Futures Drift Near Record High As Nvidia Fails To Restart Rally

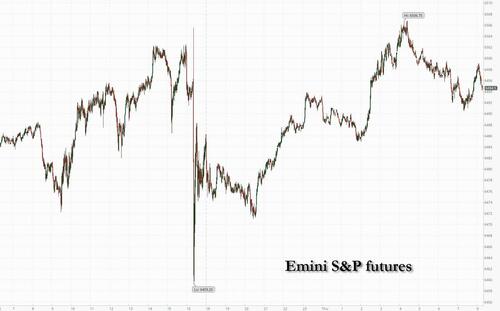

US equity futures are flat as the much-anticipated print from NVDA failed to produce any real fireworks one way or the other, at least relative to sky-high expectations. Most seemed to walk away from the print thinking it was “good enough” to sustain the AI trade broadly. As of 8:00am, S&P 500 contracts were little changed, signaling the US benchmark will hold near Wednesday’s record high. European stocks fell 0.3%. Nvidia dropped 1.8% in premarket trading, joining Tesla Inc. as the only decliners among Magnificent Seven stocks. The yield on 10-year Treasuries was unchanged at 4.23% as pressure on long-dated debt eased. Longer term bonds in Europe traded mixed, with French notes staging a rebound. The dollar fell 0.3% for a third day of losses while gold and bitcoin gained. Macro focus will now shift to jobless claims 8:30am today & core PCE tomorrow.

In premaket trading, Mag7 stocks are mixed: Nvidia (NVDA) falls 1.8% after the AI-focused chipmaker gave a revenue forecast that was seen as underwhelmin (Apple +0.2%, Microsoft +0.2%, Amazon -0.1%, Meta +0.05%, Alphabet +0.02%, Tesla -0.6%).

- Cooper (COO) falls 14% after the lens maker reduced its revenue outlook, with analysts noting repeated cuts in guidance.

- CrowdStrike (CRWD) is down 3.4% after the software company gave an outlook for third-quarter revenue that was weaker than expected.

- Dollar General Corp. (DG) rises 6% after reporting stronger-than-expected sales and raised its forecast, adding to signals that US shoppers are still willing to spend on items they see as good value.

- Five Below Inc. (FIVE) climbs 5% after raising its profit outlook, saying that it has passed on higher costs from tariffs to its customers who continue to embrace the retail chain’s budget-friendly, pop-culture focused products.

- International Paper Co. (IP) rises 2% after BofA Global Research raised the recommendation on the packaging company to buy, expecting strong increases in containerboard prices in 2026.

- Li Auto ADRs (LI) drops 4% after the Chinese EV maker forecast revenue for the third quarter that missed the average analyst estimate.

- Nutanix (NTNX) falls 7% after the cloud software company gave an outlook that is seen as underwhelming.

- Phibro Animal Health Corp. (PAHC) rises 15% after forecasting year net sales that beat the average analyst estimate.

- Pure Storage (PSTG) gains 14% after the cloud-storage provider topped estimates for fiscal second-quarter results and raised its 2026 full-year forecast.

- Snowflake (SNOW) is up 14% after the software company reported second-quarter results that beat expectations and raised its full-year forecast for both product revenue and adjusted operating margin.

- Urban Outfitters (URBN) is down 5% after the apparel retailer reported second-quarter results. While net sales came in slightly above consensus, shares have soared 42% this year heading into the print and reached an all-time high earlier this month.

- Veeva Systems (VEEV) falls 3.6% after the software company reported its second-quarter results and gave an outlook.

Overnight, markets digested NVDA earnings released post the close yesterday that reflected a narrower beat & guide above than the market has grown accustomed to (with China business continuing to decline), offset by a fresh $60bn share repurchase authorization + positive commentary on next-gen Rubin platform (on track to launch in mid-26). Mexico plans to raise tariffs on China after pressure from the US (BBG), while India’s PM heads overseas to meet the leaders of China, Japan and Russia (RTRS). Looking ahead today, we have GDP (2nd release), claims and pending home sales. Fed voter Waller is scheduled to speak.

Investors followed Nvidia’s earnings for insight into the artificial intelligence boom that has driven equity gains in 2025. Although its revenue forecast pointed to a slowdown after two years of surging AI investment, management pushed back against the idea that demand is waning.

