikes, while she also commented that central bank independence is critically important.

- ECB’s Kazaks said the central bank entered a new monetary-policy phase where officials can focus on monitoring the economy rather than actively intervening to change its course, while he noted there is currently no need to lower rates further as inflation is at the 2% target and recent data has not signalled a marked change in the outlook since the quarterly projections in June, according to Bloomberg.

- ECB’s Rehn said the central bank is in no hurry to cut interest rates further after inflation reached its 2% target and with the economy performing slightly better than thought, according to Bloomberg.

- ECB rate cut talk may resume after a pause in September, should the economy continue to weaken, according to Reuters citing sources.

- German Chancellor Merz said tackling economic woes is tougher than expected and that the US’s 15% tariffs on German exports will be a burden on the German economy, according to Bloomberg.

- Fitch affirmed the UK on Friday at AA-; Outlook Stable but stated that greater global uncertainty and weaker external demand will dampen investment growth.

- Italy’s Deputy PM Tajani said he opposes Italy imposing windfall taxes on banks, while he commented that banks should pay taxes and contribute but should not be surprised or scolded, according to Bloomberg.

- Canadian PM Carney will travel to Poland, Germany and Latvia during August 25th-27th and will meet with German Chancellor Merz, while Carney will be focused on strengthening relationships with European allies and advancing cooperation in key areas.

FX

- DXY has kicked the week off slightly firmer. Gains, however, are relatively minor compared to the losses seen on Friday post-Powell, where he signalled to a September rate cut. Focus this week will turn to PCE on Thursday. Upside in DXY is currently capped by the 98 mark. If breached, the 50DMA sits at 98.06.

- After venturing as high as 1.1742 on Friday, EUR/USD has slipped below the 1.17 mark as the dollar attempts to atone for recent losses. German IFO data today saw a strong turnout for the expectations component, helping the headline print above the market consensus. That being said, the IFO President noted that “the recovery of the German economy remains weak”. EUR/USD has delved as low as 1.1694 thus far with interim support provided by the 50DMA at 1.1650.

- After a strong showing on Friday, the JPY rally against the USD has paused for breath. The JPY has been unable to garner any further support from comments by BoJ governor Ueda, who stated that barring a major negative demand shock, the labour market is expected to remain tight and put pressure on wages. USD/JPY has made its way back onto a 147 handle after delving as low as 146.57 overnight with a current session peak at 147.52.

- GBP is a touch softer vs. the USD with UK market participants way from market. Subsequently, newsflow surrounding the UK is light aside from comments by BoE Governor Bailey, who remarked that the UK faces an “acute challenge” over its weak underlying economic growth and reduced labour force participation since the COVID-19 pandemic. He added that the BoE shifted its focus away from long-term trends in unemployment to looking at levels of labour force participation instead.

- Steady trade for the antipodes with AUD supported by a much firmer-than-expected CNY reference rate setting. For AUD this week, RBA minutes are due on deck tomorrow with monthly CPI set to hit on Wednesday.

- Barclays month-end rebalancing model: weak USD selling against most majors. Neutral vs. EUR and JPY.

- PBoC set USD/CNY mid-point at 7.1161 vs exp. 7.1551 (Prev. 7.1321).

Fixed Income

- USTs are essentially flat and trade in a very narrow 4 tick range (112-01 to 112-05), as US paper takes a breather from Friday’s significant upside following dovish remarks from the Fed Chair. From a yield perspective, there is some mild bear flattening, with the short-end making back some of Friday’s pressure.

- Bunds are trading on the backfoot and currently lower by around 38 ticks, pulling back from the upside seen on Friday. Currently trading towards the bottom-end of a 129.02 to 129.31 range; further downside will see a test of the round 129.00 mark, and below that 128.94 (the lower from Friday). From a yield perspective, the German 10yr is currently higher by 3.7bps at around 2.756%. Focus has been on the ECB over the weekend. Firstly, Reuters reported that ECB rate cut talks may resume after the September pause, should the economy continue to deteriorate. Elsewhere, President Lagarde said Europe’s labour market has remained resilient despite severe inflation shocks and aggressive rate hikes.

