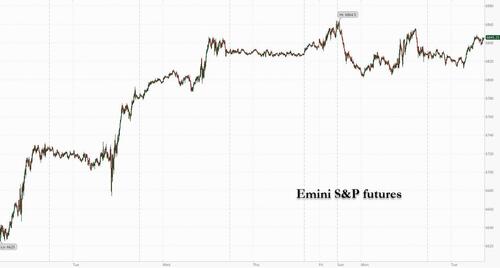

Futures Rebound As Bitcoin Halts Plunge

After Monday’s dismal start to December, US equity futures are higher (if only for the time being), although lacking conviction with few major catalysts on deck today. As of 8:15am, S&P 500 futures are up 0.3% and Nasdaq 100 contracts add 0.4%. Pre-market, Mag 7 are mostly higher led by META (+0.6%) and AMZN (+0.4%). Bond yields are unchanged and the USD is flat. Commodities are mostly mixed: Oil is flat; base metals are all higher (aluminum +0.9%), while precious metals are lower. After the latest post-BOJ bloodbath, bitcoin has managed to hold a modest bid and was trading above $87,000. The US economic calendar is blank for scheduled data releases.

In premarket trading, Mag 7 stocks are mostly higher (Meta +0.6%, Alphabet +0.5%, Nvidia +0.8%, Amazon +0.7%, Tesla +0.3%, Microsoft +0.05%, Apple -0.1%).

- Cloudflare Inc. (NET) gains 2% after Barclays launched coverage on the infrastructure software company with an overweight rating and a $235 price target.

- Credo Technology (CRDO) rises 18% after the communications equipment company’s second-quarter results came in much stronger than expected. It also gave a strong forecast. Shares of competitor Astera Labs (ALAB) gain 5%.

- MongoDB (MDB) rallies 23% after the database software company reported stronger-than-expected results. It also raised its full-year forecast.

- Six Flags Entertainment (FUN) gains 3% after Truist Securities upgraded the theme park operator’s stock to buy from hold.

- Solaris Energy Infrastructure Inc. (SEI) rises 4% after the data center power generator was initiated at Morgan Stanley with a recommendation of overweight on power supply demand.

- Warner Bros. Discovery Inc. (WBD) inches 1.1% higher. The company was fielding a second round of bids on Monday, including a mostly cash offer from Netflix Inc., in an auction that could wrap up in the coming days or weeks, according to people familiar with the discussions.

In corporate news, The Information reported that Amazon is planning a new ultrafast grocery delivery offering in major US urban areas, sending shares of Instacart lower. Warner Bros. Discovery was said to be fielding a second round of bids on Monday, including a mostly cash offer from Netflix. The Commerce Department agreed to invest as much as $150 million in xLight, a chip technology startup tied to former Intel CEO Pat Gelsinger.

With the market stuck in a holding pattern until the next leg higher or lower, investors are awaiting eco data later this week, and the Fed is now in a blackout period. Black Friday and Cyber Monday offered some clues on the economy, with Bloomberg describing “anxious but still active” consumers, and Salesforce data showing Cyber Monday spending grew more slowly in the US than Europe for the first time as tariffs stung American shoppers.

“For long-only investors like we are, I’d say in the absence of any major catalyst, it’s very much wait-and-see until the Fed meeting, while keeping an eye on US jobs and inflation data,” said Karen Georges, a fund manager at Ecofi Investissements in Paris.

Much now depends on the Fed’s decision at next week’s meeting. Disappointment would pose a risk for equities, though confidence in a cut is virtually certain, with market odds of a cut at 100% following softer labor and inflation data and a run of dovish comments from officials.

“Dips continue to present attractive buying opportunities,” wrote Michael Brown, senior research strategist at Pepperstone. “The narrative behind that bull case remains an attractive one, with earnings growth solid, the underlying economy resilient, a calmer tone on trade continuing to prevail, and the monetary backdrop growing looser.”