“The growth is changing, but you can’t have two years in a row with growth improving” more than 100%, Claudia Panseri, chief investment officer for France at UBS Wealth Management, told Bloomberg TV. “Yesterday’s results are good enough to keep the trend going.”

With Nvidia’s results having wrapped up the earnings season, traders will again shift their focus to next month’s Federal Reserve rate decision. They’re also watching US President Donald Trump’s unfolding battle with the Fed and any efforts to reshape the policy committee.

Initial jobless claims data, along with revised second-quarter gross domestic product figures, are due later Thursday. The GDP report is forecast to show personal consumption picked up to a moderate pace after a sluggish start to 2025. Friday’s core PCE index — the Fed’s preferred inflation gauge — is expected to edge higher, highlighting policymakers’ challenge of taming prices without further straining a softening labor market.

Swaps are currently pricing around an 85% likelihood of a September quarter-point cut, little changed from Wednesday, with at least three more by June next year.

“The market has been complacent in the number of Fed cuts it is pricing,” said Karen Georges, an equity fund manager at Ecofi. “If the job market shows more resilience than expected, investors might have to revise their rate cut expectations down.”

In Europe, the CAC 40 rises 0.5%, outperforming regional peers as France’s benchmark bond-yield premium over Germany narrows back below 80 basis points. The Stoxx 600 is little changed, with gains in autos and consumer stocks offset by weakness in real estate and utilities. Here are the biggest movers Thursday:

- European automotive stocks rallied as much as 2%, making it one of the best-performing sectors of the Stoxx 600 after data showed a jump in new car registrations

- BioArctic shares rise as much as 10% to the highest level since September 2023 after the Swedish biotech company reported results for the second quarter, which included an improved cash position

- Pernod Ricard climbs as much as 8.5%, to the highest since mid March, as the spirits maker delivers full-year EPS above expectations

- Cancom jumps while Dermapharm and Friedrich Vorwerk come under pressure as Jefferies makes six changes in its coverage of European mid-caps, factoring in events such as the expected German stimulus and a potential ceasefire in Ukraine

- Intellego Technologies gains as much as 23%, the most since its 2021 IPO, after the Swedish UV monitoring technology firm reported earnings, which showed a large step up in net turnover, cash flows and earnings per share

- Drax shares fall as much as 12%, the steepest decline since March 2023, after the UK power producer said it’s facing a probe by the Financial Conduct Authority

- Softcat rises as much as 3.8% after a stronger-than-expected full-year trading update from the British IT services company. Analysts did express caution about earnings estimates for 2026

- SoftwareOne shares fall as much as 9.1%, the most since April, after the IT services provider reported first-half results. Citi analysts expect 2025 and 2026 adjusted Ebitda expectations to move lower

- Redcare Pharmacy slides as much as 11%, hitting their lowest level in over two years, after analysts at Jefferies lowered their price target on the stock as they cut margin estimates due to a slower-than expected ramp-up in prescription medicines

- Fielmann shares fall as much as 9.2%, the most since November 2024, after the German eye-wear firm reported sales for the second quarter that missed the average analyst estimate. Shares are still up about 26% YTD

Earlier, Asian equity markets traded mixed on Thursday as a rally in mainland Chinese stocks was offset by losses in India after US President Donald Trump imposed a 50% tariff on the nation’s goods. The MSCI Asia Pacific Index was little changed. While a tepid revenue forecast from Nvidia weighed on regional technology stocks, overall losses were contained as Chinese chip shares climbed following a report that firms aim to triple the output of AI processors next year. That also helped the CSI 300 Index rebound after a sudden late-afternoon selloff on Wednesday. Gains in Chinese equities came as Hong Kong-listed shares of the nation’s top e-commerce firms like Meituan and Alibaba slumped. That’s after Meituan warned of major losses this quarter from on ongoing price war in the sector. As China’s onshore rally extends, there are also signs emerging that a rotation from Hong Kong to mainland stocks may be underway. Local Chinese investors sold a record HK$20.4 billion ($2.6 billion) worth of Hong Kong-listed shares on Thursday. Up more than 9% in August, the CSI 300 is heading for its best performance since last September. That is owing to a liquidity-driven rally spurred by cash-rich investors shifting into stocks amid a lack of alternatives, as well as optimism over the pace of AI development in the nation.