- Gilt futures trading is currently shut today on account of the UK’s Bank Holiday.

Commodities

- The crude complex trades with a modest positive bias on the first trading session of the week. On the geopolitical front, Ukrainian drones attacked an industrial facility in Russia’s Samara region which sparked a fire at Russia’s Novatek Ust-Luga terminal. However, Kazakhstan’s energy ministry said the nation’s oil exports had not been interrupted by the disruption. Aside from this, energy-specific drivers are light. WTI trades within a USD 63.53-64.03/bbl range, while Brent trades within USD 67.04-67.50/bbl.

- Precious metals trade mixed. Palladium modestly outperforms despite weakness in auto stocks, while gold is softer amid a modestly firmer dollar and a pullback from Fed Chair Powell’s dovish address on Friday. XAU/USD currently trades choppily within a USD 3,405-3,417/oz range, towards the top end of Friday’s parameters with a high at 3,425/oz.

- 3M LME trade is closed today amid the UK bank holiday.

- Iraq raised its refining capacity to 1.3mln bpd from 1.1mln bpd in 2024, according to the PM’s office.

- Libya’s NOC said it will host the first Libyan-US energy forum soon.

- Codelco said Chile’s mining regulator authorised the restart of operations at Andes Norte and Diamante divisions of the El Teniente mine.

- Kazakhstan’s energy ministry says the nation’s oil exports have not been interrupted following a Ukrainian drone strike on Russia’s Ust-Luga.

Geopolitics: Middle East

- Israel’s military conducted an attack on the Yemeni capital of Sanaa against targets which included a military compound where the presidential palace is located, two power stations and a fuel storage site.

- Iran’s Supreme Leader said the current situation with the United States was “unsolvable” and that they will stand strongly against the US demand to make Tehran ‘obedient’, according to Reuters citing state media.

- Iran is prepared to significantly lower uranium enrichment to prevent Britain reimposing UN sanctions, according to The Telegraph.

Geopolitics: Ukraine

- Ukraine’s PM discussed security guarantees with US special representative Kellogg.

- US Pentagon quietly blocked Ukraine’s long-range missile strike on Russia with the US Defense Department withholding approval as the White House sought to entice Moscow to open peace talks, according to WSJ. However, it was later reported that Ukrainian President Zelensky said Ukraine has lately been using its own weapons to hit Russia and does not consult on this with Washington.

- Russia and Ukraine conducted an exchange of POWs in which they swapped 146 POWs each.

- Russia’s Defence Ministry said Russian forces captured Filiia in Ukraine’s Dnipropetrovsk region, according to Interfax.

- Russian air defence forces shot down a Ukrainian drone near the Kursk nuclear power plant and a fire broke out at the plant, although there were no safety threats to people or the plant. However, the Kusk acting Governor separately commented that the Ukrainian drone attack on the nuclear power plant is a threat to nuclear safety.

- Russian air defences downed a drone flying towards Moscow. It was separately reported that Ukrainian drones attacked an industrial facility in Russia’s Samara region and that debris from a destroyed Ukrainian drone attack sparked a fire at Russia’s Novatek Ust-Luga terminal.

- Norway is providing air defences worth NOK 7bln to Ukraine, which will be delivered from Germany to Ukraine, with Norway and Germany funding two patriot systems including missiles.

- Russian defence ministry says its forces captured Zaporizke in eastern Ukraine, via RIA.

Geopolitics: Other

- North Korean leader Kim oversaw the firing of new air defence missiles, according to KCNA. In relevant news, South Korea confirmed it fired warning shots earlier last week at North Korean soldiers who briefly crossed the border between the two countries, according to the BBC.