Bitcoin is steady today after a more than 5% plunge on Monday which saw almost $1 billion of leveraged crypto positions liquidated. Crypto retail investors who piled into exchange-traded funds tracking Strategy’s volatile stock have paid a heavy price. Both MSTX and MSTU – which offer double the daily return – have dropped more than 80% this year, among the 10 worst-performing funds in the entire US ETF market.

While bitcoin longs were hammered again, so were stock short sellers: they were down $80 billion in mark-to-market losses in the final week of November, wiping out the bulk of what had been nearly $95 billion in month-to-date profits prior to last week, per data compiled by S3 Partners. “Being short here requires high confidence in a much weaker economic backdrop or a significant change in the outlook for AI capex,” said Dennis Debusschere, co-founder and chief market strategist at 22V Research.

Ahead of next week’s Fed decision, Barclays strategists noted that S&P 500 implied moves ahead of FOMC meetings have declined since early 2023, with realized moves hovering near zero recently. It’s a trend that underscores the fading influence of monetary policy, they wrote.

After hitting a record high just shy of $60, silver pulled back modestly with a technical gauge showing that a six-day rally had pushed the metal into overbought territory. Copper also retreated amid signs that softer Chinese demand heading into winter might help to ease a looming global supply crunch.

Elsewhere, Bloomberg found that among the 14 largest markets, the US currently ranks 5th from last in local-currency terms and 4th from last in dollar terms this year. That raises questions about whether the AI theme will lead it to victory or whether volatility tied to nascent tech exposure is doing more harm than good.

European stocks and US equity futures hold modest gains; the Stoxx 600 rises 0.2%, led by gains in banks, utilities and construction. Bayer soars after the Trump administration urged the Supreme Court to take up the company’s appeal of the Roundup case. Here are some of the biggest movers on Tuesday:

- Bayer shares surge as much as 15% after the US solicitor general urged the high court to consider the German company’s appeal targeting thousands of lawsuits blaming its Roundup weedkiller for causing cancer.

- Bilfinger shares rise as much as 6% after the German company said it aims to achieve an advanced average revenue growth of 8% to 10% annually, elevate its Ebita margin to 8% to 9%, and ensure a cash conversion rate of at least 90% until 2030.

- Victrex shares jump as much as 11% after JPMorgan said the thermoplastic maker cleared a low bar by beating expectations in the second half. Jefferies noted that a feared dividend cut hasn’t materialized.

- Biotalys shares rise as much as 8.8% after the Belgian agricultural technology company received regulatory approval from the US Environmental Protection Agency for its first biofungicide, called Evoca.

- Compagnie des Alpes rises as much as 6.9% following 2025 results from the French ski resort and theme park operator, which CIC Market Solutions describes as “excellent.”

- Swissquote shares tumble as much as 8.6% after one of its investors offered shares at a discount to the last closing price. Shares fell below the offer price before paring losses.

- Scandic Hotels drops as much as 8.8% as Morgan Stanley downgrades to underweight from equal-weight, saying the country’s acquisition of Dalata’s hotel operation may not be as profitable as previously expected.

- Foresight Group shares decline as much as 8.2% after the UK infrastructure and private equity investment management services company’s interim results, with Peel Hunt noting impact from margin compression.

- Pantheon Resources shares drop as much as 28% after the company’s update on work at the Dubhe-1 well. Canaccord Genuity said markets are still waiting for representative flow rates and that the cost of the work has come in higher than previously forecast.

Earlier in the session, Asian stocks gained, snapping a two-day decline, helped by a rally in tech-heavy markets of South Korea and Taiwan. The MSCI Asia Pacific Index rose as much as 0.5%, before paring gains. TSMC, Samsung Electronics and SK Hynix were among the biggest boosts to the gauge’s climb. Shares eked out small gains in Japan as banks extended advances on speculation of a Bank of Japan interest-rate hike this month. Growing expectations of an interest rate cut in the US is aiding risk-on in the region. A stabilization in bitcoin also helped sentiment after a selloff in cryptocurrencies led declines in global risk assets on Monday. Shares drop in India, as the rupee hit a record low. Concerns over the lack of a trade deal with the US is weighing on the currency. Benchmarks in China also traded lower.