In rates,treasuries are twist flattening overnight compared to yesterday’s 3pm closing levels even as the 10Y is largely unchanged while 30-year yields are down 2 bps to 4.90%. In Japan, a two-year government bond auction Thursday met demand that was weaker than the 12-month average, as investors remain wary of the risk that the Bank of Japan will raise interest rates this year. European rates underperformed US rates as EUR markets face a slate of heavy corporate supply. Looking ahead to this morning, data picks up with jobless claims, Q2 GDP revisions, July pending home sales, and KC Fed manufacturing. We will also hear from Fed Governor Waller this evening.

In Fx, the Bloomberg Dollar Spot Index falls 0.2% underperforming all of its G10 peers this morning. The Swedish krona is the best performing G-10 currency, rising 0.3% against the greenback. The Aussie dollar also outperforms. The FX market remains sideways, with price action often attributed to “month-end flows.” USDJPY is trading -40bps weaker as NY sits down. The pair experienced a brief move higher overnight Minister Akazawa abruptly canceled his U.S. trip where he was expected to push for an executive order to cut tariffs on autos and auto parts, but retraced the move as exporter selling pushed USDJPY lower. EUR is gaining +30 bps after our Traders (Molyneux) note that there was a decent amount of stopping through the 1.1600 and 1.1585 levels yesterday. USDCNH (-40bps) is in focus this morning after breaking below the YTD low of 7.14. The pair continues to grind lower post the break with the move likely onshore driven alongside southbound outflows.

In commodities, WTI crude futures fall 0.7% to near $63.70 a barrel. Spot gold edges up to around $3,400/oz. Bitcoin rises 0.5%.

Looking at today’s economic data slate we get 2Q GDP revision and weekly jobless claims (8:30am), July pending home sales (10am) and August Kansas City Fed manufacturing activity (11am). Fed speaker slate includes Waller on monetary policy (6pm)

Market Summary

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini +0.7%

- Stoxx Europe 600 little changed

- DAX +0.2%, CAC 40 +0.6%

- 10-year Treasury yield little changed at 4.23%

- VIX -0.4 points at 14.42

- Bloomberg Dollar Index -0.2% at 1202.83

- euro little changed at $1.1647

- WTI crude -0.6% at $63.75/barrel

Top Overnight News

- CDC Director Susan Monarez was fired just weeks into her tenure after clashing with Robert F. Kennedy Jr. on vaccines, a person familiar said. At least three other senior CDC leaders told coworkers they were resigning. BBG

- White House Trade Advisor Navarro said it appears to be a slam dunk case against Fed’s Cook, while he added this is due process and that Cook weaponised the Fed.

- Russia hit Kyiv with a fierce air attack overnight, the biggest strike since the Putin-Trump summit in Alaska. Also, Putin and Kim Jong Un will attend a military parade in China in a show of collective defiance amid Western pressure. RTRS

- Xi Jinping wrote a letter to India’s president in March when Trump was ratcheting up his trade war with China, according to an Indian official, to test the waters on improving ties. BBG

- China’s commercial banks are tightening oversight of clients using credit cards to fund stock investments as small-time investors pour in to catch the nation’s $1 trillion market rally. Lenders including China Minsheng Banking Corp. and Huaxia Bank Co. warned over the past month that credit card funds and cash advances can’t be used for investments among other prohibited areas. BBG

- South Korea’s central bank its policy rate unchanged at 2.5%, as expected, although signaled that cuts could be forthcoming soon. BBG

- Indian Prime Minister Narendra Modi heads overseas on Thursday to meet the leaders of China, Japan and Russia, seeking to build closer diplomatic ties as New Delhi battles fallout from U.S. President Donald Trump’s escalating tariff offensive. BBG

- The Mexican government plans to increase tariffs on China as part of its 2026 budget proposal next month, protecting the nation’s businesses from cheap imports and satisfying a longstanding demand of US President Donald Trump. BBG

- Google will invest an additional $9 billion in Virginia through 2026 to boost cloud and AI infrastructure. BBG

Trade/Tariffs

- Chinese Commerce Ministry confirms trade negotiator Li Chenggang will travel to Washington for meetings with US officials.

- French President Macron reportedly told his ministers that the EU should consider retaliatory measures against the US digital sector, according to Politico.