US Event Calendar

- 8:30 am: Jul Chicago Fed Nat Activity Index, est. -0.11, prior -0.1

- 10:00 am: Jul New Home Sales, est. 630k, prior 627k

- 10:00 am: Jul New Home Sales MoM, est. 0.48%, prior 0.6%

- 10:30 am: Aug Dallas Fed Manf. Activity, est. -1.7, prior 0.9

Central Bank speakers

- 3:15 pm: Fed’s Logan Speaks at Bank of Mexico Centennial Conference

DB’s Jim Reid concludes the overnight wrap

Markets ended last week in a buoyant mood as a dovish tilt by Powell at Jackson Hole left investors increasingly confident on upcoming Fed easing. While Fed news will continue to draw attention this week, the focus will also shift to a slew of inflation releases out of the US, Europe and Japan on Friday, while Nvidia’s earnings on Wednesday will be all-important after tech stocks slumped prior to Friday’s rally.

Powell’s Jackson Hole speech saw a couple of notable shifts compared to his last FOMC press conference in late July. First, the Fed Chair emphasized that “the balance of risks appears to be shifting”, with the unusual situation in the labour market suggesting that “downside risks to employment” are rising. Second, on the policy outlook, Powell noted “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance”. Put together, this suggests that Powell no longer sees a further weakening of labour market data as necessary to ease policy.

While Powell made no explicit commitment on timing, market pricing of a Fed rate cut next month rose from 72% to 81% by Friday’s close and up to 86% this morning, while the amount of cuts priced in by December rose by +6.7bps to 54bps. Following Powell’s comments, our US economists now expect a 25bps cut next month, with further 25bps cuts in December and March, bringing the Fed funds rate to their longer-run estimate of neutral. You can read their full reaction here.

Markets responded euphorically to Powell’s speech, reversing the pessimistic mood that dominated much of last week (see weekly recap at the end). Treasuries rallied with the 2yr yield falling by -9.7bps and the 10yr by -7.4bps on Friday. The S&P 500 (+1.52%) had its best day since May, closing less than 0.1% from its August 14 record high. The NASDAQ (+1.88%) and the Magnificent 7 (+2.51%) saw even larger advances and the small cap Russell 2000 surged by 3.86% in its best day since April 9 when Trump delayed his Liberation Day tariffs. Other risks assets also gained, with US HY credit spreads -8bps lower and the VIX volatility index (-2.38pts to 14.22) falling to its lowest level year-to-date. Those reactions were consistent with the historical pattern that rate cuts outside recessions tend to be very positive for risk assets.

Looking ahead, central bank commentary will continue to garner attention this week with the Fed’s Logan (non-voter), Williams, Barkin (non-voter) and Waller due to speak. Divisions among the FOMC are likely to remain evident, and we would expect Logan today to sound more hawkish than Powell on near-term cuts, but Waller on Thursday to lean into the dovish elements of Powell’s speech. The topic of Fed independence will also remain salient with Trump saying last Friday that he would fire Fed Governor Lisa Cook if she did not resign. As a reminder, the controversy emerged last Wednesday as FHFA Direct Bill Pulte alleged that Governor Cook may have committed mortgage fraud. Were Cook to leave her post, it would open another seat for Trump to fill, increasing the prospects of a dovish majority on the seven-person Fed Board.

In Europe, the ECB will release the accounts of its July meeting on Thursday, which come as ECB commentary at Jackson Hole was consistent with an extended pause. President Lagarde avoided discussing the policy outlook but highlighted the resilience of the euro area labour market. Germany’s Nagel argued that the bar for further cuts was high with few arguments for more easing and Finland’s Rehn said that, as “inflation is for now in a good place”, an “insurance cut” was not necessary.

On the data front, inflation will be in focus in both sides of the Atlantic on Friday. In the US, our economists expect the July core PCE deflator to come in at +0.29% MoM (vs. +0.26% previous), bringing the YoY rate a tenth higher to 2.9%, with risks of this even rounding up to 3.0%. They also foresee the accompanying personal income (DBe: +0.4% vs. +0.3% previous) and consumption (+0.6% vs. +0.3%) releases showing solid growth. In Europe, the flash August CPI print for Germany, France, Italy and Spain are due, with our economists expecting annual inflation to edge up slightly across the Big 3 euro area economies (see here for more). And in Japan, we will have the August Tokyo CPI on Friday, with our Japan economist expecting a retreat in core inflation ex. fresh food to 2.5% YoY (2.9% in July).