In FX, the yen is the weakest of the G-10 currencies, falling 0.4% against the dollar and pushing USD/JPY above 156. The euro loses a few pips with little reaction to a surprise uptick in euro-area CPI. The pound is down 0.2%.

In rates, treasury yields are higher, within two basis points of Monday’s close with 10-year trading around 4.11%. Bund and gilts are little changed. In Asia, JGBs were supported after Tuesday’s 10-year auction drew solid demand. The corporate issuance slate is expected to grow following a heavy day on Monday. The IG dollar bond issuance slate is empty so far. Tuesday is expected to bring more US investment-grade bond issuance after around $16 billion of new deals on Monday, led by Merck’s acquisition-related $8 billion eight-part offering.

In commodities, spot gold falls $45 and back below $4,200/oz. US crude futures are treading water at $59.30 a abrrel.

The US economic calendar is blank for scheduled data releases. Fed members are in external communications blackout ahead of the Dec. 10 policy announcement

Market Snapshot

- S&P 500 mini +0.2%

- Nasdaq 100 mini +0.3%

- Russell 2000 mini +0.5%

- Stoxx Europe 600 +0.2%

- DAX +0.5%

- CAC 40 +0.2%

- 10-year Treasury yield unchanged at 4.09%

- VIX -0.4 points at 16.85

- Bloomberg Dollar Index little changed at 1219.09

- euro little changed at $1.1604

- WTI crude little changed at $59.34/barrel

Top Overnight News

- Trump’s schedule noted he will host a Cabinet meeting on Tuesday at 11:30am and will make an announcement at 2:00pm. Some expect he could announce Kevin Hassett as next Fed Chair (Hassett’s odds are up to 79% on Polymarket).

- Senators have about a week before they’re set to vote on soon-to-expire Affordable Care Act subsidies. Most of them already believe the chances for a bipartisan breakthrough by then are roughly zero. Politico

- US envoy Steve Witkoff is set to meet Vladimir Putin to discuss a Ukraine peace plan as Russia claimed its forces seized Pokrovsk on the Donetsk frontline. A fourth Russia-connected tanker in less than a week was attacked today. BBG

- Officially, the search for a new Federal Reserve chair is still under way. A handful of finalists are scheduled to sit down for interviews beginning this week with Vice President JD Vance and senior White House staff. Unofficially, the process seems to be all but over, with President Trump appearing to favor longtime adviser Kevin Hassett. If Hassett does end up the nominee, it will be because he met Trump’s two key criteria: loyalty, and credibility with the markets. WSJ

- OpenAI Chief Executive Sam Altman told employees Monday that the company was declaring a “code red” effort to improve the quality of ChatGPT and delaying other products as a result. OpenAI plans to launch a new reasoning model next week that the company claims outperforms Gemini 3. WSJ

- The world economy is weathering Trump’s trade tariffs better than expected, the OECD said. It raised its US and euro-area growth forecasts. Still, it continues to predict global growth will slow to 2.9% in 2026, from 3.2% in 2025. BBG

- China is expected to ramp up US soybean purchases this month to meet a pledge to buy at least 12 million tons by year-end, led by state firms like Cofco, traders said. So far, only about 3 million have been booked. BBG

- Strong demand for Japanese government bonds helped to steady Asian markets on Tuesday, a day after hawkish comments from the central bank governor sparked a global selloff. FT

- Europe’s headline CPI for Nov ran a bit warmer than anticipated at +2.2% (vs. the Street +2.1% and up from +2.1% in Oct) while the core number was inline at +2.4% (and steady vs. Oct). BBG

- Members of the House of Representatives are quitting Congress at a record rate, with Republican retirements and resignations outpacing Democrats by a nearly 2-to-1 ratio in the first 11 months of the year. In previous cycles, the party with more departures tends to lose seats — if not the majority. Axios

- Apple plans not to follow the order by the Indian government to preload phones with a state-run cyber safety app, according to Reuters, citing sources; Co. to voice its concerns around privacy and security following new app order

Trade/Tariffs

- Chinese rare-earth magnet companies are reportedly finding workarounds to their government’s export restrictions, as they seek to keep sales flowing to Western buyers, according to WSJ.