- White House trade advisor Navarro said India can get 25% off tariffs if it stops buying Russian oil.

- India’s government decided to extend the import duty exemption on cotton from September 30th to December 31st this year.

- Japanese government source said Japan’s top trade negotiator Akazawa cancelled his US trip and eyes a visit as early as next week.

- Mexico’s government plans to increase tariffs on China as part of its 2026 budget proposal next month with tariff hikes expected on imports from China, including cars, textiles and plastics, according to Bloomberg.

- China’s top trade negotiator Li Chenggang co-chaired the Joint Economic and Trade Committee in Ottawa, while MOFCOM noted that China and Canada had frank and pragmatic and constructive exchanges on improving and developing bilateral economic and trade relations. MOFCOM also stated that both sides agreed to follow-up communication and that China is ready to manage differences through constructive methods and pragmatic actions.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were predominantly higher but with mixed trade seen throughout the session as risk appetite was clouded post-NVIDIA earnings despite the AI darling beating on top of bottom lines, with investors wary as guidance was not as strong as some had hoped and questions remained regarding China chip sales. ASX 200 lacked conviction amid another deluge of earnings and with sentiment not helped by disappointing capex data. Nikkei 225 edged higher but with price action indecisive after Japan’s top trade negotiator postponed a planned US trip. Hang Seng and Shanghai Comp traded mixed with underperformance seen in Hong Kong following recent earnings including Meituan which reported a substantial drop in profits, while participants look ahead to results from China’s largest lenders.

Top Asian News

- Japan’s MOF sounds out dealers of reducing super-long JGBs, according to Nikkei.

- China issued plans to stabilise growth in the steel sector between 2025 and 2026, while it aims to speed up production commencement, capacity and output expansion for key domestic iron ore projects. Furthermore, China will enhance management of steel exports and will promote the reduction of steel output.

- BoK maintained the Base Rate at 2.50%, as expected, with the decision not unanimous as board member Shin Sung-hwan dissented and saw a need to cut rates to aid growth. BoK said domestic demand is expected to sustain a modest recovery and it will maintain a rate cut stance to mitigate downside risks to economic growth, while it will adjust the timing and pace of any further base rate cuts. BoK Governor Rhee stated that a majority of the seven-member board assessed there is a need to work in tandem with government policies to stabilise local property prices, as well as noted that five board members said the door for an imminent rate cut should be open and one board member said the current policy rate should be maintained for the next three months. Furthermore, Rhee said the easing stance will stay through at least the first half of next year and it is difficult to comment on the terminal policy rate, but added that faster policy rate easing risks overstimulating the local property market at this stage.

- BoJ’s Nakagawa says will make policy decisions based on hard data, including Tankan survey; risks of being behind the curve not high right now.

- Mainland investors sell a record USD 2.6bln of Hong Kong stocks on Thursday, via Bloomberg.

European bourses opened firmer, initially edging higher throughout the morning but have since reversed, which coincided with the US pre-market open. European sectors began the session almost entirely in positive territory, though have since moved to show a mixed picture as stocks wane a little. Consumer products and services at the top of the pile, helped by Luxury strength. LVMH (+3.5%), Hermes (+1.7%), Swatch (+2.3%).

Top European News

- UK Treasury is said to be considering a tax hike on landlords by imposing national insurance on rental income ahead of Chancellor Reeves’ autumn budget, according to The Times.

- ECB’s Rehn says EZ growth more resilient than expected, inflation is slowing to below 2% target; consider rapid and significant weakening of USD dominance as unlikely EZ inflation being at 2% target is linked to ECB’s independent decision making. US President Trump pressure on Fed could have global effects on markets and real economy. ECB will keep close eye on economy and stand ready to act if needed.

- French Finance Minister Lombard says the public deficit will be on target in 2025, 2026 budget almost ready, text that gets voted will be the “fruit of compromise” Do not see possibility of French financial crisis. Tap the markets regularly, no problem financing economy. Budget we are preparing does not have a surtax on big companies. Everything is up for discussion on the 2026 budget as we reduce the deficit and protect companies.

FX

- DXY remains confined to a tight range after trading little changed overnight and following the previous day’s ultimately flat performance as data and market-moving events for the buck were sparse. Focus today on US data, which includes GDP/PCE (Q2) and Jobless Claims. DXY currently resides in a narrow 98.05-98.21 parameter.