Ahead of that, other notable US economic releases include new home sales (Mon), the Conference Board’s consumer confidence indicator and durable goods orders (both Tue). In Europe, we also have the Ifo survey in Germany (Mon), euro area M3 and credit data for July (Thu) and the ECB’s consumer expectations survey (Fri). The full week ahead calendar is at the end as usual.

Rounding out US events, in tariffs, the “de minimis” exemption will end this Friday, while additional 25% tariffs on India (taking the total levy to 50%) are due to come into effect on Wednesday. On tariff news, last Friday Canada announced that it will remove its retaliatory tariffs on US products that comply with the USMCA, though it will keep symmetrical tariffs on US steel, aluminium and autos.

Finally, the big event in corporate earnings will be Nvidia’s results on Wednesday, which come as tech stocks had seen their biggest five-day pullback since April prior to Friday’s rally. Other US tech earnings due include Crowdstrike, Dell and Marvell. In China, the spotlight will be on results from Alibaba, Meituan and BYD. In tech news last Friday Trump announced a deal that will see the US receive 9.9% of Intel’s shares funded by $8.9bn of government grants that have not yet been paid to the company. Intel’s stock rose by +5.53% on the news.

This morning Asian equity markets are building on Friday’s rally on Wall Street. Across the region, Chinese stocks are leading the way, with the Hang Seng up +2.09%, followed by the CSI (+1.39%) and the Shanghai Composite (+0.86%), with the latter on course to reach a 10-year high. The KOSPI (+1.01%), the Nikkei (+0.68%) and the S&P/ASX 200 (+0.33%) are also all advancing. However, US equity futures on both the S&P 500 (-0.09%) and the NASDAQ (-0.10%) are marginally lower, with 10yr Treasuries (+1.3bps to 4.27%) also slightly softer after Friday’s rally.

In the bond space, 10yr JGB yields (-0.7bps to 1.62%) are a touch lower after reaching a post-2008 high on Friday, even as Governor Kazuo Ueda’s remarks at Jackson Hole reinforced market expectations that the central bank may resume its rate hiking cycle later this year given accelerating wage growth.

Recapping last week’s moves in more detail, markets had underperformed prior to Friday, with Friday’s spike leaving the S&P 500 narrowly higher over the week (+0.27%), while the Nasdaq (-0.58% on the week) and the Magnificent 7 (-1.02%) were unable to recoup their losses. Treasury yields had been trading a little higher as last Thursday’s stronger-than-expected US August flash PMIs saw the manufacturing PMI rebound to its highest level since May 2022 and the composite output price index rise to its highest in three years. But Friday’s rally meant that yields were lower over the week, with the 10yr yield down -6.4bps (-7.4bps Friday) and the 2yr down -5.5bps (-9.7bps Friday).

The Euro area and the UK also saw robust August PMI releases and European stocks were more universally positive. The STOXX 600 rose +1.40% (+0.40% on Friday) led by the FTSE 100, which rose +2.00% in its biggest weekly jump since May to reach a new record high. European bonds rallied, with yields on 10yr bunds down -6.7bps to 2.72% (-3.6bps Friday), while gilts (-0.3bps on the week, -3.6bps Friday) saw a marginal decline.

Earlier last week, European markets had benefited from increased optimism on talks over Russia-Ukraine, but these faded as Russian officials ruled out any immediate meeting between President Putin and President Zelenskiy. On Friday, Trump said that depending on events “over the next two weeks” he would make a decision “whether or not” to target Russia with “massive sanctions or massive tariffs or both”. With prospects of new US restrictions on Russian oil still in play, Brent crude rose +2.85% on the week to $67.73/bbl (+0.09% Friday).

Tyler Durden

Mon, 08/25/2025 – 08:35ZeroHedge NewsRead More

R1

R1

T1

T1