- China reportedly issues first rare earth magnet general export licence after the Trump-Xi meeting, according to Reuters sources

- Exxon (XOM) is reportedly in talks with Iraq over purchasing Lukoil’s stake in the West Qurna 2 oilfield, via Reuters citing sources.

- Russia’s Kremlin Spokesperson Peskov says that Russia continues to be an important supplier of energy to India on a competitive basis. Looking at possibilities to increase imports from India. A decrease in oil trade volumes can be decreased for a brief period of time.

A more detailed look at global markets courtesy of Newsqsuawk

APAC stocks were predominantly in the green as the region shrugged off the weak lead from Wall Street, but with the upside capped amid quiet macro catalysts and in the absence of any tier-1 data. ASX 200 eked mild gains with the help of outperformance in energy, resources and mining, but with gains limited by underperformance in tech and utilities, while data was uninspiring with a larger-than-expected contraction in building approvals. Nikkei 225 nursed some of the prior day’s losses but with the rebound contained amid risks of a BoJ December hike. Hang Seng and Shanghai Comp mostly traded mixed as participants reflected on a slew of monthly auto sales updates, while the mainland lagged after the PBoC’s open market operations resulted in a net daily drain of CNY 146bln.

Top Asian News

- RBNZ Governor Breman said she will discuss with the MPC the possibility of being more transparent with how members vote, while she added that the mandate is very clear that we should focus on keeping inflation low and stable. Breman said that they aim to support a healthy, strong and growing economy, but keep inflation low and stable. It was separately reported that the RBNZ is to begin weekly open-market operations from December 4th and will update changes to the format in Q1 2026.

- Samsung Electronics (005930 KS) has completed development of its 6th-gen HBM4 and is entering full-scale mass production, via AJUNews.

European bourses (STOXX 600 +0.2%) started the session flat/incrementally firmer before then catching a bid as the morning progressed; no clear driver for the upside, but a move which has sustained as indices reside near peaks. European sectors hold a slight positive bias. Banks take the top spot, with gains broad-based across the UK and Europe, but traders may also be digesting the latest update via the BoE, where it lowered capital requirements for UK banks as they pass stress tests. Media is found at the foot of the pile, joined closely by Travel & Leisure.

Top European News

- Confederation of British Industry said Britain’s private sector expects output to decline during the next three months in the gloomiest outlook since May as cautious consumer spending and cost pressures continue to weigh on businesses.

- BoE Financial Policy Committee Record: System-wide level of Tier 1 capital requirements is now around 13% of risk-weighted assets, 1ppt lower than its previous benchmark of around 14%. CCyB maintained at 2%. “The Committee has also identified areas for further work, including on buffer usability, the implementation of the leverage ratio in the UK, and initiatives by the Bank to respond to feedback on interactions, proportionality, and complexity. Committee supports the Bank’s plans for a private markets system-wide exploratory scenario (SWES)”.

- OECD sees global growth of 3.2% in 2025 (maintained from prev. forecast), 2.9% in 2026 (maintained), 3.1% in 2027 (new forecast).

- UK OBR’s Miles says it was not misleading for Chancellor Reeves to have said that the situation with public finances was very challenging.

- BoE Governor Bailey says he expects banks to support the economy through lending following recent capital changes.

FX

- DXY and most G10 FX are uneventful in relatively quiet trade, with a similar lack of macro drivers seen during APAC hours. Specifically, DXY resides in a narrow 99.38-99.52 parameter, with ING calling for a lower dollar this week – “we expect that the remainder of the week will validate the market’s dovish pricing for next week’s Fed meeting”. As it stands, the index trades at the upper end of the mentioned ranges, with recent strength thanks to some pressure seen in the GBP.