- EUR/USD is moving in tandem with the buck after yesterday’s intraday recovery and rebound from a brief dip beneath the 1.1600 handle. There has been little in terms of fresh updates from the French political debacle. French Finance Minister Lombard said the public deficit will be on target in 2025, 2026 budget is almost ready, the text that gets voted will be the “fruit of compromise”. EUR/USD resides in a current 1.1631-1.1654 range at the time of writing

- USD/JPY oscillates within a narrow band and struggles for a clear direction after recent fluctuations and amid the indecisive risk appetite in Japan. Comments from BoJ’s Nakagawa garnered very little reaction as she reiterated the BoJ will continue to raise the interest rate if the outlook for economic activity and prices is realised. USD/JPY bounced off levels near its 50 DMA (146.98) this morning, notching a current range between 147.01-147.49.

- GBP/USD at the whim of the dollar, having briefly reclaimed 1.3500 status in the overnight session but with upside capped amid quiet newsflow. Aside from that, data and speakers remain on the quieter side for GBP, with Cable currently on either side of its 50 DMA (1.3493) in a 1.3484-1.3518.

- Antipodeans hold a mild upward bias against the dollar in quiet newsflow. Strength was seen overnight after the PBoC continued to strengthen the yuan reference rate.

- PBoC set USD/CNY mid-point at 7.1063 vs exp. 7.1479 (Prev. 7.1108)

- PBoC extended bilateral currency swap agreement with the RBNZ for five years.

Fixed Income

- USTs are firmer by a handful of ticks, with a slight bid caught soon after the European equity cash open, but seemingly without a fresh driver. Currently trading towards the upper end of a 112-12 to 112-17+ range. Peak for the day marks the weekly high, now currently trading at levels not seen since 1st May 2025 (112-23 was the best from that day). On the data front, markets will have US GDP 2nd Estimate (Q2), PCE (Q2) and Jobless Claims to digest. As for supply, a 7yr auction is on the docket, which follows on from a strong 2yr on Tuesday but a mixed 5yr outing on Wednesday.

- Bunds are slightly lower in what has been a very choppy trade so far. Caught a bid soon after the European cash open, which saw Bunds make a fresh WTD high at 129.90; next level to the upside includes the round 130.00 mark and then 130.06 (Aug 14th high).

- On Wednesday, German-French spreads widened to as high as 81.89 – approaching the high of this year at 84.5bps. Today, yields are tightening a touch back down below 80.00. Most recently, the French Finance Minister said the public deficit will be on target in 2025 and 2026, and the budget is almost ready. Adding that the budget we are preparing does not have a surtax on big companies.

- Gilts marginally outperform today, gapped higher at the open, by around 20 ticks before paring some of that move. Markets have an interesting report via The Times to digest; the UK Treasury is said to be considering a tax hike on landlords by imposing national insurance on rental income ahead of Chancellor Reeves’ autumn budget. This report has helped to lift Gilts, but also as UK paper plays catch-up to some of the strength seen in the prior session in USTs after Gilts shut. Gilts trade in a 90.68 to 90.83 range.

- Italy sells EUR 6bln vs exp. EUR 5.25-6.0bln 2.70% 2030, 3.65% 2035, 3.60% 2035 BTP & EUR 1.25bln vs exp. EUR 1.5-2.0bln 2034 CCTeu.

Commodities

- Softer trade across crude contracts, although some upside was seen shortly after reports that the EU mission HQ in Kyiv was struck by Russian missiles, although delegate staff are safe according to the European Commission, which prompted an unwind of those earlier modest gains. Some upticks were seen recently alongside reports from IRNA that “It seems that Europe will activate the “snapback” mechanism against Iran this week”. WTI currently resides in a 63.48-64.00/bbl range while Brent sits in a USD 67.40-67.48/bbl range.

- Spot gold edges higher in quiet trade to test USD 3,400/oz to the upside with the yellow metal in a USD 3,384.62-3,401.11/oz range at the time of writing. Upward tilt in prices also comes amid narrowing prospects of a Russia-Ukraine peace deal, with both sides still carrying out heavy strikes.

- Flat/mostly firmer trade across base metals with no real conviction amid a tentative Dollar and a similarly non-committal risk tone. 3M LME copper trades in a USD 9,775.75-9,833.00/t range.