- EUR traded flat ahead of the EZ HICP metrics, and then was little moved on the release itself. Headline printed a touch above expected at 2.20% (exp. 2.10%) whilst the Services figure also ticked higher from the prior month. Overall, given the figures were near enough in line with expectations, there was little follow-through into the single-currency and held within a 1.1604 to 1.1616 range, before then touching 1.1600 as the USD picked up a touch.

- USD/JPY outperforms amid a pick-up in risk sentiment and after the pair’s volatile Monday session, which saw a slump to 154.66 lows before bouncing back up and clear of 155.50 and then 156.00, with the pair eyeing yesterday’s 156.15 peak as the near-term resistance level, and thereafter Black Friday’s 156.58 high.

- GBP traded flat against the USD, before then moving lower in recent trade. Nothing behind the latest bout of pressure, but it does come after Cable breached 1.3200 to the downside, and then continued to tumble to make a fresh trough at 1.3180 (though it is a moving target).

- AUD outperforms after ANZ removed its call for an RBA cut in H1-2026, now sees the RBA on an “extended pause” through 2026. As a reminder, CBA and NAB also expect the RBA to be on hold for an extended period of time/foreseeable future. Westpac continues to expect two 2026 cuts, touting May and August for those. AUD/NZD marginally eclipsed 1.1450, from a 1.1418 trough.

Fixed Income

- A lack of fresh drivers for USTs. The March contract is near-enough flat in a narrow 112-25 to 112-29 band. Overnight, WSJ’s Timiraos wrote that, regarding the search for the next Fed Chair, “Unofficially, the process seems to be all but over, with President Trump appearing to favour longtime adviser Kevin Hassett.”.

- Bund Dec’25 is contained in a thin 128.18-35 band this morning. Specifics light. No move in Bunds on the EZ Flash HICP for November, the headline came in hotter-than-expected and ticked up from the prior, while Services lifted from the previous rate. Overall, the hotter-than-expected series chimes with the view that the ECB’s easing cycle has likely concluded.

- Gilts underperform. If the move continues, we look to support for the Gilt Mar’26 contract at 90.53, a double-bottom from the session of and before the Budget. Currently, the low is 90.98, taking out Monday’s base by a tick. A move that lifted the UK 10yr yield back above the 4.5% mark. However, this pressure proved somewhat fleeting as the benchmark bounced and has made its way back to the unchanged mark. Nothing fresh, though the OBR briefing is underway and we note remarks from BoE officials on the morning’s FSR/FPC briefings.

- Saudi National Bank is seeking a USD 1bln syndicated loan, via Bloomberg. Loan is being syndicated to the broader market, incl. Asia, according to sources cited.

- JGB’s led overnight after a strong 10yr auction and in a bit of a breather from the largely Ueda-induced selling seen at the start of the week. To a 134.72 peak with gains of just over 20 ticks at best.

- UK sells GBP 1bln 0.125% 2031 I/L Gilt: b/c 3.88x (prev. 3.49x), real yield 0.949% (prev. 0.889%)

- Germany sells EUR 3.563bln vs exp. EUR 4.5bln 2.00% 2027 Schatz: b/c 1.7x (prev. 1.7x), average yield 2.05% (prev. 1.98%), retention 20.82% (prev. 24.68%)

Commodities

- WTI and Brent continue to trade within Monday’s post-OPEC range of USD 58.83-59.97/bbl and USD 62.69-63.82/bbl, respectively, as a pause in output hike and rising geopolitical concerns continue to support crude prices in the near term. WTI and Brent peaked at the start of the APAC session at USD 59.67/bbl and 63.36/bbl before falling to troughs of 59.09/bbl and 62.88/bbl.

- XAU and XAG traded muted at the start of the European session. Oscillated in a tight USD 4201-4236/oz and USD 56.60-58/oz band, respectively. More recently, the yellow metal has fallen to make fresh session troughs of USD 4,181/oz – a move which lacked catalysts, but technicians highlight accelerating selling pressure after spot gold slipped below USD 4.2k/oz.