- Hungary’s MOL says crude supplies have arrived in Hungary and Slovakia after the Druzhba pipeline restarted; Slovak Economy Minister says supplies have resumed to the nation.

Geopolitics

- Israel says its forces are operating in “all combat zones”, after Syrian state media reports a raid by Israeli ground troops on a site it had already bombed outside Damascus, according to AFP.

- Russian drones reportedly flying over US weapons routes in Germany, according to officials cited by NYT.

- “European Union announces that its mission headquarters in Kyiv was damaged by the Russian attack”, according to Al Arabiya.

- European Commission President von der Leyen says “Delegation staff are safe”, in reference to Russian attack which damaged EU mission HQ in Kyiv.

- Ukrainian President Zelensky says Russian attack on Kyiv killed at least eight, including a child, adds the attack demonstrates Russian answer to diplomacy and he called for stronger sanctions against Russia.

- Fire at unit of Afipsky oil refinery in Russia’s Krasnodar region extinguished, according to local authorities; Fire broke out following Ukrainian drone strike.

- Ukrainian Energy Ministry says Russia’s combined attack damaged energy facilities in several regions.

- EU Diplomat told Politico “Thursday’s EU meetings aim to increase the pressure on Russia”.

- Ukrainian Air Force says Russia attacked Ukrainian with 598 drones and 31 missiles overnight.

US Event Calendar

- 8:30 am: 2Q S GDP Annualized QoQ, est. 3.1%, prior 3%

- 8:30 am: 2Q S Personal Consumption, est. 1.6%, prior 1.4%

- 8:30 am: 2Q S GDP Price Index, est. 2%, prior 2%

- 8:30 am: 2Q S Core PCE Price Index QoQ, est. 2.55%, prior 2.5%

- 8:30 am: Aug 23 Initial Jobless Claims, est. 230k, prior 235k

- 8:30 am: Aug 16 Continuing Claims, est. 1965.5k, prior 1972k

- 10:00 am: Jul Pending Home Sales MoM, est. -0.24%, prior -0.8%

DB’s Jim Reid concludes the overnight wrap

Risk assets put in another decent performance yesterday, with the S&P 500 (+0.24%) closing at a new record. But even as US equities reached new heights, there were still plenty of doubts swirling in the background that took some of the shine off that. First were the ongoing questions about the Fed’s independence, which led investors to price in faster inflation and drove a fresh round of yield curve steepening. Second, French bonds remained under pressure given the fiscal trajectory there, with the Franco-German 10yr spread up to a 7-month high of 82bps. And after the US close, Nvidia’s share price fell in after-hours trading, as their results added to the sense that the explosive growth seen during the AI boom of 2023-24 was decelerating. So US equity futures have also fallen a bit this morning, with those on the S&P 500 down -0.12%.

In terms of those Nvidia results last night, the company delivered a modest quarterly revenue beat ($46.7bn vs $46.2bn est.) with guidance for the current quarter coming largely in line with expectations ($54bn vs $53.5bn est.). This still represented a sales increase of over 50% compared to a year earlier, but is a clear deceleration from the growth numbers of recent years, when year-on-year sales growth had peaked above 200%. Additionally, revenue at the chipmaker’s main data centre division was actually a touch below estimates ($41.1bn vs $41.3 est.), whilst sales to China remain a major source of uncertainty. The chipmaker said it didn’t record any sales of its H20 chips to China in Q2 but claimed it could ship $2bn to $5bn of the chips this quarter if it can overcome geopolitical issues. Bear in mind that earlier this month, the US announced that it would resume export licenses for H20 chips to China, which were paused earlier in the year, in return for 15% of the revenue. However, the company said this plan had not yet been codified.

The results left Nvidia’s shares down by just over -3% in after-hours trading, having been down -0.09% in yesterday’s session. So that’s dragged on broader market sentiment overnight, and futures on the NASDAQ 100 (-0.29%) have posted a larger fall than the S&P 500 (-0.12%). Meanwhile in Asia this morning, Meituan’s shares are down -10.32% in Hong Kong after they warned about significant losses this quarter due to price competition with Alibaba Group (-3.70%) and JD.com (-3.54%). So that’s meant the Hang Seng (-0.66%) has posted a third consecutive day of losses, with Meituan as the largest decliner in the index today. However, there’ve been steady gains elsewhere in Asia, with the KOSPI (+0.64%) moving higher after the Bank of Korea left rates unchanged, in line with expectations. In Japan, the Nikkei (+0.47%) has also risen, despite weak demand at a 2yr government bond auction this morning, with the lowest bid-to-cover ratio since 2009. And the CSI 300 (+0.69%) and the Shanghai Comp (+0.07%) have also advanced.