- 3M LME Copper gapped lower and fell to a trough of USD 11.12k/t before rebounding to a session high of USD 11.27k/t as global risk tone slightly turns around following Monday’s selloff.

Geopolitics: Middle East

- Arab media reported new Israeli attacks in Khan Yunis and Rafah, according to Iran International.

Geopolitics: Ukraine

- European Commission proposals for the Ukraine reparation loan should be distributed to member states tomorrow, and likely first discussion by EU ambassadors on Friday, according to Radio Liberty journalist

- Russian Foreign Minister Lavrov is to meet with Chinese Foreign Minister Wang Yi on Tuesday.

- Russia’s Kremlin Spokesperson Peskov says US Special Envoy Witkoff and President Putin will discuss the understanding reached between the US and Ukraine, in a meeting at 14:00GMT/09:00EST, via TASS. S-400 and SU-57 fighter jets will be on the agenda.

Geopolitics: Other

- Venezuelan President Maduro reportedly asked for sanction removal for more than 100 officials during a previous call with US President Trump. Furthermore, Trump gave Maduro a Friday deadline to leave Venezuela with his family, while the failure to meet the Friday deadline prompted Trump’s comments on Saturday about the closure of airspace, according to sources cited by Reuters.

- US Treasury Secretary Bessent said the Treasury is investigating allegations that Minnesota tax dollars may have been diverted to Al-Shabaab.

- China’s Coast Guard said it expelled a Japanese vessel in the waters of the Senkaku Islands on Tuesday.

- “Turkey says oil tanker attacked in Black Sea while sailing from Russia to Georgia”, according to Sky News Arabia. However, Sky News Arabia later clarifies, “Turkey says cargo ship attacked in Black Sea while sailing from Russia to Georgia”.

- Japan’s Defence Minister Koizumi is considering a visit to the US as early as mid-January to hold talks with War Secretary Hegseth, via Kyodo.

US Event Calendar

- Nov Wards Total Vehicle Sales, est. 15.4m, prior 15.32m

- 10:00 am: Fed’s Bowman Testifies Before House Committee

DB’s Jim Reid concludes the overnight wrap

Markets got December off to a rocky start yesterday, with bonds and equities losing ground, alongside a sharp slump in Bitcoin (-5.19%). The moves gathered pace right from the open, as hawkish remarks from BoJ Governor Ueda had already pushed 10yr JGB yields up to a post-GFC high. But that then cascaded across global markets, with bond yields moving sharply higher in the US and Europe too. In the meantime, matters weren’t helped by the latest data, as the ISM manufacturing print leant in a stagflationary direction, whilst higher oil prices only exacerbated those fears. So with all said and done, the S&P 500 (-0.53%) slipped back, whilst 10yr Treasury yields (+7.2bps) saw their biggest daily jump in nearly four weeks.

Those developments in Japan were critical for yesterday’s moves, because Ueda’s comments had led investors to price in a December rate hike from the BoJ as a near-certainty. So that meant bond yields hit a whole bunch of new records, and by the close in Japan yesterday, the 10yr yield (+5.8bps) was at a post-2008 high of 1.86%, whilst the 30yr yield (+4.1bps) was at 3.37%, and the highest since that maturity was first issued in the late-1990s. Similarly at the front end, the 2yr yield closed above 1% for the first time since the GFC. This morning yields on 2yr and 10yr JGBs are both down a basis point after a decent 10yr auction has provided some respite to the bond sell-off. The bid-to-cover ratio was recorded at 3.59, compared to 2.97 at the previous sale in November, and a 12-month average of 3.20.

US futures are also fairly flat, indicating that the sell-off has paused for now. The KOSPI (+1.81%) is leading the way in Asia after rebounding from yesterday and after the US announced that the general tariff rate on imports from South Korea, including automobiles, will decrease to 15% retroactively effective from November 1. In other markets, the Nikkei (+0.24%) is recovering a little this morning after a near two percent decline yesterday, while the S&P/ASX 200 (+0.11%) is also experiencing modest gains. Meanwhile, the Hang Seng (+0.13%) is maintaining small gains, in contrast to the CSI (-0.61%) and the Shanghai Composite (-0.55%), which are lower after a stronger session on Monday.

The moves in Japan echoed around the world yesterday, with a sharp bond selloff on both sides of the Atlantic. For instance, Treasury yields rose across the curve, with the 2yr yield (+4.0bps) up to 3.53%, the 10yr yield (+7.2bps) rose to 4.09%, and 30yrs (+7.4bps) to 4.74%. Moreover, those moves got further support from several inflationary indicators, including the ISM manufacturing survey. Admittedly, the headline index unexpectedly fell back to 48.2 (vs. 49.0 expected), but the prices paid component ticked up to 58.5 (vs. 57.5 expected) after a run of 4 consecutive monthly declines. So that exacerbated concerns about tariff-driven inflation persisting. And with oil prices rising (+1.27% for Brent) after Ukraine’s weekend attack against an oil terminal in the Black Sea, the 1yr inflation swap (+1.7bps) also posted a 4th consecutive increase to 2.64%.

That downbeat tone was seen for equities too, where the S&P 500 (-0.53%) fell back after a run of 5 consecutive gains, and the small-cap Russell 2000 (-1.25%) saw an even bigger slump. Nearly three quarters of the S&P constituents were lower on the day, though the index did recover some ground after futures in Asia had suggested an even larger fall. The Mag-7 (-0.10%) outperformed as Nvidia (+1.65%) rebounded from Friday’s -1.81% decline. By contrast, crypto assets suffered, with Bitcoin (-5.19%) falling to $86,446 by the close, and trading below $84k intra-day. Unsurprisingly, that meant there were sizeable losses for crypto-related stocks like Coinbase (-4.76%). Overnight Bitcoin has bounced a little.

Earlier in Europe, markets had followed a very similar pattern, with bonds and equities selling off together. So the STOXX 600 (-0.20%) also fell back after 5 consecutive gains, and there was a particularly sharp decline for the German DAX (-1.04%). And there wasn’t much data capable of boosting the mood either, with the Euro Area manufacturing PMI revised down a tenth from the flash reading to 49.6, so still in contractionary territory. Meanwhile, yields on 10yr bunds (+6.1bps), OATs (+7.5bps) and BTPs (+6.9bps) all moved higher.

Here in the UK, we also heard yesterday that the head of the OBR budget watchdog had resigned, which comes after their analysis of the budget’s contents went live on its website ahead of the Chancellor’s announcement. However, that wasn’t a market moving story, and the rise in 10yr gilt yields (+4.1bps) was more muted than in other countries yesterday, whilst the FTSE 100 (-0.18%) largely matched the STOXX 600. We did get a bit of UK data too, with October mortgage approvals down to 65.0k (vs. 64.5k expected), but that very much kept them within their 60-70k range that they’ve been in for the last 18 months.

Looking forward to today, we’ll see some focus on geopolitics as Trump’s envoy Witkoff is due to meet Russia’s President Putin in Moscow to discuss US proposals to end the war in Ukraine. The visit comes as US-led peace talks intensified over the past couple of weeks with “productive” meetings between US and Ukrainian officials but Kyiv staying resistant to territorial demands that have been made by Moscow.

In terms of the rest of the day ahead, data releases include the Euro Area flash CPI print for November, with Friday’s country-level releases suggesting that headline and core inflation should be unchanged at 2.1% and 2.4% respectively. We’ll also see the Euro area unemployment rate for October. Otherwise, central bank speakers include the Fed’s Bowman but with the blackout on it won’t be about monetary policy.

Tyler Durden

Tue, 12/02/2025 – 08:43ZeroHedge NewsRead More

R1

R1

T1

T1