Prior to Nvidia’s results, US equities had powered ahead, with the S&P 500 (+0.24%) closing at another record high. The advance was led by the energy sector (+1.15%), which benefited from the stabilisation in oil prices, whilst information technology (+0.48%) also outperformed. Small-caps were another group that did relatively well too, with the Russell 2000 (+0.64%) hitting an 8-month high. In fact, that leaves the Russell 2000 just 3% beneath its record high from November 2021, the same month that other risk assets like the NASDAQ and Bitcoin also hit their local peaks before the 2022 bear market.

But even as equities were advancing, ongoing concern about the Fed’s independence clearly remained in the background, and investors responded by pricing in faster rate cuts and higher inflation. Indeed, the 2yr inflation swap (+2.7bps) moved up to its highest level since late-2022, at 3.08%. So this isn’t just an abstract issue, and there was a fresh steepening in the yield curve too as a result. So the 2yr yield (-3.6bps) fell to its lowest since April, at 3.61%, whilst the 10yr yield fell -2.7bps to 4.23%, and the 30yr yield inched +0.2bps higher at 4.92%. So that left the 2s30s curve at its steepest level since January 2022.

When it comes to the near-term path for policy, Fed speakers continued to keep open the prospect of a September rate cut. For instance, New York Fed President Williams said that “I definitely think that every meeting is, from my perspective, live”. And he also said that rates were still “modestly restrictive”. Otherwise, we got a bit more on the timeline for the appointment of the new Fed Chair, as Treasury Secretary Bessent said in a Fox Business interview that there were 11 candidates, of which three or four would be presented to Trump, and then the decision would “surely” be known in the fall.

In Europe yesterday, French sovereign bonds remained under pressure ahead of the confidence vote on September 8. That comes as investors continue to worry about the fiscal trajectory and whether the government (or their successors) will be able to cut the deficit. We did hear from Prime Minister Bayrou yesterday evening, who made his first televised comments since he called for the confidence vote. He offered to meet with opposition parties and negotiate on individual budget proposals. But given the number of other parties who’ve said they’ll vote against the government, the government would fall if those parties followed through, opening the way for a new PM, or even fresh legislative elections.

That backdrop meant French long-end yields kept moving higher, and the 30yr yield even closed at a post-2011 high of 4.42%, last seen at the height of the Euro crisis. Moreover, the selloff continued to be concentrated around France, as the Franco-German 10yr spread moved up to a 7-month high of 82bps. For reference, the peak last December was at 88bps just before the Barnier government fell, so we’re getting close to that point again. And the ongoing convergence with Italian yields continued as well, with the French 10yr yield closing just 5bps beneath its Italian counterpart, which is the smallest gap since 2003. Admittedly, French equities did begin to stabilise after their slump at the start of the week, with the CAC 40 up +0.44%. But even there, banks posted further declines, including BNP Paribas (-0.65%) and Crédit Agricole (-0.58%).

Elsewhere in Europe, markets had generally been pretty cautious too, with the STOXX 600 was only up +0.10%. Even that was largely down to the recovery in French equities, and other indices generally fell back across the continent, including the FTSE 100 (-0.11%), the DAX (-0.44%) and the FTSE MIB (-0.72%). That risk-off tone was echoed in sovereign bond markets too, with an outperformance for German bunds that saw the 10yr yield fall -2.3bps on the day to 2.70%.

To the day ahead now, and US data releases include the weekly initial jobless claims, the second estimate of Q2 GDP, and pending home sales for July. Meanwhile in the Euro Area, we’ll get the European Commission’s economic sentiment indicator for August and the money supply and bank credit data for July. Otherwise from central banks, we’ll hear from the Fed’s Waller and the ECB’s Rehn, and the ECB will also publish the accounts of their July meeting.

Tyler Durden

Thu, 08/28/2025 – 08:32ZeroHedge NewsRead More

R1

R1

T1

T1